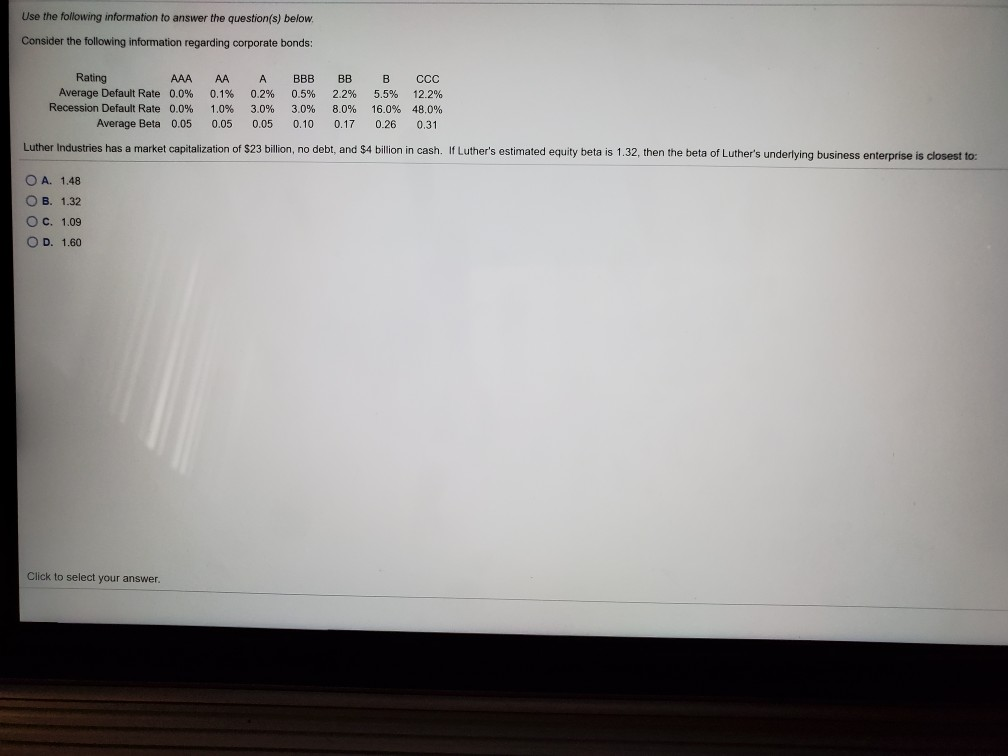

Question: Use the following information to answer the question(s) below. Consider the following information regarding corporate bonds: Rating AAA Average Default Rate 0.0% ession Default Rate

Use the following information to answer the question(s) below. Consider the following information regarding corporate bonds: Rating AAA Average Default Rate 0.0% ession Default Rate 0.0% Average Beta 0.05 AAA 0.1% 0.2% 0.0% 3.0% 0.05 0.05 BBB 0.5% 3.0% 0.10 BB 2.2% 8.0% 0.17 B 5.5% 16.0% 0.26 CCC 12.2% 48.0% 0.31 Luther Industries has a market capitalization of $23 billion, no debt, and $4 billion in cash. If Luther's estimated equity beta is 1.32, then the beta of Luther's underlying business enterprise is closest to: O A. 1.48 OB. 1.32 O c. 1.09 O D. 1.60 Click to select your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock