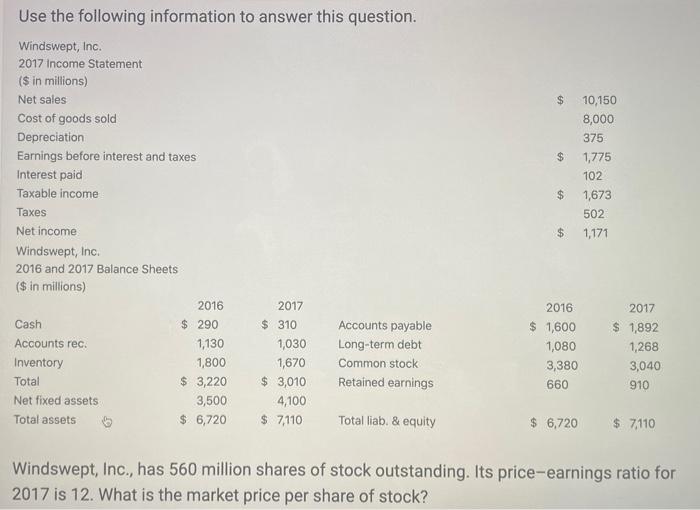

Question: $ Use the following information to answer this question. Windswept, Inc. 2017 income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings

$ Use the following information to answer this question. Windswept, Inc. 2017 income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net incon Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 Cash $ 290 $ 310 Accounts payable Accounts rec. 1,130 1,030 Long-term debt Inventory 1,800 1,670 Common stock Total $ 3,220 $ 3,010 Retained earnings Net fixed assets 3,500 4,100 Total assets $ 6,720 $ 7,110 Total liab. & equity 10,150 8,000 375 $ 1,775 102 $ 1,673 502 $ 1,171 2016 $ 1,600 1,080 3,380 660 2017 $ 1,892 1,268 3,040 910 $ 6,720 $ 7110 Windswept, Inc., has 560 million shares of stock outstanding. Its price-earnings ratio for 2017 is 12. What is the market price per share of stock? Windswept, Inc., has 560 million shares of stock outstanding. Its price-earnings ratio for 2017 is 12. What is the market price per share of stock? O a $38.04 O b. $14.14 Oc. $20.91 od $25.09 Oe. $19.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts