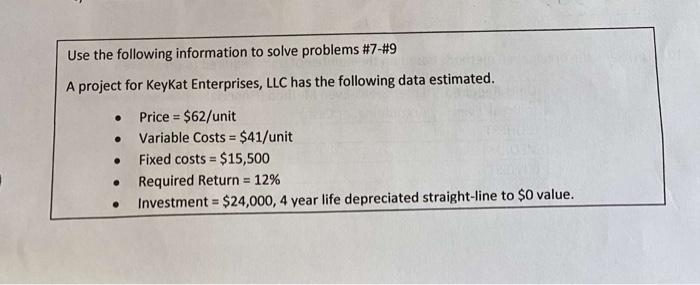

Question: Use the following information to solve problems #7-#9 A project for KeyKat Enterprises, LLC has the following data estimated. - Price =$62/ unit - Variable

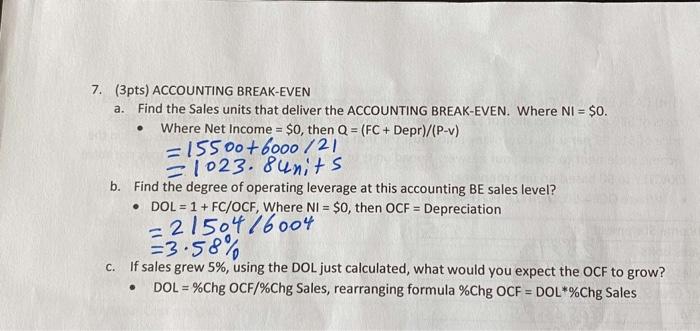

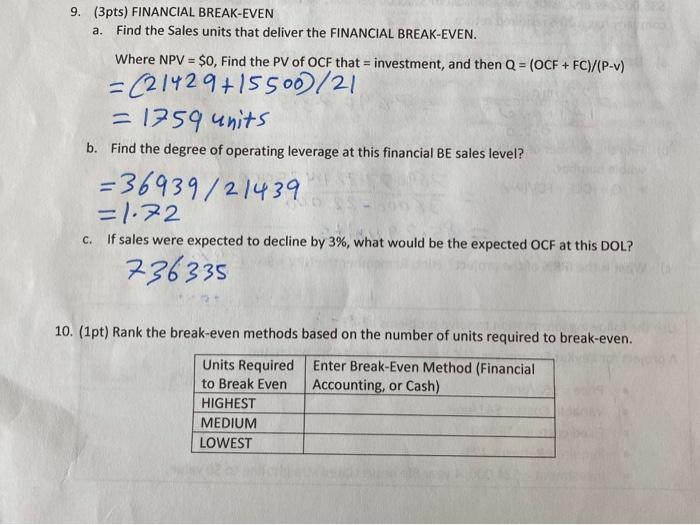

Use the following information to solve problems \#7-\#9 A project for KeyKat Enterprises, LLC has the following data estimated. - Price =$62/ unit - Variable Costs =$41 /unit - Fixed costs =$15,500 - Required Return =12% - Investment =$24,000,4 year life depreciated straight-line to $0 value. 7. (3pts) ACCOUNTING BREAK-EVEN a. Find the Sales units that deliver the ACCOUNTING BREAK-EVEN. Where NI=$0. - Where Net Income =$0, then Q=(FC+ Depr )/(Pv) =15500+6000/21=1023.84ni+5 b. Find the degree of operating leverage at this accounting BE sales level? - DOL=1+FC/OCF, Where NI=$0, then OCF= Depreciation =2150416004=3.58% c. If sales grew 5%, using the DOL just calculated, what would you expect the OCF to grow? - DOL=%Chg OCF /% Chg Sales, rearranging formula % Chg OCF = DOL*\%Chg Sales Where NPV =$0, Find the PV of OCF that = investment, and then Q=(OCF+FC)/(Pv) =(21429+15500)21=17594units b. Find the degree of operating leverage at this financial BE sales level? =36939/21439=1.72 c. If sales were expected to decline by 3%, what would be the expected OCF at this DOL? 736335 0. (1pt) Rank the break-even methods based on the number of units required to break-even. Use the following information to solve problems \#7-\#9 A project for KeyKat Enterprises, LLC has the following data estimated. - Price =$62/ unit - Variable Costs =$41 /unit - Fixed costs =$15,500 - Required Return =12% - Investment =$24,000,4 year life depreciated straight-line to $0 value. 7. (3pts) ACCOUNTING BREAK-EVEN a. Find the Sales units that deliver the ACCOUNTING BREAK-EVEN. Where NI=$0. - Where Net Income =$0, then Q=(FC+ Depr )/(Pv) =15500+6000/21=1023.84ni+5 b. Find the degree of operating leverage at this accounting BE sales level? - DOL=1+FC/OCF, Where NI=$0, then OCF= Depreciation =2150416004=3.58% c. If sales grew 5%, using the DOL just calculated, what would you expect the OCF to grow? - DOL=%Chg OCF /% Chg Sales, rearranging formula % Chg OCF = DOL*\%Chg Sales Where NPV =$0, Find the PV of OCF that = investment, and then Q=(OCF+FC)/(Pv) =(21429+15500)21=17594units b. Find the degree of operating leverage at this financial BE sales level? =36939/21439=1.72 c. If sales were expected to decline by 3%, what would be the expected OCF at this DOL? 736335 0. (1pt) Rank the break-even methods based on the number of units required to break-even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts