Question: use the i formation provided in E3-5B to prepare journal entries to close the accounts using the income summary account.After these. entries are posted what

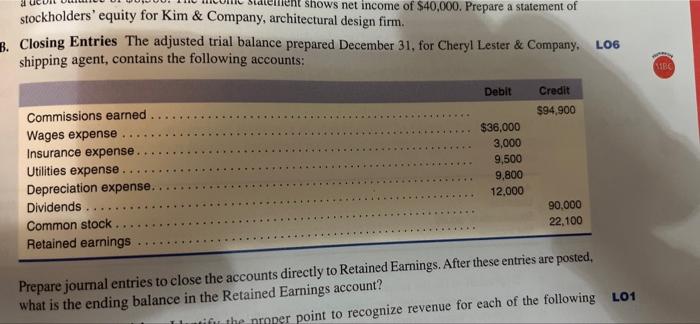

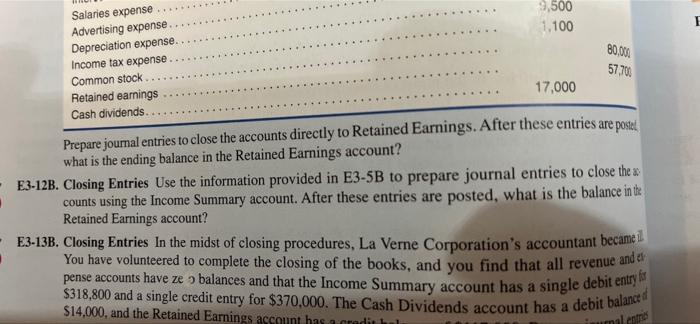

a shows net income of $40,000. Prepare a statement of stockholders' equity for Kim & Company, architectural design firm. 3. Closing Entries The adjusted trial balance prepared December 31, for Cheryl Lester & Company, L06 shipping agent, contains the following accounts: Credit 1BC Debit $94.900 Commissions earned Wages expense Insurance expense. Utilities expense Depreciation expense. Dividends Common stock Retained earnings $36.000 3,000 9,500 9,800 12.000 90.000 22.100 Prepare journal entries to close the accounts directly to Retained Earnings. After these entries are posted, what is the ending balance in the Retained Earnings account? if the proper point to recognize revenue for each of the following L01 9,500 1.100 Salaries expense Advertising expense Depreciation expense. Income tax expense. Common stock Retained earnings Cash dividends. 80.8 57.70 17,000 Prepare journal entries to close the accounts directly to Retained Earnings. After these entries are postel what is the ending balance in the Retained Earnings account? E3-12B. Closing Entries Use the information provided in E3-5B to prepare journal entries to close the counts using the Income Summary account. After these entries are posted, what is the balance in the Retained Earnings account? E3-138. Closing Entries In the midst of closing procedures, La Verne Corporation's accountant became il You have volunteered to complete the closing of the books, and you find that all revenue and es pense accounts have ze 3 balances and that the Income Summary account has a single debit entre $318.800 and a single credit entry for $370,000. The Cash Dividends account has a debit balanced $14,000, and the Retained Earnings account has a credil hal amal.com

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts