Question: Use the images to answer the question on Image five using the SAME ACCOUNTS. All that has changed in the third image are the numbers.

Use the images to answer the question on Image five using the SAME ACCOUNTS. All that has changed in the third image are the numbers. Don't use pencil or pen. Answers must be typed using professional accounting formatting. Answer b).

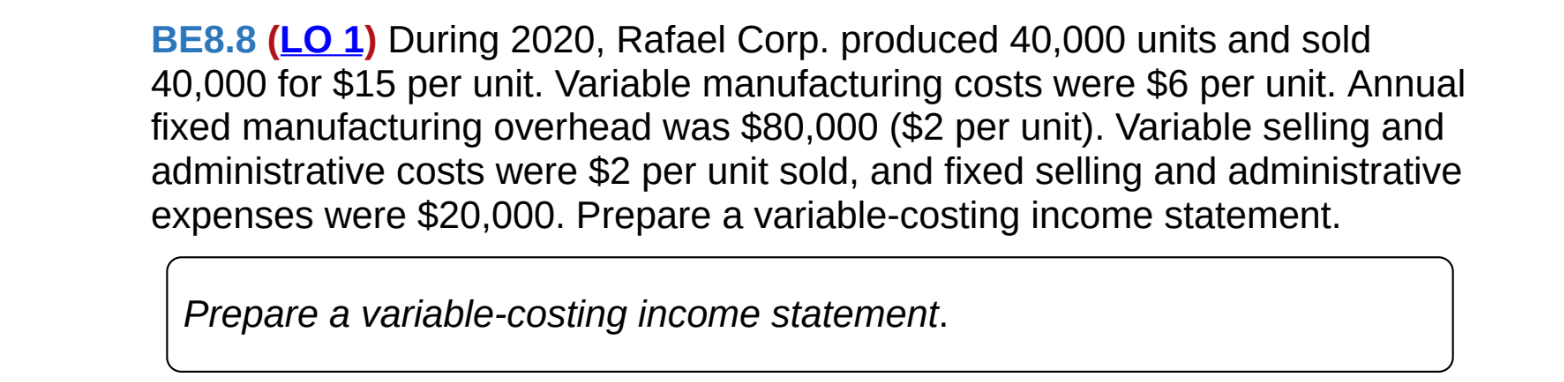

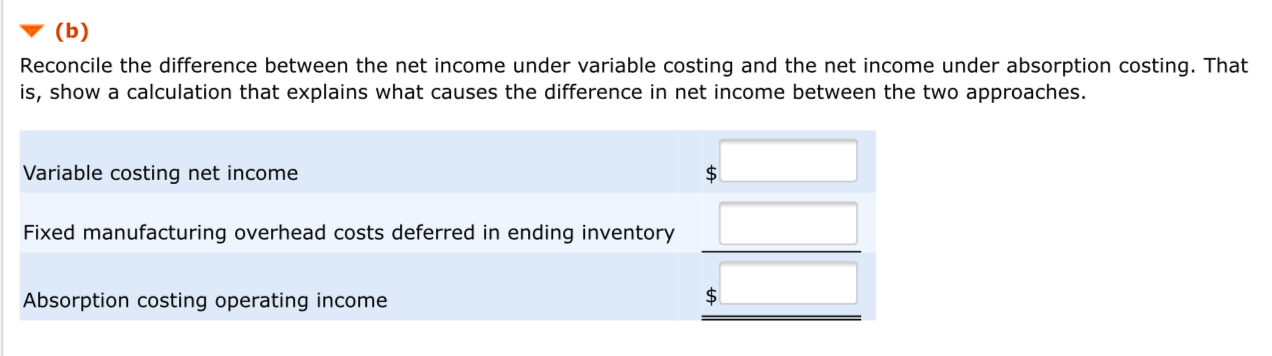

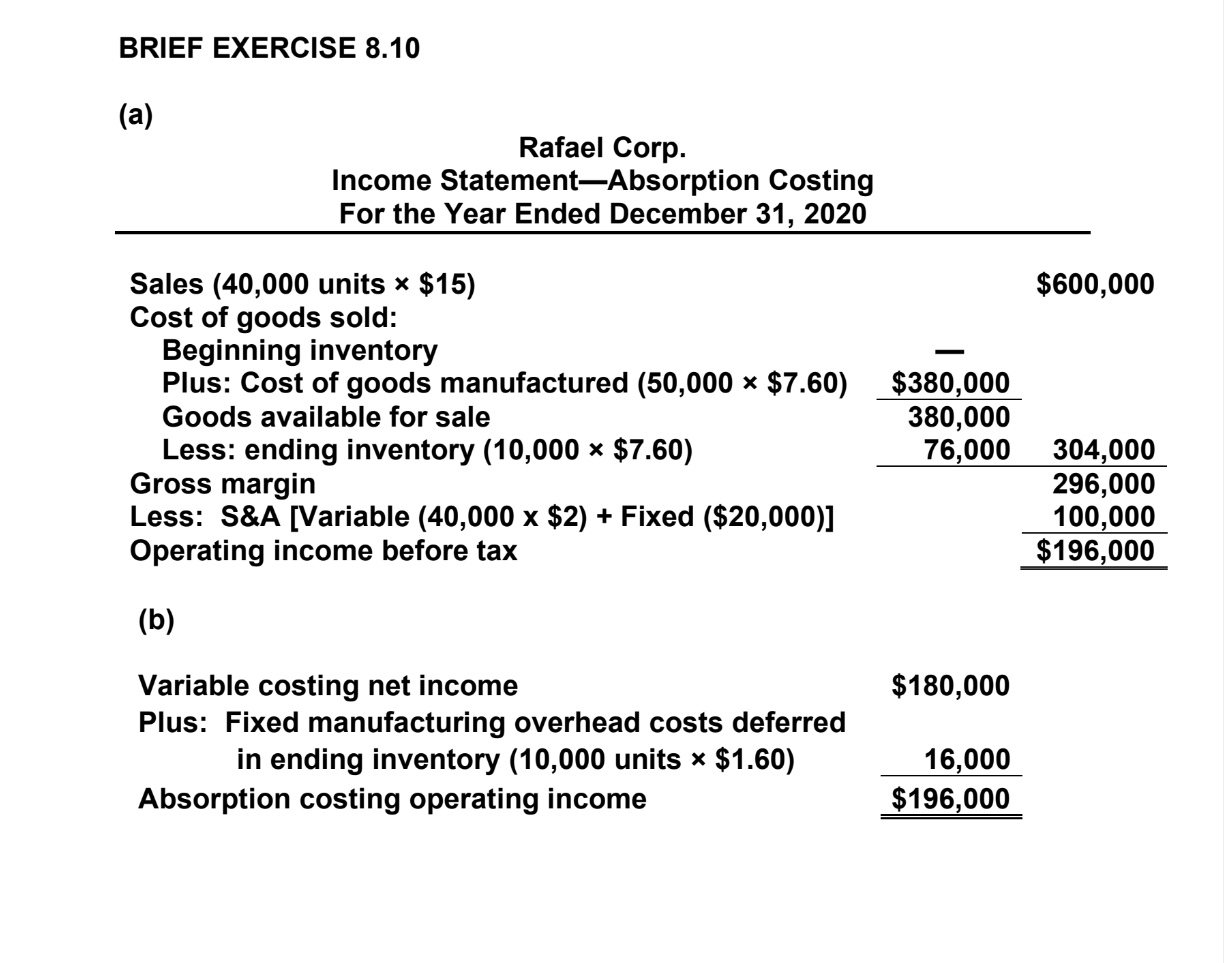

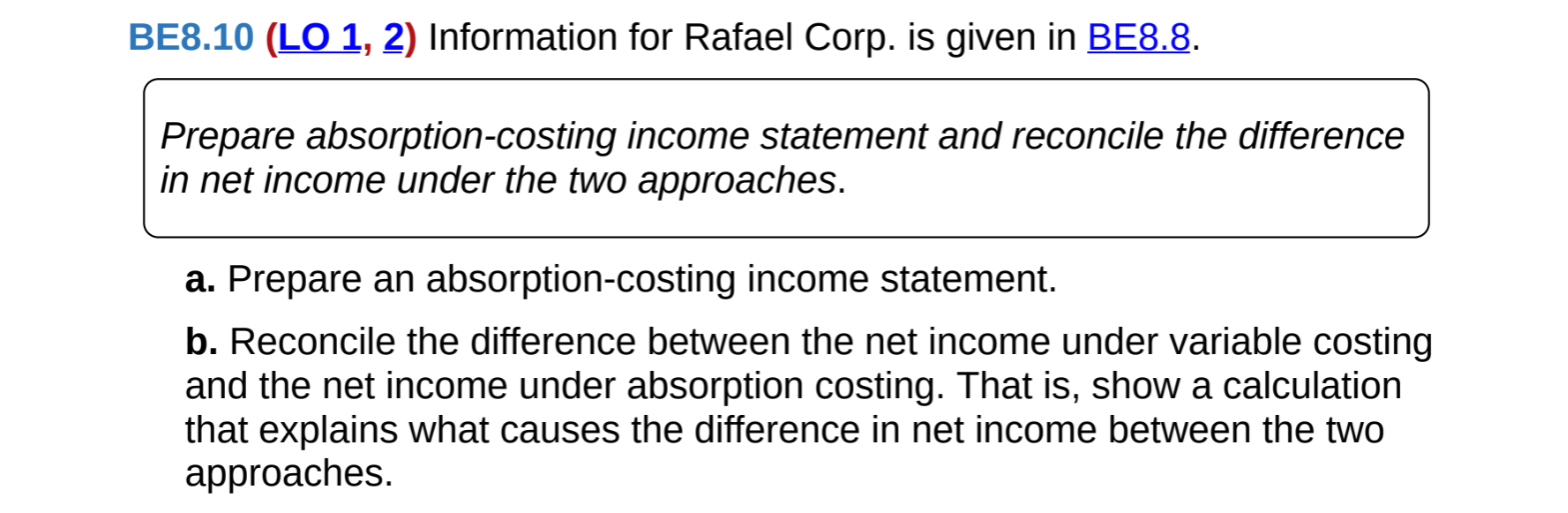

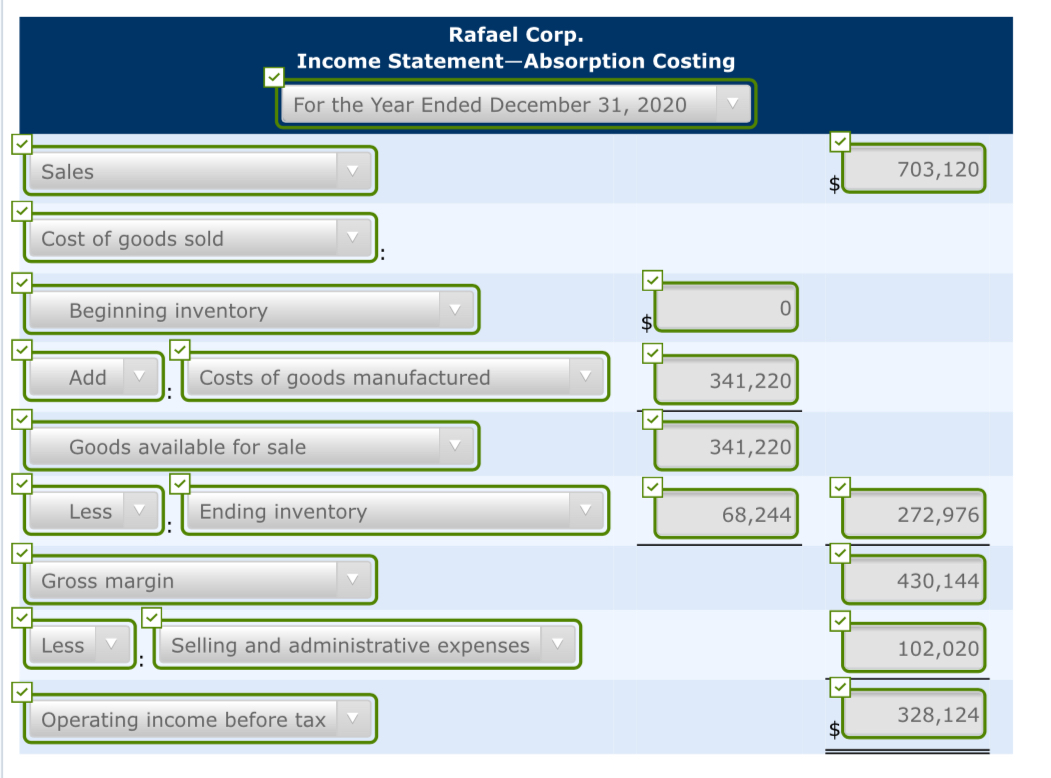

BE8.8 (LO1) During 2020, Rafael Corp. produced 40,000 units and sold 40,000 for $15 per unit. Variable manufacturing costs were $6 per unit. Annual fixed manufacturing overhead was $80,000 ($2 per unit). Variable selling and administrative costs were $2 per unit sold, and fixed selling and administrative expenses were $20,000. Prepare a variable-costing income statement. Prepare a variable-costing income statement. V (b) Reconcile the difference between the net income under variable costing and the net income under absorption costing. That is, show a calculation that explains what causes the difference in net income between the two approaches. Variable costing net income 45 Fixed manufacturing overhead costs deferred in ending inventory Absorption costing operating income '5 BRIEF EXERCISE 8.10 (a) Rafael Corp. Income StatementAbsorption Costing For the Year Ended December 31, 2020 Sales (40,000 units x $15) Cost of goods sold: Beginning inventory Plus: Cost of goods manufactured (50,000 x $7.60) $380,000 Goods available for sale 380,000 Less: ending inventory (10,000 at $7.60) 76,000 Gross margin Less: S&A [Variable (40,000 x $2) + Fixed ($20,000)] Operating income before tax (b) Variable costing net income $180,000 Plus: Fixed manufacturing overhead costs deferred in ending inventory (10,000 units 8 $1.60) 16,000 Absorption costing operating income $196,000 $600,000 304,000 296,000 1 00,000 $196,000 BE8.10 (L9 1, 2) Information for Rafael Corp. is given in BEgg. Prepare absorption-costing income statement and reconcile the difference in net income under the two approaches. a. Prepare an absorption-costing income statement. b. Reconcile the difference between the net income under variable costing and the net income under absorption costing. That is, show a calculation that explains what causes the difference in net income between the two approaches. Rafael Corp. Income Statement-Absorption Costing V For the Year Ended December 31, 2020 V Sales 703,120 Cost of goods sold Beginning inventory 0 Add Costs of goods manufactured 341,220 Goods available for sale 341,220 v V Less Ending inventory 68,244 272,976 Gross margin 430, 144 V Less Selling and administrative expenses 102,020 V Operating income before tax 328,124

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts