Question: USE THE FORMULAS BELOW, PLEASE GIVE DETAIL STEPS 12.02-PR003 WP Polaris Industries has $1,250,000 available for additional innovations on the Victory Vision motorcycle. These include

USE THE FORMULAS BELOW, PLEASE GIVE DETAIL STEPS

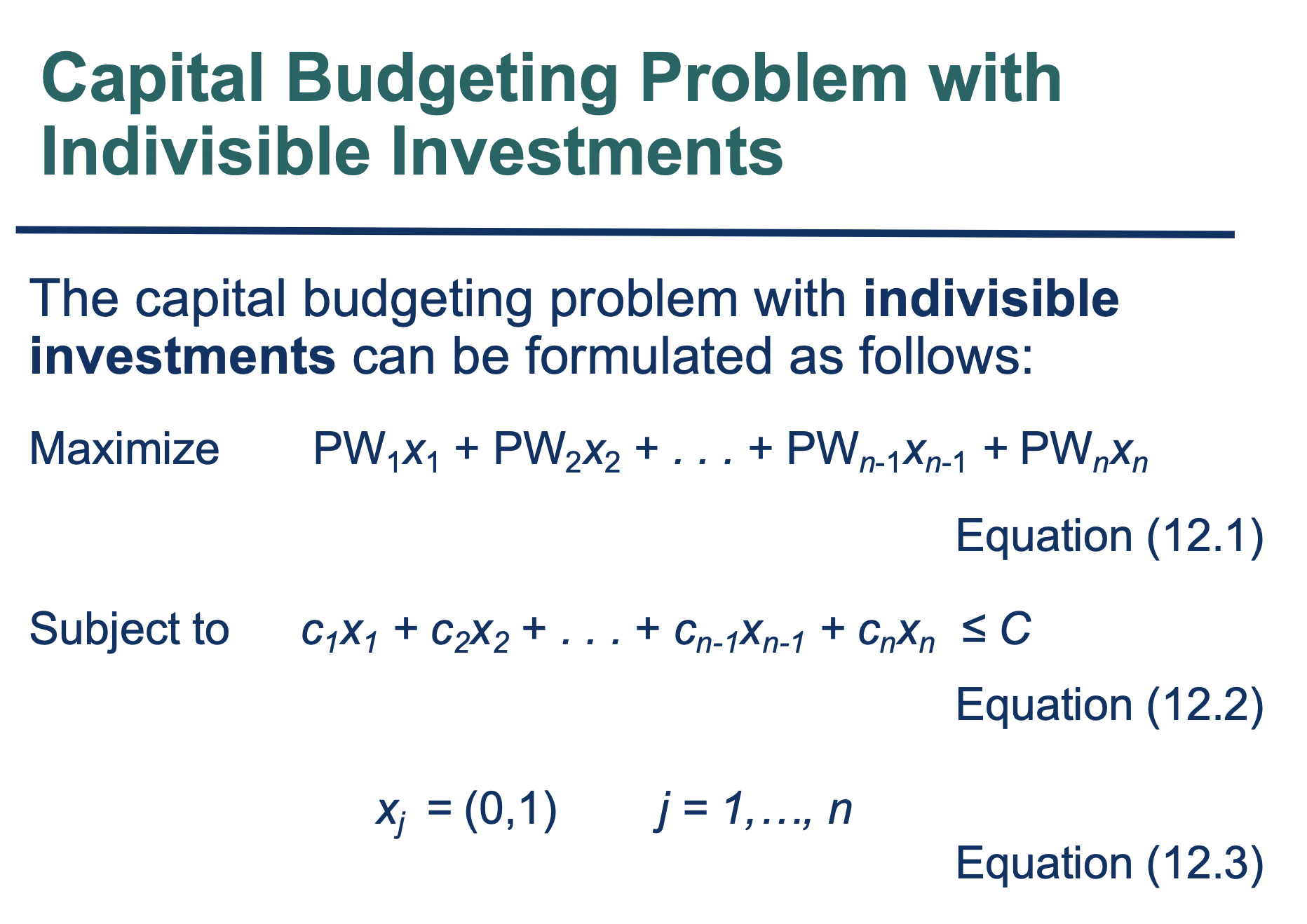

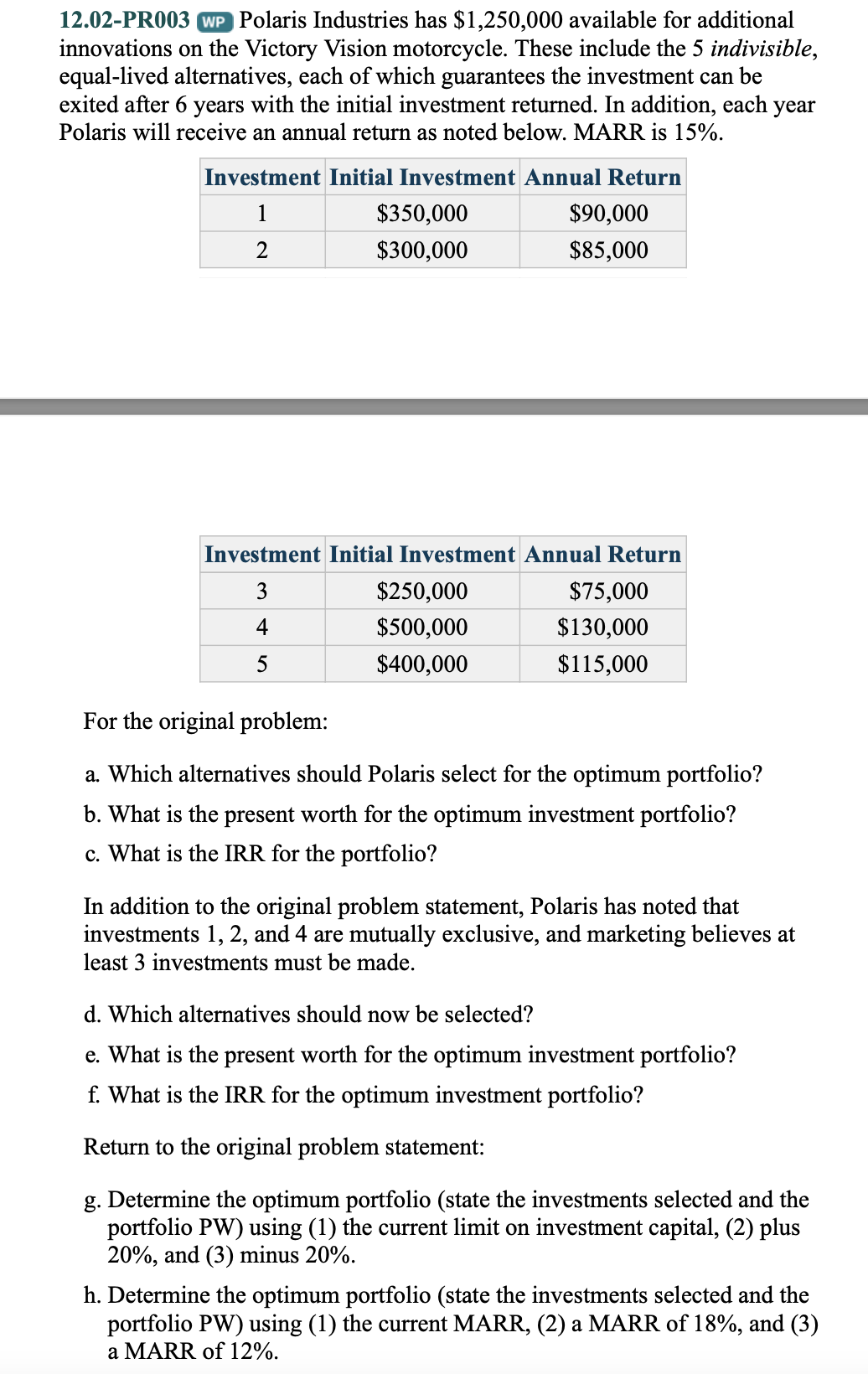

12.02-PR003 WP Polaris Industries has $1,250,000 available for additional innovations on the Victory Vision motorcycle. These include the 5 indivisible, equal-lived alternatives, each of which guarantees the investment can be exited after 6 years with the initial investment returned. In addition, each year Polaris will receive an annual return as noted below. MARR is 15%. For the original problem: a. Which alternatives should Polaris select for the optimum portfolio? b. What is the present worth for the optimum investment portfolio? c. What is the IRR for the portfolio? In addition to the original problem statement, Polaris has noted that investments 1,2 , and 4 are mutually exclusive, and marketing believes at least 3 investments must be made. d. Which alternatives should now be selected? e. What is the present worth for the optimum investment portfolio? f. What is the IRR for the optimum investment portfolio? Return to the original problem statement: g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) a MARR of 18%, and (3) a MARR of 12%. Capital Budgeting Problem with Indivisible Investments The capital budgeting problem with indivisible investments can be formulated as follows: Maximize PW1x1+PW2x2++PWn1xn1+PWnxn Equation (12.1) Subject to c1x1+c2x2++cn1xn1+cnxnC Equation (12.2) xj=(0,1)j=1,,n Equation (12.3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts