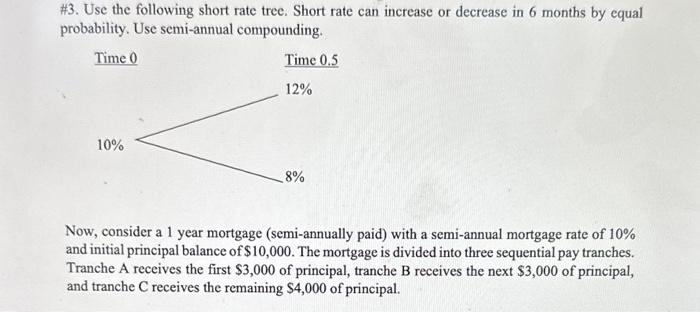

Question: Use the following short rate tree. Short rate can increase or decrease in 6 months by equal probability. Use semi-annual compounding. Time 0 Time 0.5

Use the following short rate tree. Short rate can increase or decrease in 6 months by equal probability. Use semi-annual compounding.

Time 0 Time 0.5

10%-12%-8%

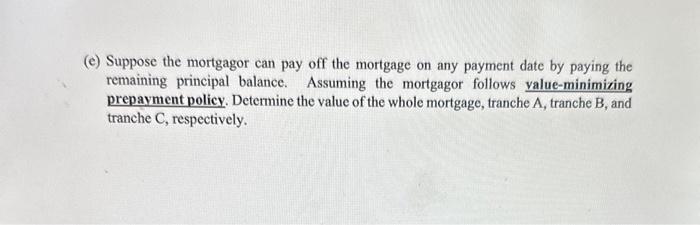

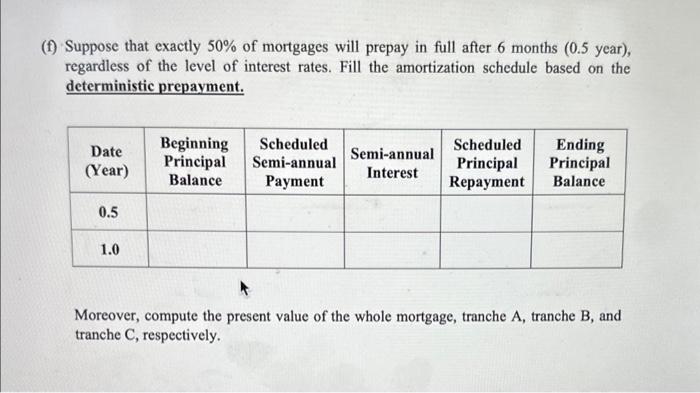

Now, consider a 1 year mortgage (semi-annually paid) with a semi-annual mortgage rate of 10% and initial principal balance of $10,000. The mortgage is divided into three sequential pay tranches. Tranche A receives the first $3,000 of principal, tranche B receives the next $3,000 of principal, and tranche C receives the remaining $4,000 of principal. ( it is urgent! pls help me!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts