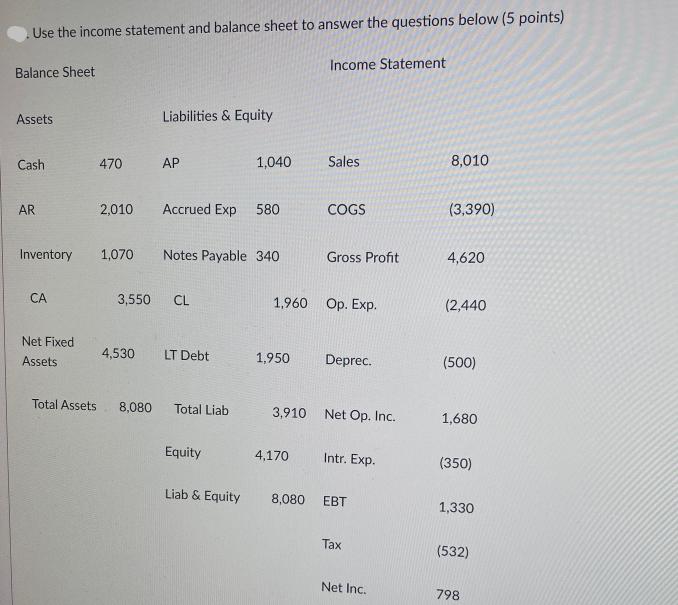

Question: Use the income statement and balance sheet to answer the questions below (5 points) Balance Sheet Assets Cash AR Inventory CA Net Fixed Assets

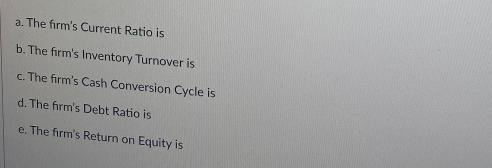

Use the income statement and balance sheet to answer the questions below (5 points) Balance Sheet Assets Cash AR Inventory CA Net Fixed Assets Total Assets 470 Liabilities & Equity 1,070 AP 2,010 Accrued Exp 580 Notes Payable 340 3,550 CL 4,530 LT Debt 1,040 8,080 Total Liab Equity Income Statement Sales COGS 4,170 Gross Profit 1,960 Op. Exp. 1,950 Deprec. 3,910 Net Op. Inc. Intr. Exp. Liab & Equity 8,080 EBT Tax Net Inc. 8,010 (3,390) 4,620 (2,440 (500) 1,680 (350) 1,330 (532) 798 a. The firm's Current Ratio is b. The firm's Inventory Turnover is c. The firm's Cash Conversion Cycle is d. The firm's Debt Ratio is e. The firm's Return on Equity is

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

To calculate the requested financial ratios well use the information provided in the balance sheet a... View full answer

Get step-by-step solutions from verified subject matter experts