Question: Use the high - low method find the variable and fixed overhead rates. Standard cost per unit: The fixed cost standard rate uses 1 ,

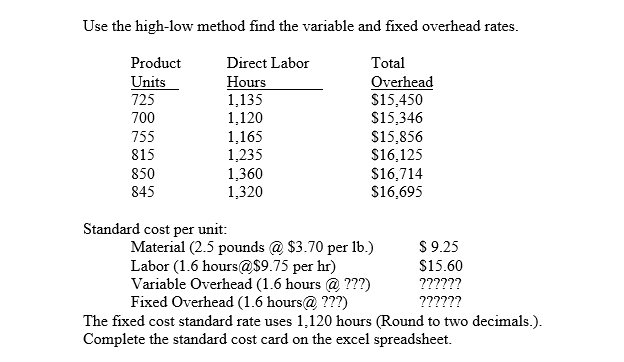

Use the highlow method find the variable and fixed overhead rates.

Standard cost per unit:

The fixed cost standard rate uses hours Round to two decimals.

Complete the standard cost card on the excel spreadsheet. Analysis of the actual factory data show the following none has been recorded:

Production:

Material is added at the beginning of the process.

Beginning units in process complete conversion

Transferred to finished goods

units

Ending units in process complete conversion

units

Material used during the month pounds

Material purchased during the month pounds costing $

Labor used hours costing $

Variable Factory overhead $

Fixed factory overhead $

Santa's workshop uses the FIFO method

Required:

Find the variable overhead rate, fixed overhead rate, and standard cost card Due in Module begintabularcccc

hline Direct Labor Hours & & &

hline & Product & Direct & Budgeted

hline & Units & Labor Hours & Overhead

hline Lowest activity and cost & & &

hline Highest activity and cost & & &

hline & & &

hline Std cost & & &

hline Direct Material & & &

hline Direct labor & & &

hline Overhead Based on direct labor & & &

hline Variable overhead & & &

hline Fixed overhead & & &

hline & & &

hline

endtabular Other information:

Overhead rate

Fixed overhead rate is based on direct labor hours.

Fill in the shaded areas.

Type explanation here on how the overhead was calculated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock