Question: Use the following information to perform the calculations below (using the indirect method). Net income $620,000 Beginning accounts payable $129,000 Depreciation expense 92,000 Ending accounts

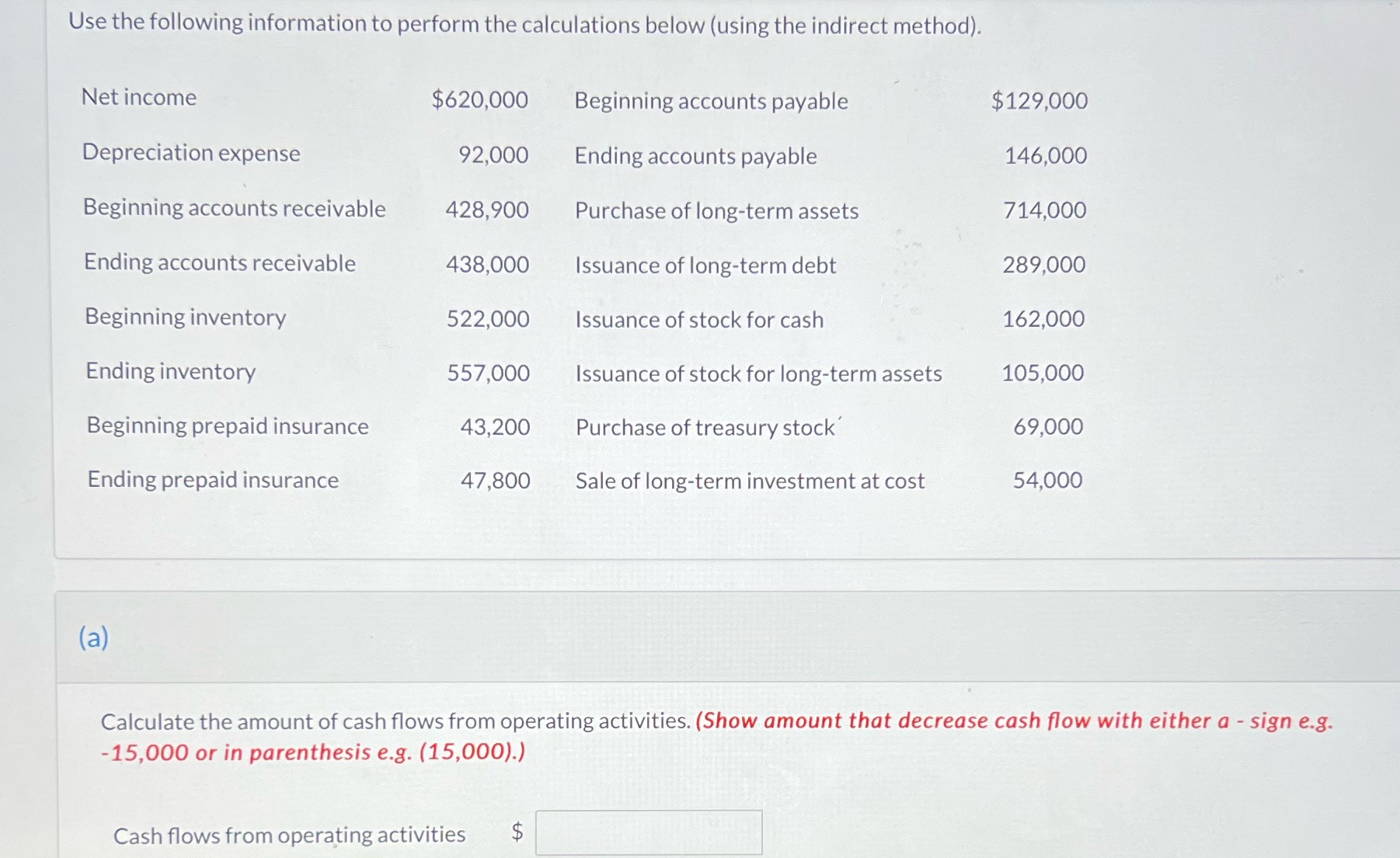

Use the following information to perform the calculations below (using the indirect method). Net income $620,000 Beginning accounts payable $129,000 Depreciation expense 92,000 Ending accounts payable 146,000 Beginning accounts receivable 428,900 Purchase of long-term assets 714,000 Ending accounts receivable 438,000 Issuance of long-term debt 289,000 Beginning inventory 522,000 Issuance of stock for cash 162,000 Ending inventory 557,000 Issuance of stock for long-term assets 105,000 Beginning prepaid insurance 43,200 Purchase of treasury stock 69,000 Ending prepaid insurance 47,800 Sale of long-term investment at cost 54,000 (a) Calculate the amount of cash flows from operating activities. (Show amount that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash flows from operating activities $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts