Question: Use the following information to answer Exercises E9-17 and E9-18. At January 1, 2016, Hilly Mountain Flagpoles had Accounts Receivable of $31,000, and Allowance for

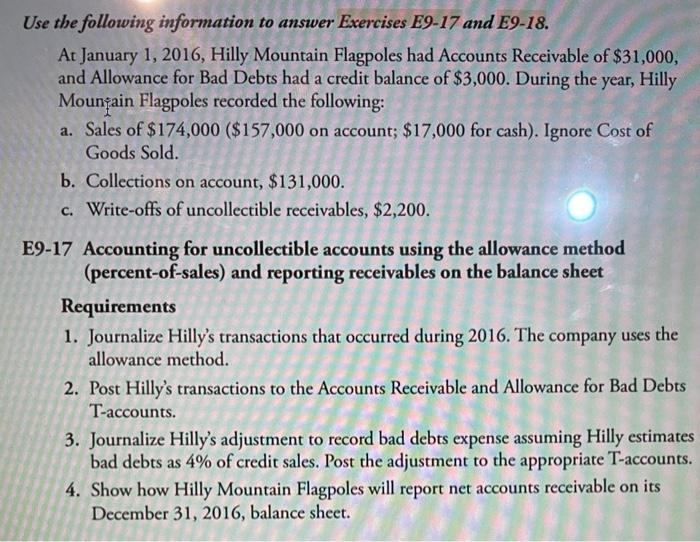

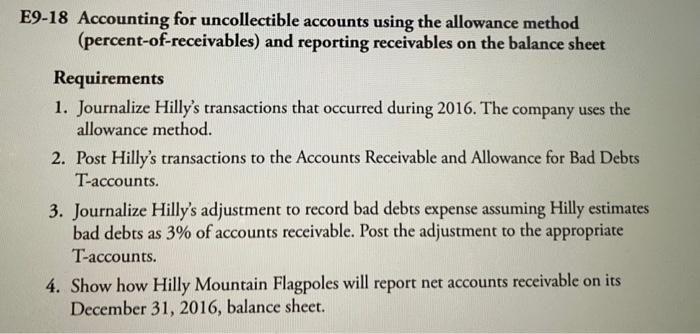

Use the following information to answer Exercises E9-17 and E9-18. At January 1, 2016, Hilly Mountain Flagpoles had Accounts Receivable of $31,000, and Allowance for Bad Debts had a credit balance of $3,000. During the year, Hilly Mountain Flagpoles recorded the following: a. Sales of $174,000 ( $157,000 on account; $17,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $131,000. c. Write-offs of uncollectible receivables, $2,200. E9-17 Accounting for uncollectible accounts using the allowance method (percent-of-sales) and reporting receivables on the balance sheet Requirements 1. Journalize Hilly's transactions that occurred during 2016. The company uses the allowance method. 2. Post Hilly's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize Hilly's adjustment to record bad debts expense assuming Hilly estimate: bad debts as 4% of credit sales. Post the adjustment to the appropriate T-accounts. 4. Show how Hilly Mountain Flagpoles will report net accounts receivable on its December 31,2016 , balance sheet. E9-18 Accounting for uncollectible accounts using the allowance method (percent-of-receivables) and reporting receivables on the balance sheet Requirements 1. Journalize Hilly's transactions that occurred during 2016. The company uses the allowance method. 2. Post Hilly's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. 3. Journalize Hilly's adjustment to record bad debts expense assuming Hilly estimates bad debts as 3% of accounts receivable. Post the adjustment to the appropriate T-accounts. 4. Show how Hilly Mountain Flagpoles will report net accounts receivable on its December 31, 2016, balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts