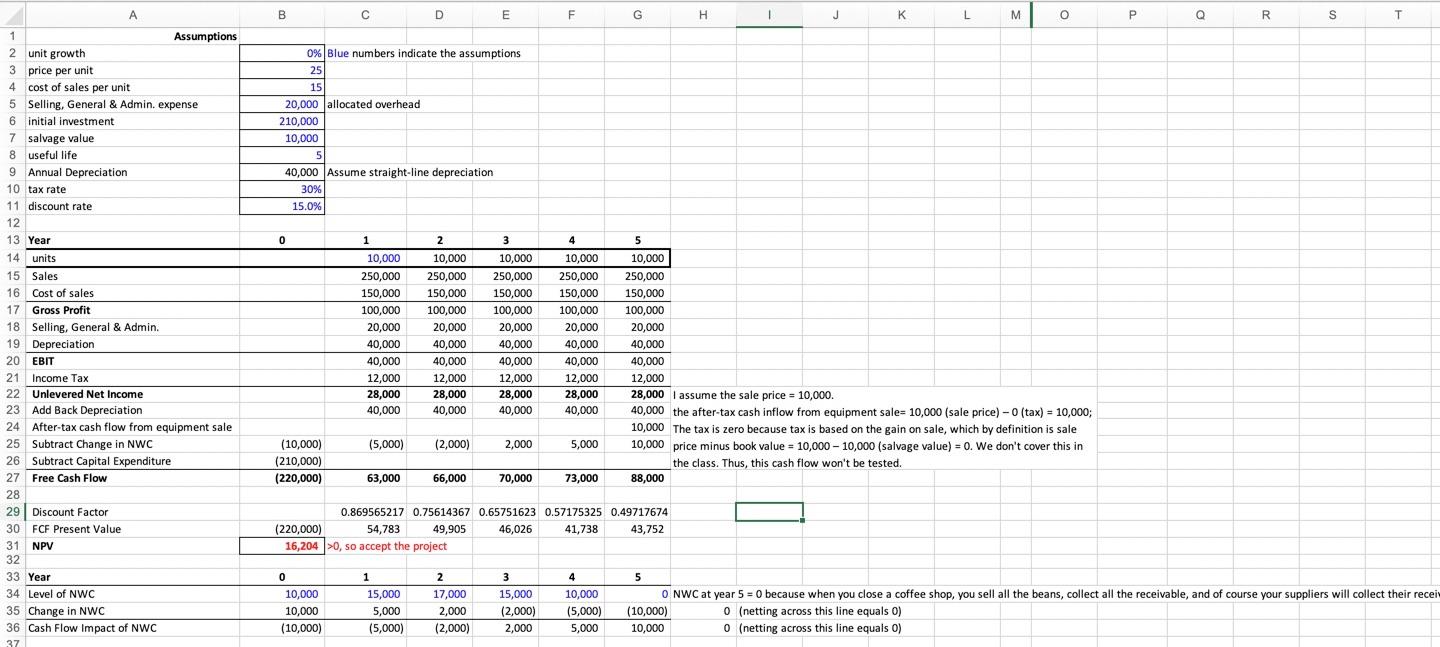

Question: Use the In-class exercise for this problem. The company has a preexisting line of shelves that for $25 per unit with a unit cost of

Use the In-class exercise for this problem. The company has a preexisting line of shelves that for $25 per unit with a unit cost of $15. You estimate that sales for this preexisting line will increase by 1,000 units per year as long as the new line of shelves is in production. What is the new NPV?

o A B D E F G H 1 J L M P Q R S T 0% Blue numbers indicate the assumptions 25 15 20,000 allocated overhead 210,000 10,000 5 40,000 Assume straight-line depreciation 30% 15.0% 0 1 Assumptions 2 unit growth 3 price per unit 4 cost of sales per unit 5 Selling, General & Admin. expense 6 initial investment 7 salvage value 8 useful life 9 Annual Depreciation 10 tax rate 11 discount rate 12 13 Year 14 units 15 Sales 16 Cost of sales 17 Gross Profit 18 Selling, General & Admin. 19 Depreciation 20 EBIT 21 Income Tax 22 Unlevered Net Income 23 Add Back Depreciation 24 After-tax cash flow from equipment sale 25 Subtract Change in NWC 26 Subtract Capital Expenditure 27 Free Cash Flow 28 29 Discount Factor 30 FCF Present Value 31 NPV 32 33 Year 34 Level of NWC 35 Change in NWC 36 Cash Flow Impact of NWC 37 1 10,000 250,000 150,000 100,000 20,000 40,000 40,000 12,000 28,000 40,000 2 10,000 250,000 150,000 100,000 20,000 40,000 40,000 12,000 28,000 40,000 3 10,000 250,000 150,000 100,000 20,000 40,000 40,000 12,000 28,000 40,000 4 10,000 250,000 150,000 100,000 20,000 40,000 40,000 12,000 28,000 40,000 5 10,000 250,000 150,000 100,000 20,000 40,000 40,000 12,000 28,000 I assume the sale price = 10,000. 40,000 the after-tax cash inflow from equipment sale= 10,000 (sale price) - 0 (tax) = 10,000; 10,000 The tax is zero because tax is based on the gain on sale, which by definition is sale 10,000 price minus book value = 10,000 - 10,000 (salvage value) = 0. We don't cover this in the class. Thus, this cash flow won't be tested. 88,000 (5,000) (2,000) 2,000 5,000 (10,000) (210,000) (220,000) 63,000 66,000 70,000 73,000 0.869565217 0.75614367 0.65751623 0.57175325 0.49717674 (220,000) 54,783 49,905 46,026 41,738 43,752 16,204 >0, so accept the project 5 0 10,000 10,000 (10,000) 1 15,000 5,000 (5,000) 2 17,000 2,000 (2,000) 3 15,000 (2,000) 2,000 4 10,000 (5,000) 5,000 O NWC at year 5 = 0 because when you close a coffee shop, you sell all the beans, collect all the receivable, and of course your suppliers will collect their recei (10,000) 0 (netting across this line equals 0) 10,000 0 (netting across this line equals 0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts