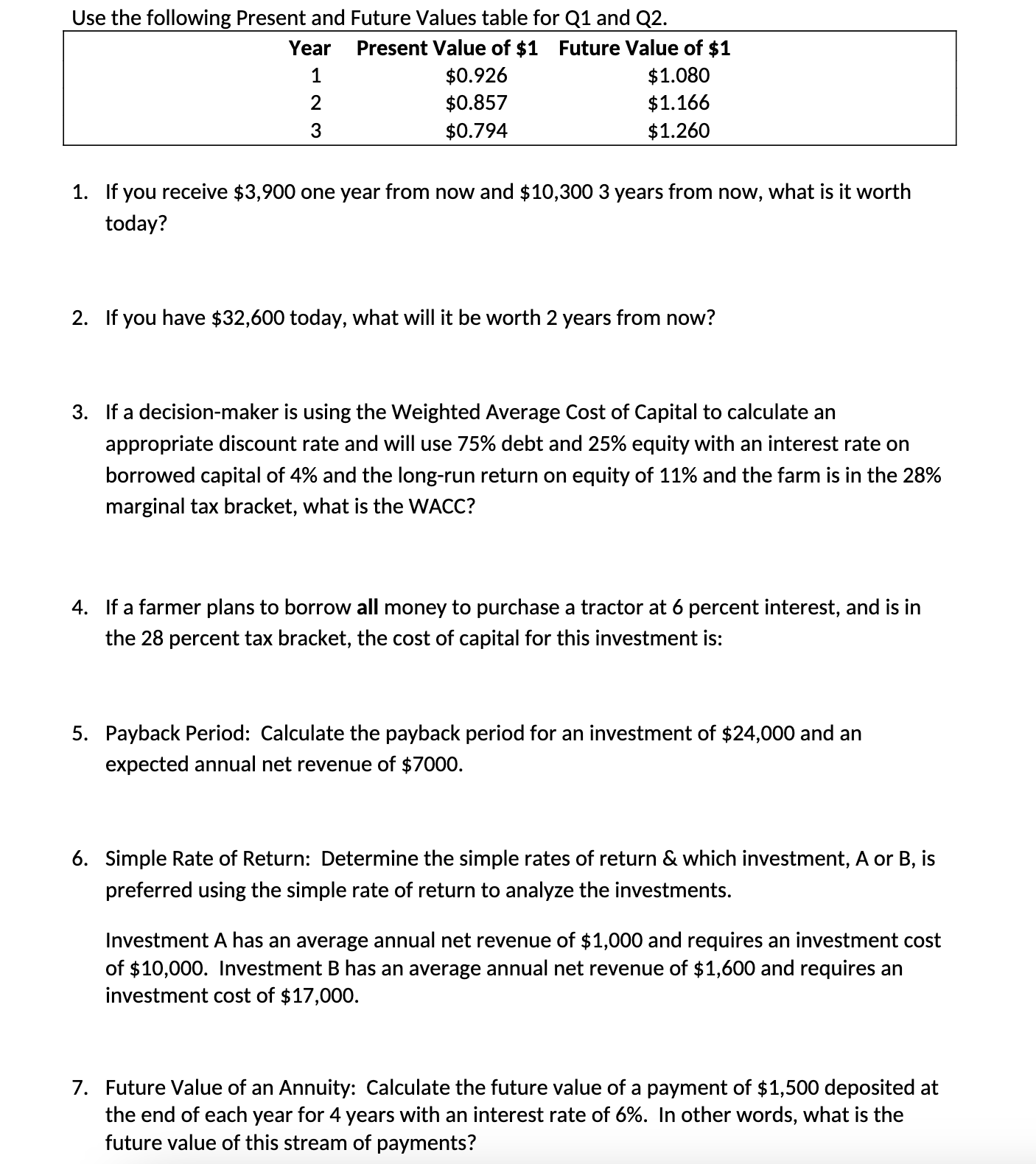

Question: Use the following Present and Future Values table for Q1 and Q2. Year 1 Present Value of $1 Future Value of $1 2 3

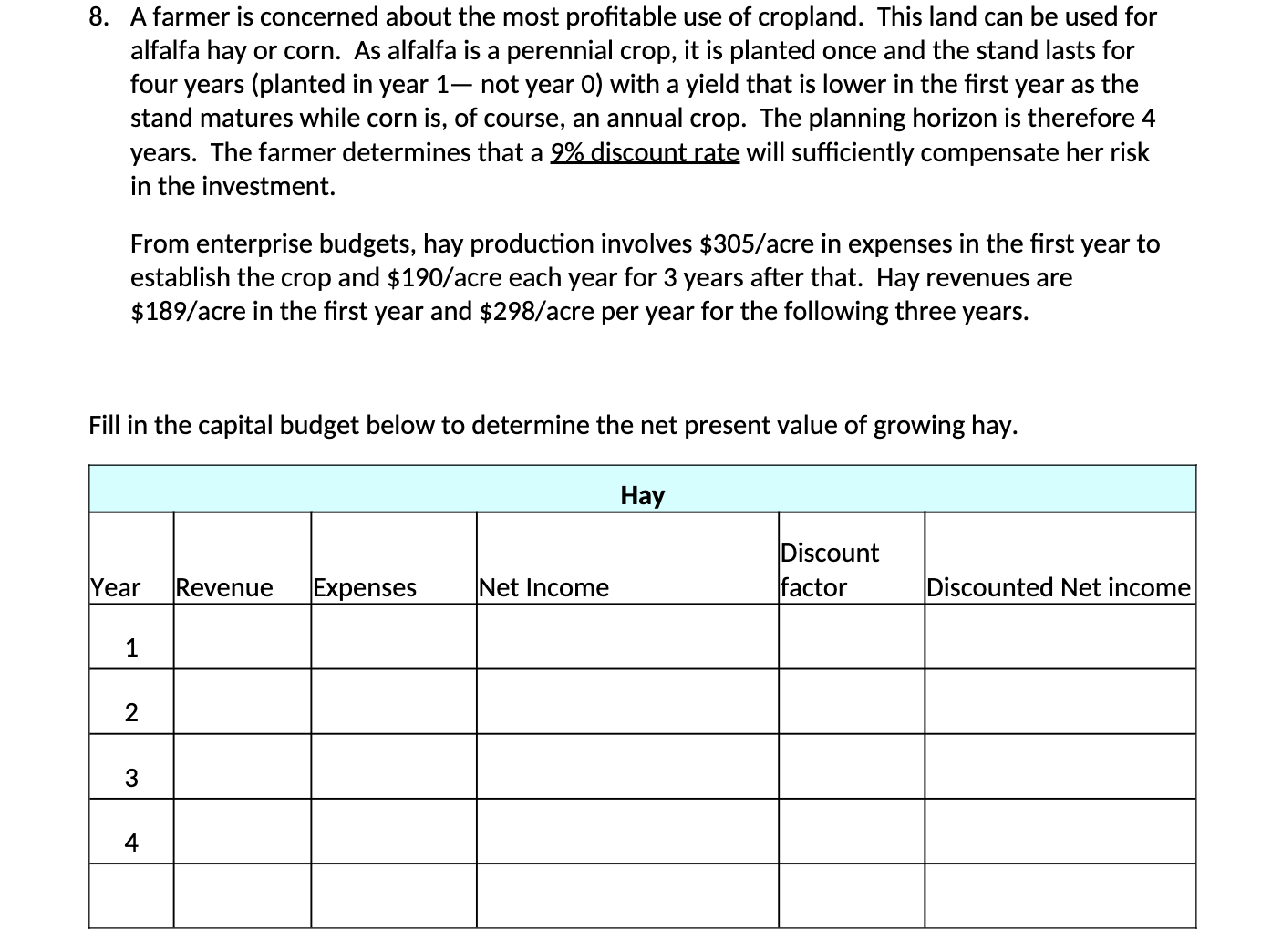

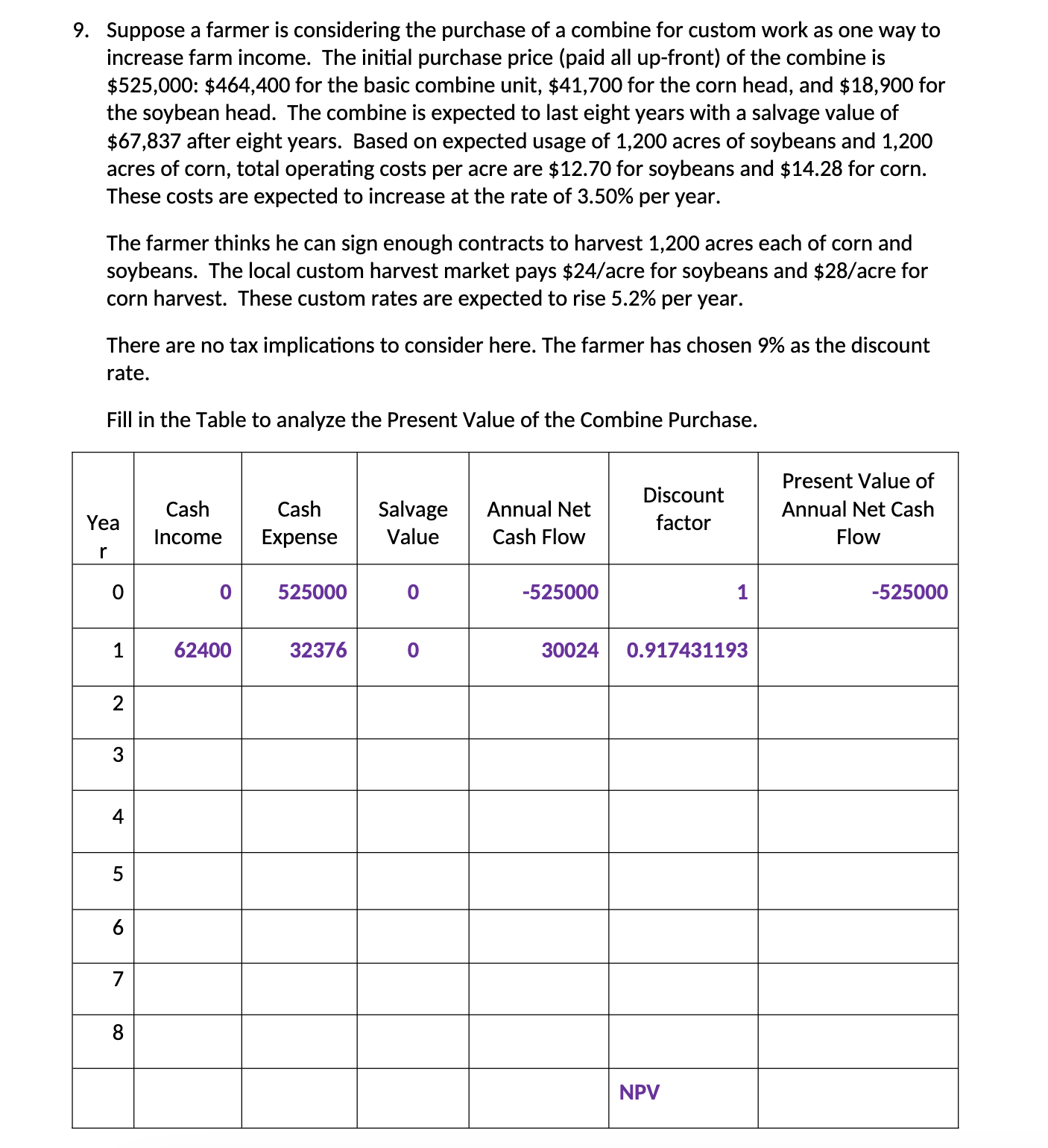

Use the following Present and Future Values table for Q1 and Q2. Year 1 Present Value of $1 Future Value of $1 2 3 $0.926 $0.857 $0.794 $1.080 $1.166 $1.260 1. If you receive $3,900 one year from now and $10,300 3 years from now, what is it worth today? 2. If you have $32,600 today, what will it be worth 2 years from now? 3. If a decision-maker is using the Weighted Average Cost of Capital to calculate an appropriate discount rate and will use 75% debt and 25% equity with an interest rate on borrowed capital of 4% and the long-run return on equity of 11% and the farm is in the 28% marginal tax bracket, what is the WACC? 4. If a farmer plans to borrow all money to purchase a tractor at 6 percent interest, and is in the 28 percent tax bracket, the cost of capital for this investment is: 5. Payback Period: Calculate the payback period for an investment of $24,000 and an expected annual net revenue of $7000. 6. Simple Rate of Return: Determine the simple rates of return & which investment, A or B, is preferred using the simple rate of return to analyze the investments. Investment A has an average annual net revenue of $1,000 and requires an investment cost of $10,000. Investment B has an average annual net revenue of $1,600 and requires an investment cost of $17,000. 7. Future Value of an Annuity: Calculate the future value of a payment of $1,500 deposited at the end of each year for 4 years with an interest rate of 6%. In other words, what is the future value of this stream of payments? 8. A farmer is concerned about the most profitable use of cropland. This land can be used for alfalfa hay or corn. As alfalfa is a perennial crop, it is planted once and the stand lasts for four years (planted in year 1 not year 0) with a yield that is lower in the first year as the stand matures while corn is, of course, an annual crop. The planning horizon is therefore 4 years. The farmer determines that a 9% discount rate will sufficiently compensate her risk in the investment. From enterprise budgets, hay production involves $305/acre in expenses in the first year to establish the crop and $190/acre each year for 3 years after that. Hay revenues are $189/acre in the first year and $298/acre per year for the following three years. Fill in the capital budget below to determine the net present value of growing hay. Year Revenue Expenses Net Income 1 2 3 4 Hay Discount factor Discounted Net income 9. Suppose a farmer is considering the purchase of a combine for custom work as one way to increase farm income. The initial purchase price (paid all up-front) of the combine is $525,000: $464,400 for the basic combine unit, $41,700 for the corn head, and $18,900 for the soybean head. The combine is expected to last eight years with a salvage value of $67,837 after eight years. Based on expected usage of 1,200 acres of soybeans and 1,200 acres of corn, total operating costs per acre are $12.70 for soybeans and $14.28 for corn. These costs are expected to increase at the rate of 3.50% per year. The farmer thinks he can sign enough contracts to harvest 1,200 acres each of corn and soybeans. The local custom harvest market pays $24/acre for soybeans and $28/acre for corn harvest. These custom rates are expected to rise 5.2% per year. There are no tax implications to consider here. The farmer has chosen 9% as the discount rate. Fill in the Table to analyze the Present Value of the Combine Purchase. Yea Cash Income Cash Expense Salvage Value Annual Net Cash Flow Discount factor Present Value of Annual Net Cash Flow r 525000 0 -525000 1 -525000 1 62400 32376 0 30024 0.917431193 2 3 4 5 6 7 8 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts