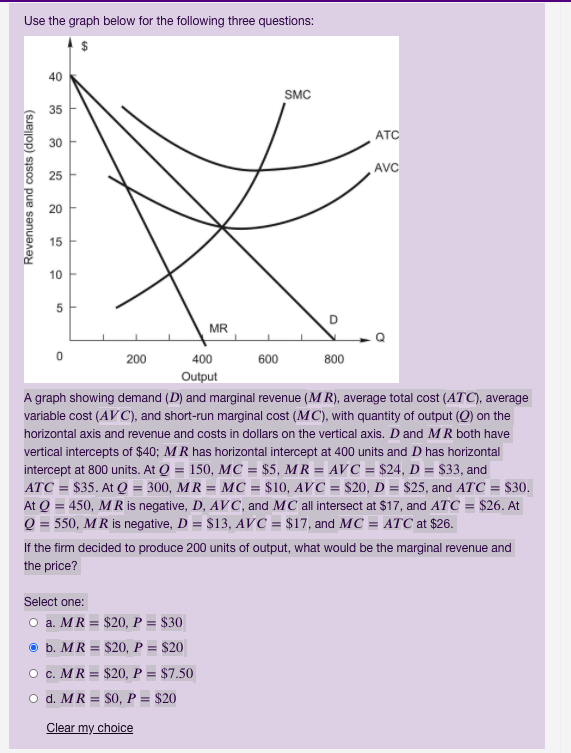

Question: Use the graph below for the following three questions: $ 40 SMC Revenues and costs (dollars) 35 30 ATC 25 AVC 20 15 10 5

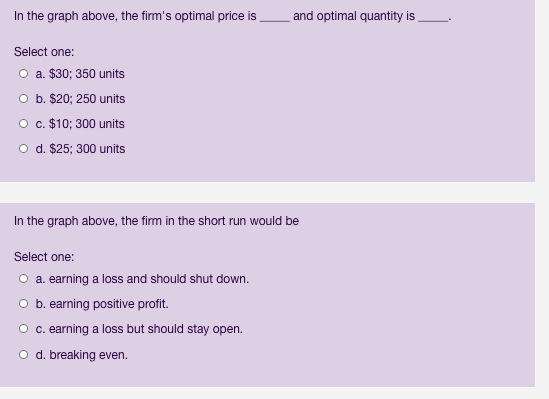

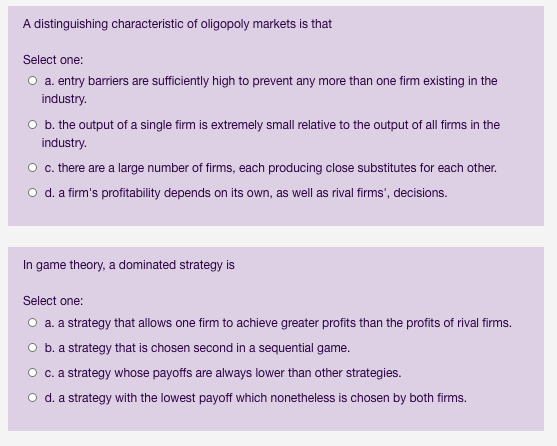

Use the graph below for the following three questions: $ 40 SMC Revenues and costs (dollars) 35 30 ATC 25 AVC 20 15 10 5 MR D Q 0 200 400 600 800 Output A graph showing demand (D) and marginal revenue (M R), average total cost (ATC), average variable cost (AVC), and short-run marginal cost (MC), with quantity of output (Q) on the horizontal axis and revenue and costs in dollars on the vertical axis. D and MR both have vertical intercepts of $40; M K has horizontal intercept at 400 units and D has horizontal intercept at 800 units. At 0 = 150, MC = $5, MR = AVC = $24, D = $33, and ATC = $35. At Q = 300, MR = MC = $10, AVC = $20, D = $25, and ATC = $30. At Q = 450, MR is negative, D, AVC, and MC all intersect at $17, and ATC = $26. At Q = 550, MR is negative, D = $13, AVC = $17, and MC = ATC at $26. If the firm decided to produce 200 units of output, what would be the marginal revenue and the price? Select one: O a. MR = $20, P = $30 O b. MR = $20, P = $20 O C. MR = $20, P = $7.50 O d. MR = $0, P = $20 Clear my choiceIn the graph above, the firm's optimal price is and optimal quantity is Select one: O a. $30; 350 units O b. $20; 250 units O c. $10: 300 units O d. $25; 300 units In the graph above, the firm in the short run would be Select one: O a. earning a loss and should shut down. O b. earning positive profit. O c. earning a loss but should stay open. O d. breaking even.A distinguishing characteristic of oligopoly markets is that Select one: O a. entry barriers are sufficiently high to prevent any more than one firm existing in the industry. O b. the output of a single firm is extremely small relative to the output of all firms in the industry. O c. there are a large number of firms, each producing close substitutes for each other. O d. a firm's profitability depends on its own, as well as rival firms', decisions. In game theory, a dominated strategy is Select one: O a. a strategy that allows one firm to achieve greater profits than the profits of rival firms. O b. a strategy that is chosen second in a sequential game. O c. a strategy whose payoffs are always lower than other strategies. O d. a strategy with the lowest payoff which nonetheless is chosen by both firms.Two law firms compete for most of the market in the small town of Grumbleton, and must choose their advertising levels simultaneously. The following payoff table facing the two firms, Jackie Chiles Law, LLC and Lionel Hutz Law Firm, shows the weekly profit outcomes for the various advertising decision combinations. Use this payoff table to answer the following three questions. [Blank for Formatting] Hutz Advertising Level: Hutz Advertising Level: Low High Chiles Advertising Level: Low $2500/$2500 $1500/$3500 Chiles Advertising Level: High $3500/$1500 $2000/$2000 Jackie Chiles Law, LLC has Select one: O a. no dominant strategy; choose a high level if Hutz chooses high, and a low level if Hutz chooses low. O b. a dominated strategy; never choose a high level of advertising. O c. a dominant strategy: choose a high level of advertising. O d. a dominant strategy: choose a low level of advertising. Lionel Hutz Law Firm has Select one: O a. a dominant strategy: choose a high level of advertising. O b. a dominant strategy: choose a low level of advertising. O c. a dominated strategy: never choose a low level of advertising if Chiles chooses high, and never choose a high level of advertising if Chiles chooses low. O d. no dominant strategy since Hutz profits are earned after profits are earned by Chiles.Where is the Nash equilibrium outcome? Select one: O a. Both choose low with Chiles getting a slightly larger profit. O b. Chiles choose high and Hutz choose low since Hutz has a dominant strategy while Chiles has a dominated strategy. O c. Both choose high and earn a relatively low combined profit. O d. Chiles choose low and Hutz choose high because Hutz's low strategy is dominated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts