Question: Use the following information to answer questions 1-7. Present Value Tables TABLE A.1: Present Value of $1, p= 1/(1+1) Periods 2% 2.5% 2.75% 3% 1

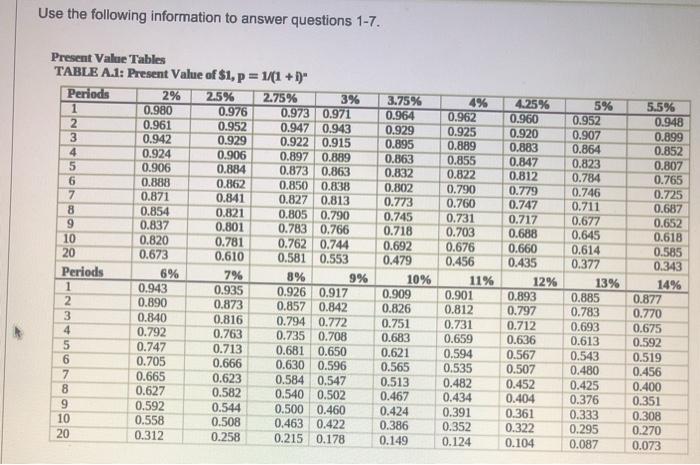

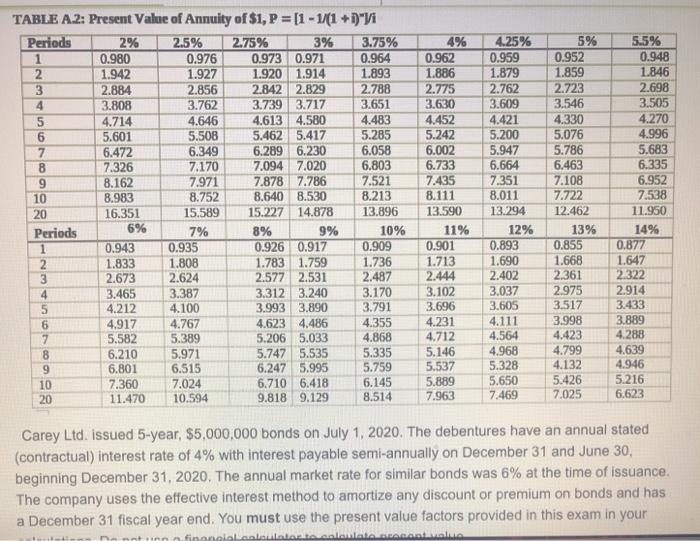

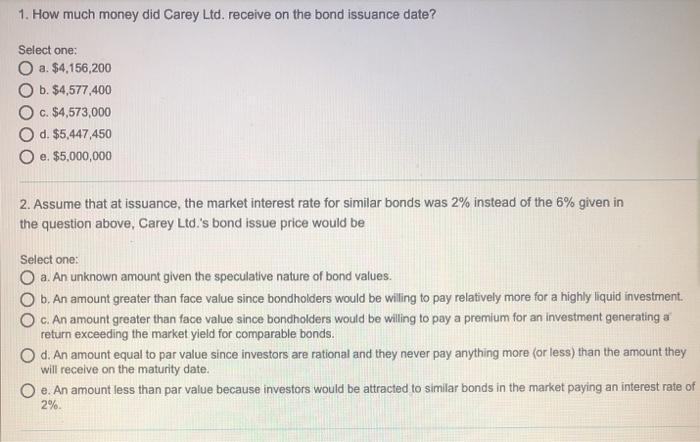

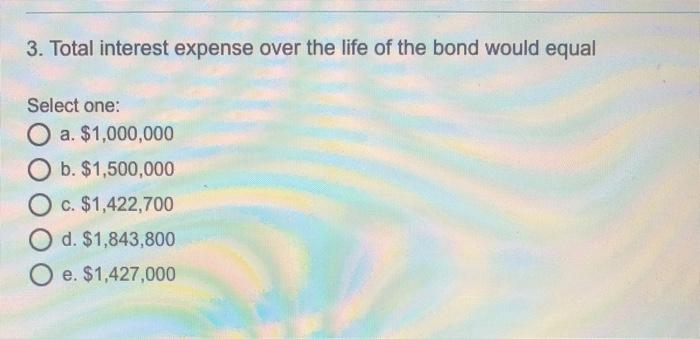

Use the following information to answer questions 1-7. Present Value Tables TABLE A.1: Present Value of $1, p= 1/(1+1)" Periods 2% 2.5% 2.75% 3% 1 0.980 0.976 0.973 0.971 2 0.961 0.952 0.947 0.943 3 0.942 0.929 0.922 0.915 4 0.924 0.906 0.897 0.889 5 0.906 0.884 0.873 0.863 6 0.888 0.862 0.850 0.838 7 0.871 0.841 0.827 0.813 8 0.854 0.821 0.805 0.790 9 0.837 0.801 0.783 0.766 10 0.820 0.781 0.762 0.744 20 0.673 0.610 0.581 0.553 Periods 6% 7% 8% 9% 1 0.943 0.935 0.926 0.917 2 0.890 0.873 0.857 0.842 3 0.840 0.816 0.794 0.772 4 0.792 0.763 0.735 0.708 5 0.747 0.713 0.681 0.650 6 0.705 0.666 0.630 0.596 7 0.665 0.623 0.584 0.547 8 0.627 0.582 0.540 0.502 9 0.592 0.544 0.500 0.460 10 0.558 0.508 0.463 0.422 20 0.312 0.258 0.215 0.178 3.75% 0.964 0.929 0.895 0.863 0.832 0.802 0.773 0.745 0.718 0.692 0.479 10% 0.909 0.826 0.751 0.683 0.621 0.565 0.513 0.467 0.424 0.386 0.149 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.456 11% 0.901 0.812 0.731 0.659 0.594 0.535 0.482 0.434 0.391 0.352 0.124 4.25% 0.960 0.920 0.883 0.847 0.812 0.779 0.747 0.717 0.688 0.660 0.435 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.104 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.377 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.087 5.5% 0.948 0.899 0.852 0.807 0.765 0.725 0.687 0.652 0.618 0.585 0.343 14% 0.877 0.770 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.073 TABLE A.2: Present Value of Annuity of $1, P = [1 - 1/(1+D"Vi Periods 2% 2.5% 2.75% 3% 3.75% 1 0.980 0.976 0.973 0.971 0.964 2 1.942 1.927 1.920 1.914 1.893 3 2.884 2.856 2.842 2.829 2.788 4 3.808 3.762 3.739 3.717 3.651 5 4.714 4.646 4.613 4.580 4.483 6 5.601 5.508 5.462 5.417 5.285 7 6.472 6.349 6.289 6.230 6.058 7.326 7.170 7.094 7.020 6.803 9 8.162 7.971 7.878 7.786 7.521 10 8.983 8.752 8.640 8.530 8.213 20 16.351 15.589 15.227 14.878 13.896 Periods 6% 7% 9% 10% 1 0.943 0.935 0.926 0.917 0.909 2 1.833 1.808 1.783 1.759 1.736 3 2.673 2.624 2.577 2.531 2.487 4 3.465 3.387 3.312 3.240 3.170 5 4.212 4.100 3.993 3.890 3.791 6 4.917 4.767 4.623 4.486 4.355 7 5.582 5.389 5.206 5.033 4.868 6.210 5.971 5.747 5.535 5.335 9 6.801 6.515 6.247 5.995 5.759 10 7.360 7.024 6.710 6.418 6.145 20 11.470 10.594 9.818 9.129 8.514 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 13.590 11% 0.901 1.713 2.444 3.102 3.696 4.231 4,712 5.146 5.537 5.889 7.963 4.25% 0.959 1.879 2.762 3,609 4.421 5.200 5.947 6.664 7.351 8.011 13.294 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5,650 7.469 5% 0.952 1.859 2.723 3,546 4.330 5.076 5.786 6.463 7.108 7.722 12.462 13% 0.855 1.668 2.361 2.975 3.517 3.998 4.423 4.799 4.132 5.426 7,025 5.5% 0.948 1.846 2.698 3.505 4.270 4.996 5.683 6.335 6.952 7.538 11.950 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 6.623 8% Carey Ltd. issued 5-year, $5,000,000 bonds on July 1, 2020. The debentures have an annual stated (contractual) interest rate of 4% with interest payable semi-annually on December 31 and June 30, beginning December 31, 2020The annual market rate for similar bonds was 6% at the time of issuance. The company uses the effective interest method to amortize any discount or premium on bonds and has a December 31 fiscal year end. You must use the present value factors provided in this exam in your financial contacto colate 1. How much money did Carey Ltd. receive on the bond issuance date? Select one: a. $4,156,200 b. $4,577,400 C. $4,573,000 d. $5,447,450 e. $5,000,000 2. Assume that at issuance, the market interest rate for similar bonds was 2% instead of the 6% given in the question above, Carey Ltd.'s bond issue price would be Select one: a. An unknown amount given the speculative nature of bond values. b. An amount greater than face value since bondholders would be willing to pay relatively more for a highly liquid investment. c. An amount greater than face value since bondholders would be willing to pay a premium for an investment generating a return exceeding the market yield for comparable bonds. O d. An amount equal to par value since investors are rational and they never pay anything more or less) than the amount they will receive on the maturity date. Oe. An amount less than par value because investors would be attracted to similar bonds in the market paying an interest rate of 2%. 3. Total interest expense over the life of the bond would equal Select one: a. $1,000,000 a. O b. $1,500,000 O c. $1,422,700 O d. $1,843,800 O e. $1,427,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts