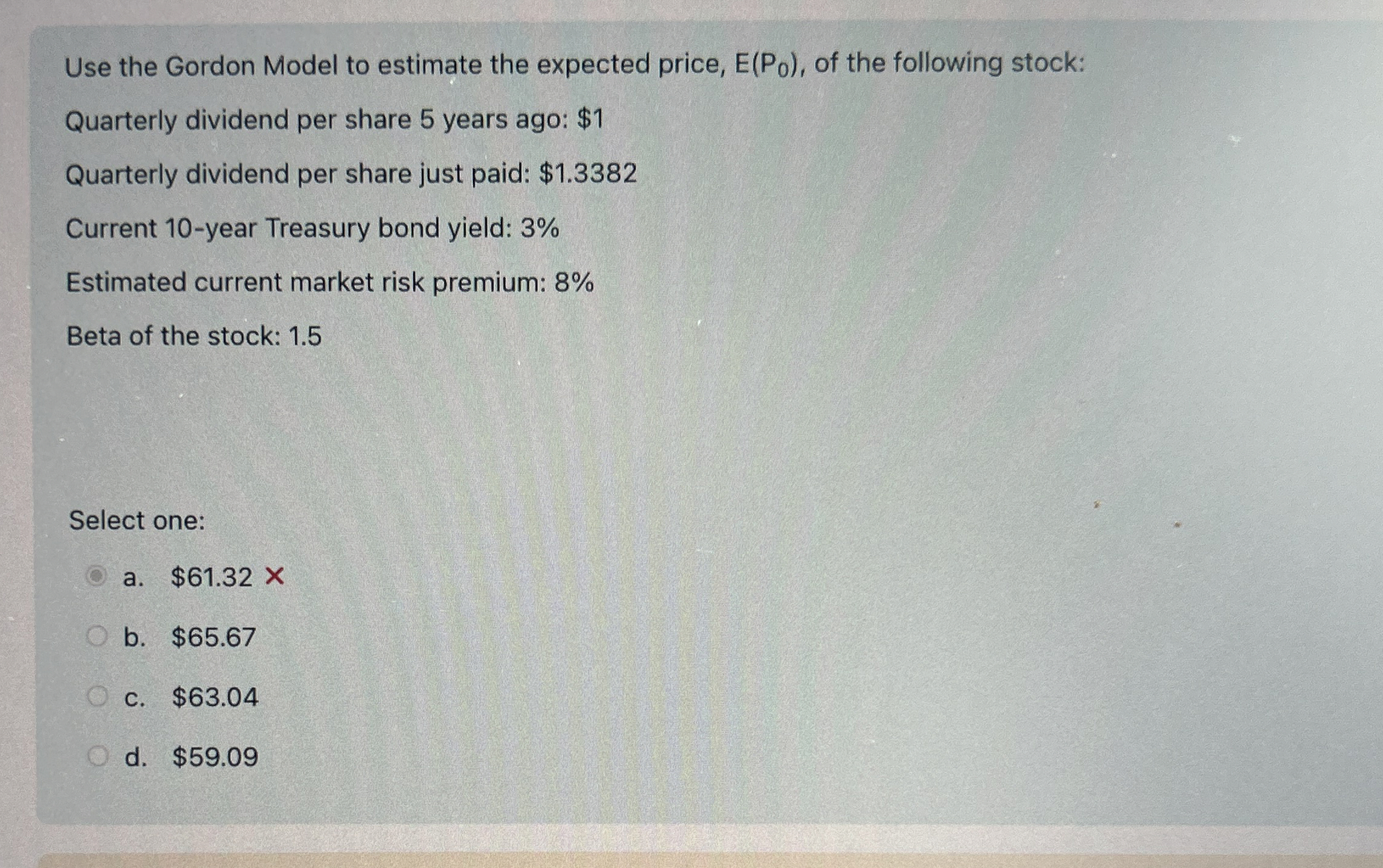

Question: Use the Gordon Model to estimate the expected price, E ( P 0 ) , of the following stock: Quarterly dividend per share 5 years

Use the Gordon Model to estimate the expected price, of the following stock:

Quarterly dividend per share years ago: $

Quarterly dividend per share just paid: $

Current year Treasury bond yield:

Estimated current market risk premium:

Beta of the stock:

Select one:

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock