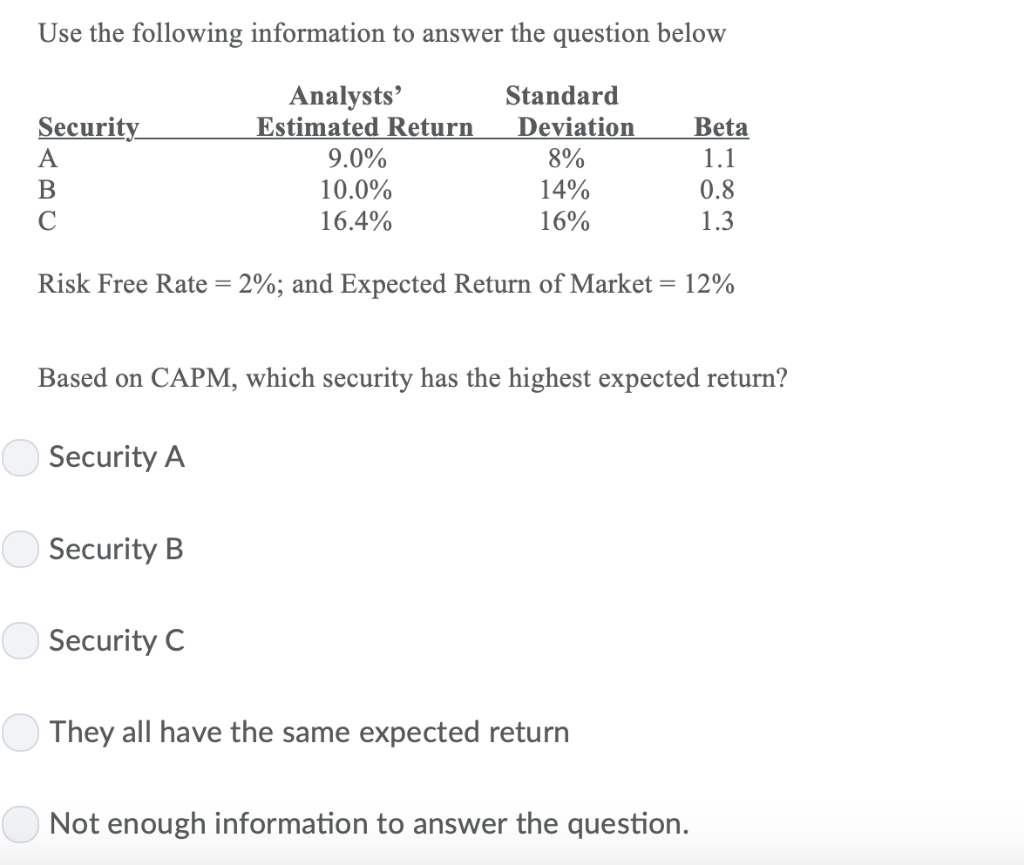

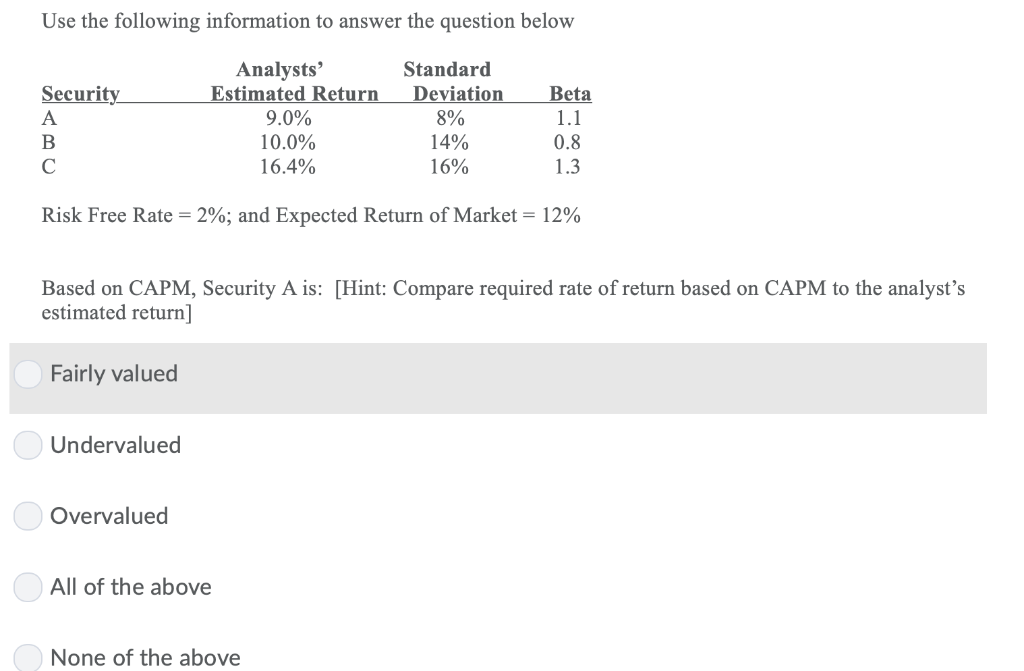

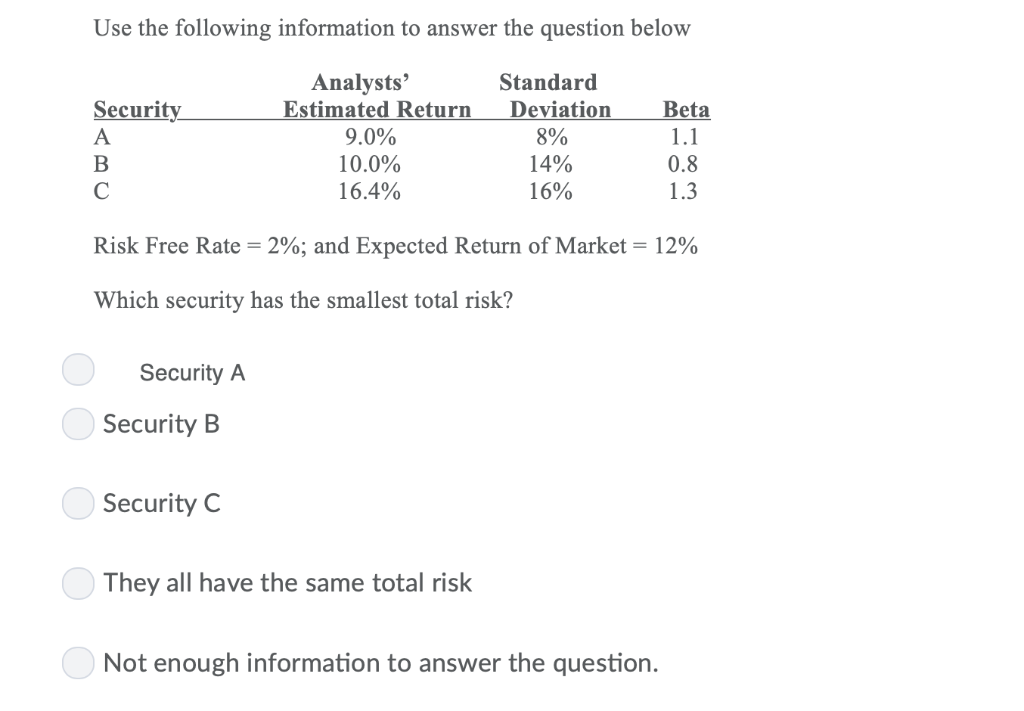

Question: Use the following information to answer the question below Analysts Estimated Return Standard Deviation 8% Security Beta 9.0% 1.1 10.0% 14% 16% 0.8 1.3 16.4%

Use the following information to answer the question below Analysts Estimated Return Standard Deviation 8% Security Beta 9.0% 1.1 10.0% 14% 16% 0.8 1.3 16.4% Risk Free Rate 2%; and Expected Return of Market 12% Based on CAPM, which security has the highest expected return? Security A Security B Security C They all have the same expected return Not enough information to answer the question. |CAC Use the following information to answer the question below Analysts' Estimated Return Standard Security Deviation Beta 9.0% 10.0% 16.4% 8% 1.1 14% 0.8 16% 1.3 Risk Free Rate = 2%; and Expected Return of Market = 12% Based on CAPM, Security A is: [Hint: Compare required rate of return based on CAPM to the analyst's estimated return] Fairly valued Undervalued Overvalued All of the above None of the above Use the following information to answer the question below Analysts Estimated Return Standard Security Deviation Beta A 9.0% 8% 1.1 10.0% 14% 0.8 1.3 C 16.4% 16% Risk Free Rate = 2%; and Expected Return of Market 12% Which security has the smallest total risk? Security A Security B Security C They all have the same total risk Not enough information to answer the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts