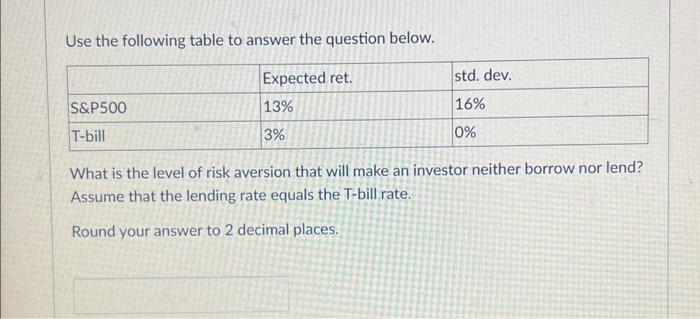

Question: Use the following table to answer the question below. What is the level of risk aversion that will make an investor neither borrow nor lend?

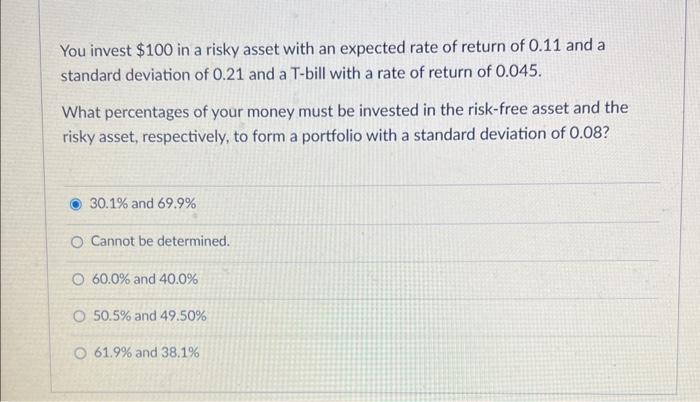

Use the following table to answer the question below. What is the level of risk aversion that will make an investor neither borrow nor lend? Assume that the lending rate equals the T-bill rate. Round your answer to 2 decimal places. You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045 . What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.08 ? 30.1% and 69.9% Cannot be determined. 60.0% and 40.0% 50.5% and 49.50% 61.9% and 38.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts