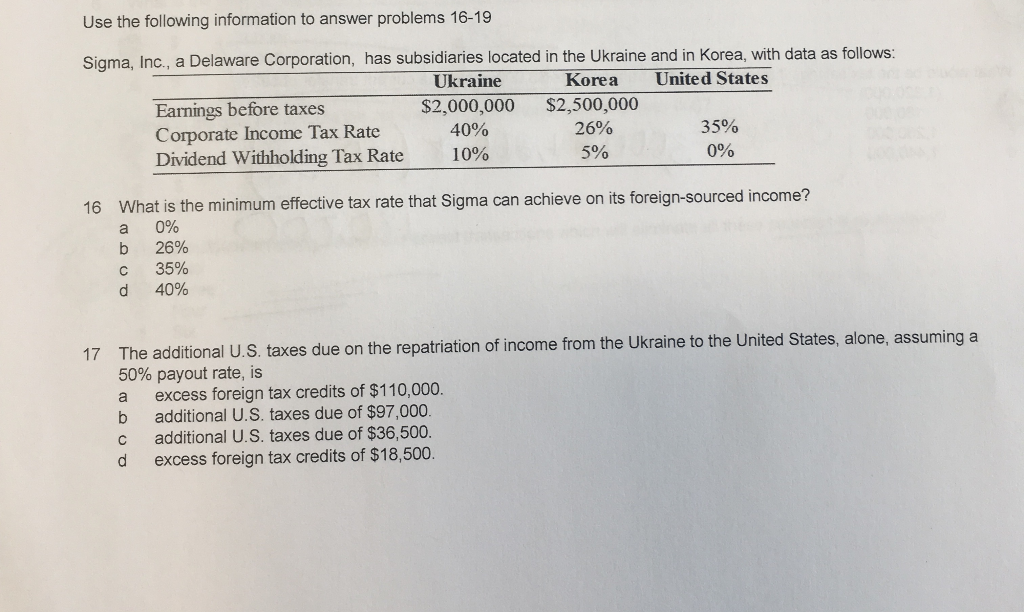

Question: Use the following information to answer problems 16-19 Sigma, Inc., a Delaware Corporation, has subsidiaries located in the Ukraine and in Korea, with data as

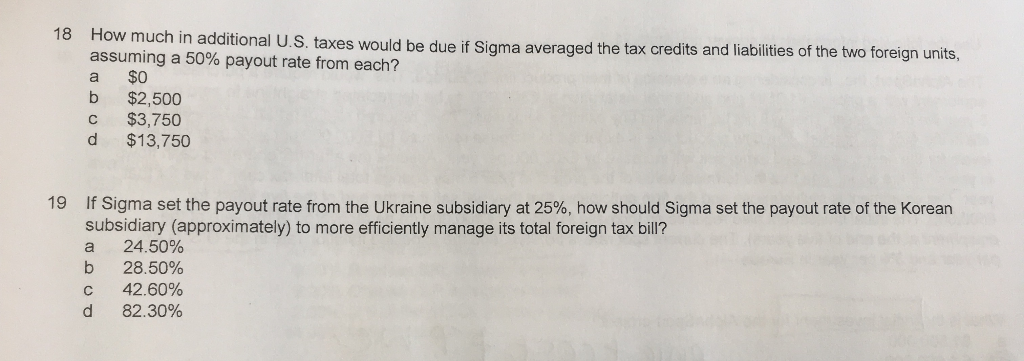

Use the following information to answer problems 16-19 Sigma, Inc., a Delaware Corporation, has subsidiaries located in the Ukraine and in Korea, with data as follows: Ukraine Korea United States Earnings before taxes $2,000,000 $2,500,000 Corporate Income Tax Rate 40% 26% 35% Dividend Withholding Tax Rate 10% 0% 5% 16 What is the minimum effective tax rate that Sigma can achieve on its foreign-sourced income? a 0% b 26% C 35% d 40% 17 The additional U.S. taxes due on the repatriation of income from the Ukraine to the United States, alone, assuming a 50% payout rate, is a excess foreign tax credits of $110,000. b additional U.S. taxes due of $97,000. C additional U.S. taxes due of $36,500. d excess foreign tax credits of $18,500 18 How much in additional U.S. taxes would be due if Sigma averaged the tax credits and liabilities of the two foreign units, assuming a 50% payout rate from each? a $0 b $2,500 C $3,750 d $13,750 19 If Sigma set the payout rate from the Ukraine subsidiary at 25%, how should Sigma set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill? a 24.50% b 28.50% 42.60% 82.30% Use the following information to answer problems 16-19 Sigma, Inc., a Delaware Corporation, has subsidiaries located in the Ukraine and in Korea, with data as follows: Ukraine Korea United States Earnings before taxes $2,000,000 $2,500,000 Corporate Income Tax Rate 40% 26% 35% Dividend Withholding Tax Rate 10% 0% 5% 16 What is the minimum effective tax rate that Sigma can achieve on its foreign-sourced income? a 0% b 26% C 35% d 40% 17 The additional U.S. taxes due on the repatriation of income from the Ukraine to the United States, alone, assuming a 50% payout rate, is a excess foreign tax credits of $110,000. b additional U.S. taxes due of $97,000. C additional U.S. taxes due of $36,500. d excess foreign tax credits of $18,500 18 How much in additional U.S. taxes would be due if Sigma averaged the tax credits and liabilities of the two foreign units, assuming a 50% payout rate from each? a $0 b $2,500 C $3,750 d $13,750 19 If Sigma set the payout rate from the Ukraine subsidiary at 25%, how should Sigma set the payout rate of the Korean subsidiary (approximately) to more efficiently manage its total foreign tax bill? a 24.50% b 28.50% 42.60% 82.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts