Question: Use the following information to answer the question below. On January 1, 2013, Falcon Corporation had 40,000 shares of $10 par value common stock issued

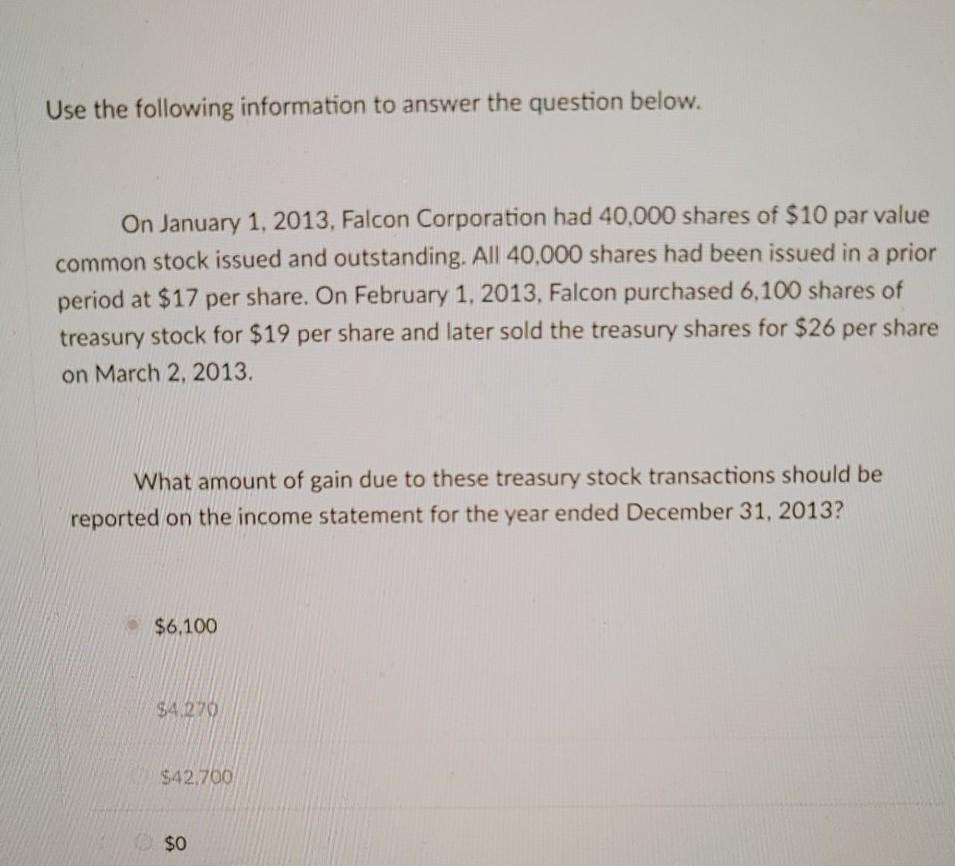

Use the following information to answer the question below. On January 1, 2013, Falcon Corporation had 40,000 shares of $10 par value common stock issued and outstanding. All 40.000 shares had been issued in a prior period at $17 per share. On February 1, 2013, Falcon purchased 6,100 shares of treasury stock for $19 per share and later sold the treasury shares for $26 per share on March 2, 2013. What amount of gain due to these treasury stock transactions should be reported on the income statement for the year ended December 31, 2013? $6,100 $4270 $42.700 $0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock