Question: Use the foolwing information to answer the question at the end. PLEASE help me answer this question. PLEASE EXPLAIN AS MUCH AS POSSIABLE WHILE ANSWERING

Use the foolwing information to answer the question at the end.

PLEASE help me answer this question.

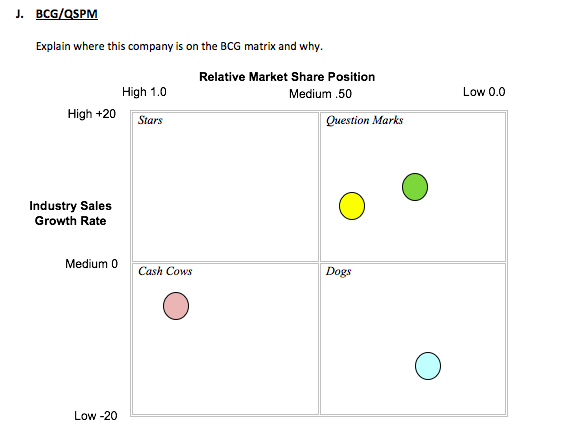

PLEASE EXPLAIN AS MUCH AS POSSIABLE WHILE ANSWERING THE QUESTION Explain where this company is on the BCG matrix and why.

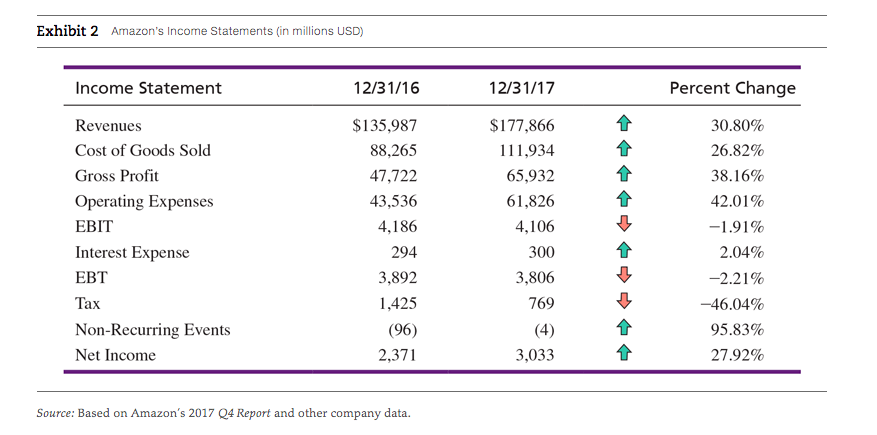

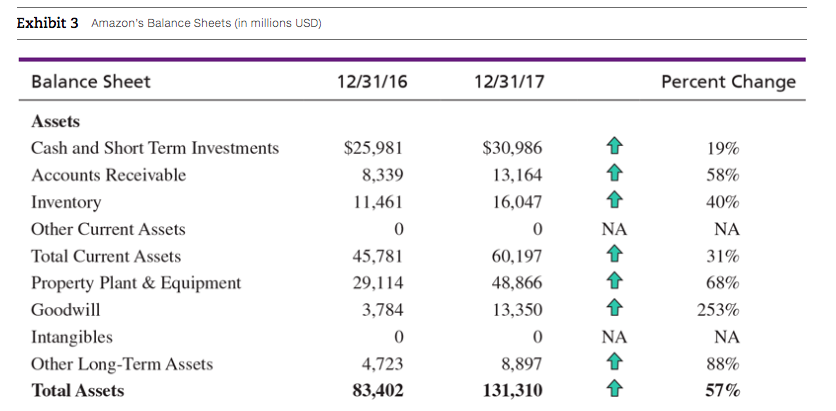

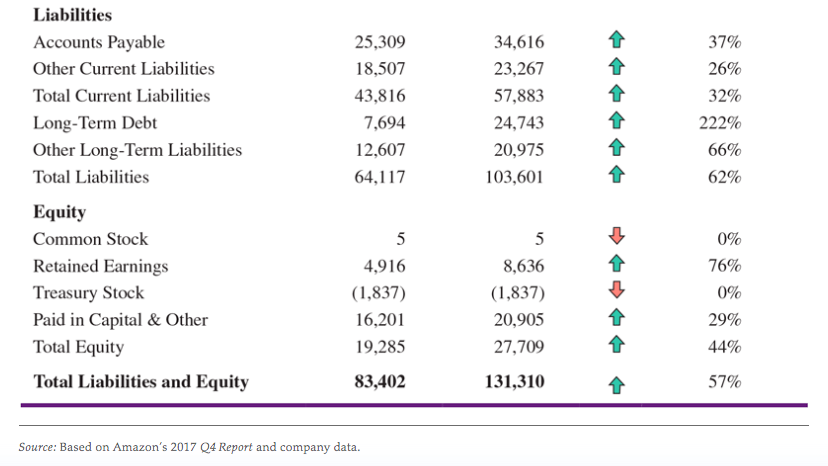

Finance Amazon reported excellent earnings in 2017, up 31 percent from 2016 with net income up 28 percent. It is important to note, however, in Exhibit 2, that EBIT actually decreased due to operating expenses, representing a larger percent of sales in 2017. The company was spared from a drop in net income due to a 46 percent drop in their tax rate. Also, the Whole Foods Market acquisitions can explain a portion of the revenue increases and likely explain a large portion of the additional goodwill in Exhibit 3. Note in Exhibit 3, the large increase in long-term debt. Amazon does not pay dividends either, but this is not a real surprise as the firm is ready to invest its capital in other ventures. Exhibit 2 Amazon's Income Statements (in millions USD) Source: Based on Amazon's 2017 Q4 Report and other company data. Exhibit 3 Amazon's Balance Sheets (in millions USD) Source: Based on Amazon's 2017 Q4 Report and company data. Explain where this company is on the BCG matrix and why. Relative Market Share Position Himt 10 Madtia on High +20 Industry Sales Growth Rate Medium 0 Low -20 Finance Amazon reported excellent earnings in 2017, up 31 percent from 2016 with net income up 28 percent. It is important to note, however, in Exhibit 2, that EBIT actually decreased due to operating expenses, representing a larger percent of sales in 2017. The company was spared from a drop in net income due to a 46 percent drop in their tax rate. Also, the Whole Foods Market acquisitions can explain a portion of the revenue increases and likely explain a large portion of the additional goodwill in Exhibit 3. Note in Exhibit 3, the large increase in long-term debt. Amazon does not pay dividends either, but this is not a real surprise as the firm is ready to invest its capital in other ventures. Exhibit 2 Amazon's Income Statements (in millions USD) Source: Based on Amazon's 2017 Q4 Report and other company data. Exhibit 3 Amazon's Balance Sheets (in millions USD) Source: Based on Amazon's 2017 Q4 Report and company data. Explain where this company is on the BCG matrix and why. Relative Market Share Position Himt 10 Madtia on High +20 Industry Sales Growth Rate Medium 0 Low -20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts