Question: Use the following information to answer questions 7-9. Note: Each question is independent, meaning that you do not need information from the previous question(s) to

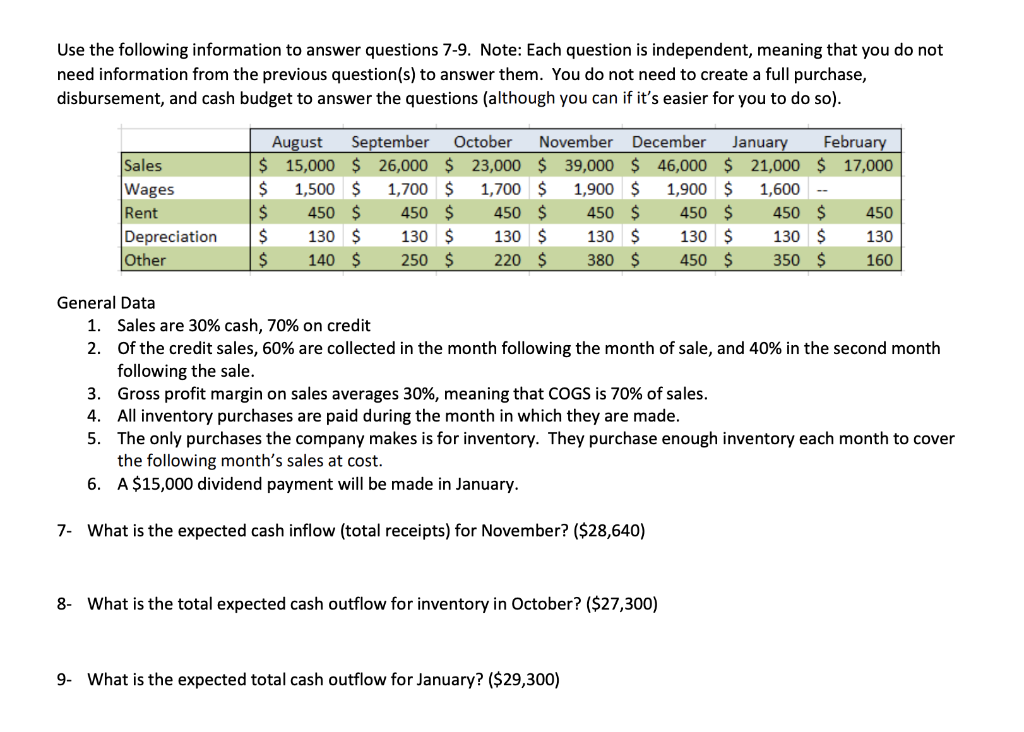

Use the following information to answer questions 7-9. Note: Each question is independent, meaning that you do not need information from the previous question(s) to answer them. You do not need to create a full purchase, disbursement, and cash budget to answer the questions (although you can if it's easier for you to do so). Sales Wages Rent Depreciation Other | August September October November December January February $ 15,000 $ 26,000 $ 23,000 $ 39,000 $ 46,000 $ 21,000 $ 17,000 $ 1,500 $ 1,700 $ 1,700 $ 1,900 $ 1,900 $ 1,600 -- $ 450 $ 450 $ 450 $ 450 $ 450 $ 450 $ 450 $ 130 $ 130 $ 130 $ 130 $ 130 $ 130 $ 130 $ 140 $ 250 $ 220 $ 380 $ 450 $ 350 $ 160 General Data 1. Sales are 30% cash, 70% on credit 2. Of the credit sales, 60% are collected in the month following the month of sale, and 40% in the second month following the sale. 3. Gross profit margin on sales averages 30%, meaning that COGS is 70% of sales. 4. All inventory purchases are paid during the month in which they are made. 5. The only purchases the company makes is for inventory. They purchase enough inventory each month to cover the following month's sales at cost. 6. A $15,000 dividend payment will be made in January. 7- What is the expected cash inflow (total receipts) for November? ($28,640) 8- What is the total expected cash outflow for inventory in October? ($27,300) 9- What is the expected total cash outflow for January? ($29,300)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts