Question: Use the formula Rt - Rft = a; + Bj[RMt - Rft] + Et to estimate the value of B using a regression. Here Rt

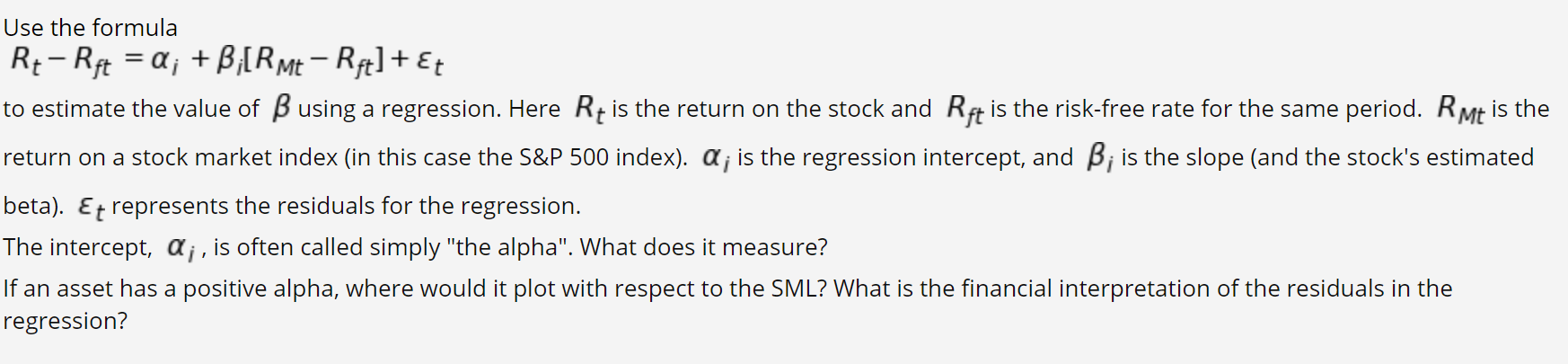

Use the formula Rt - Rft = a; + Bj[RMt - Rft] + Et to estimate the value of B using a regression. Here Rt is the return on the stock and Rft is the risk-free rate for the same period. RMt is the return on a stock market index (in this case the S&P 500 index). Q; is the regression intercept, and B; is the slope (and the stock's estimated beta). Et represents the residuals for the regression. The intercept, aj, is often called simply "the alpha". What does it measure? If an asset has a positive alpha, where would it plot with respect to the SML? What is the financial interpretation of the residuals in the regression

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock