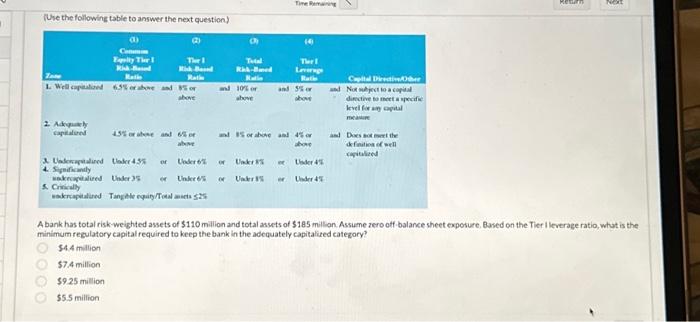

Question: (Use the following table to answer the next question.) A bank has total risk-weighted assets of ( $ 110 ) million and total assets of

Whe the following table to answer the next question) A bank has total risk-weighted assets of $110 million and total assets of $185 million. Assume zero off-balance sheet exposure, Based on the Tier I lieverage ratio, whot is the minimum regulatory capital required to keep the bank in the adequately capitalized category? 54.4 milion $7.4 million $9.25 million $5.5 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts