Question: Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable.

- Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable. You should have 3 years of income statements, so pick the 2 years with the highest and lowest revenue to do the high-low analysis, and use total operating expenses from those same two years for the analysis.

- Based on your estimate of the portion of expenses that are variable, compute your companys contribution margin (described in Chapter 3) for the more recent year.

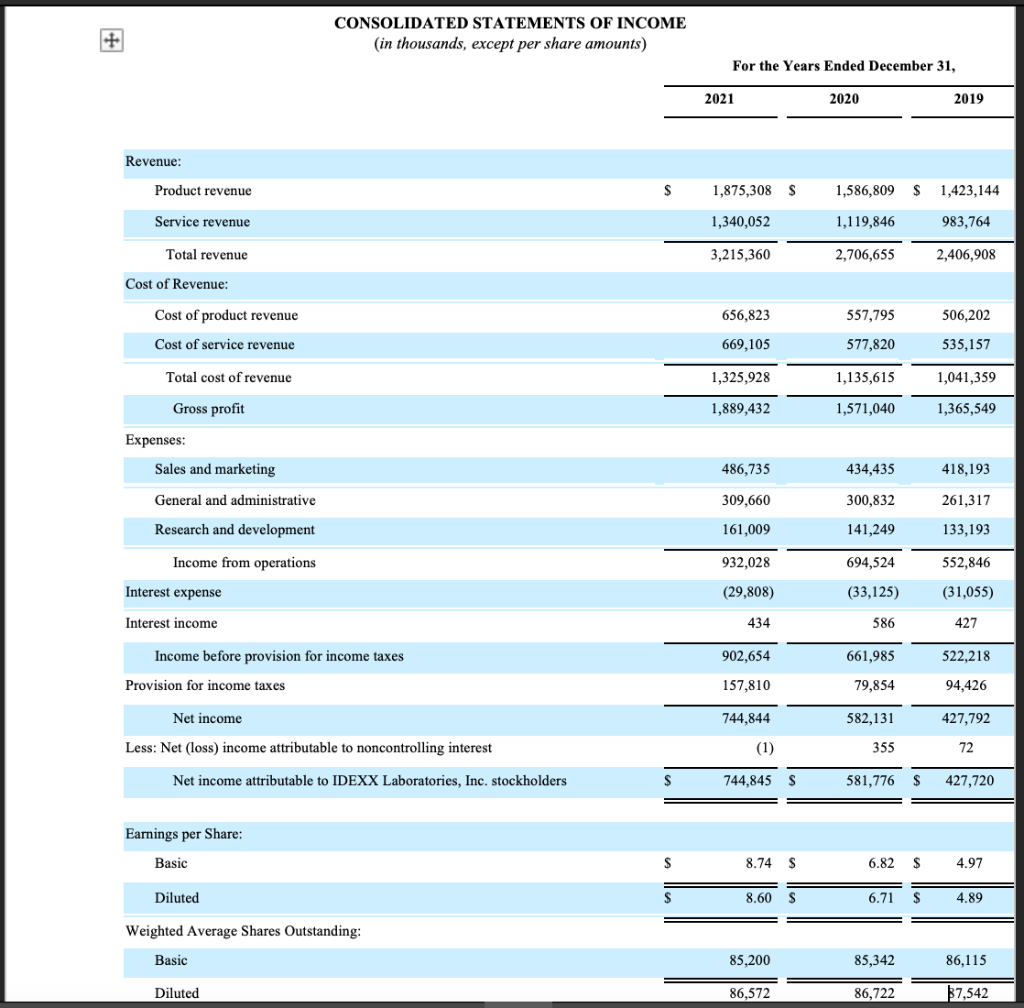

CONSOLIDATED STATEMENTS OF INCOME (in thousands, except per share amounts) For the Years Ended December 31, 2021 2020 2019 Revenue: Product revenue $ 1,875,308 S 1,586,809 $ 1,423,144 Service revenue 1,340,052 1,119,846 983,764 Total revenue 3,215,360 2,706,655 2,406,908 Cost of Revenue: Cost of product revenue 656,823 557,795 506,202 Cost of service revenue 669,105 577,820 535,157 Total cost of revenue 1,325,928 1,135,615 1,041,359 1,889,432 1,571,040 1,365,549 Gross profit Expenses: Sales and marketing 486,735 434,435 418,193 General and administrative 309,660 300,832 261,317 Research and development 161,009 141,249 133,193 Income from operations 932,028 694,524 552,846 Interest expense (29,808) (33,125) (31,055) Interest income 434 586 427 902,654 661,985 522,218 Income before provision for income taxes Provision for income taxes 157,810 79,854 94,426 Net income 744,844 582,131 427,792 (1) 355 72 Less: Net (loss) income attributable to noncontrolling interest Net income attributable to IDEXX Laboratories, Inc. stockholders $ 744,845 581,776 427,720 Earnings per Share: Basic S 8.74 $ 6.82 $ 4.97 Diluted $ 8.60 $ 6.71 $ 4.89 Weighted Average Shares Outstanding: Basic 85,200 85,342 86,115 Diluted 86,572 86,722 $7,542

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts