Question: Use the income statement to answer question b. Thanks! der m Files G equity cost X +cost+of+capital+beta&tbm=isch&ved=2ahUKEwiBspPghbloAhXKg1MKHZXPDV... @ Shapa Fill Fm - BUSI408_Assignment 5 (1)

Use the income statement to answer question b. Thanks!

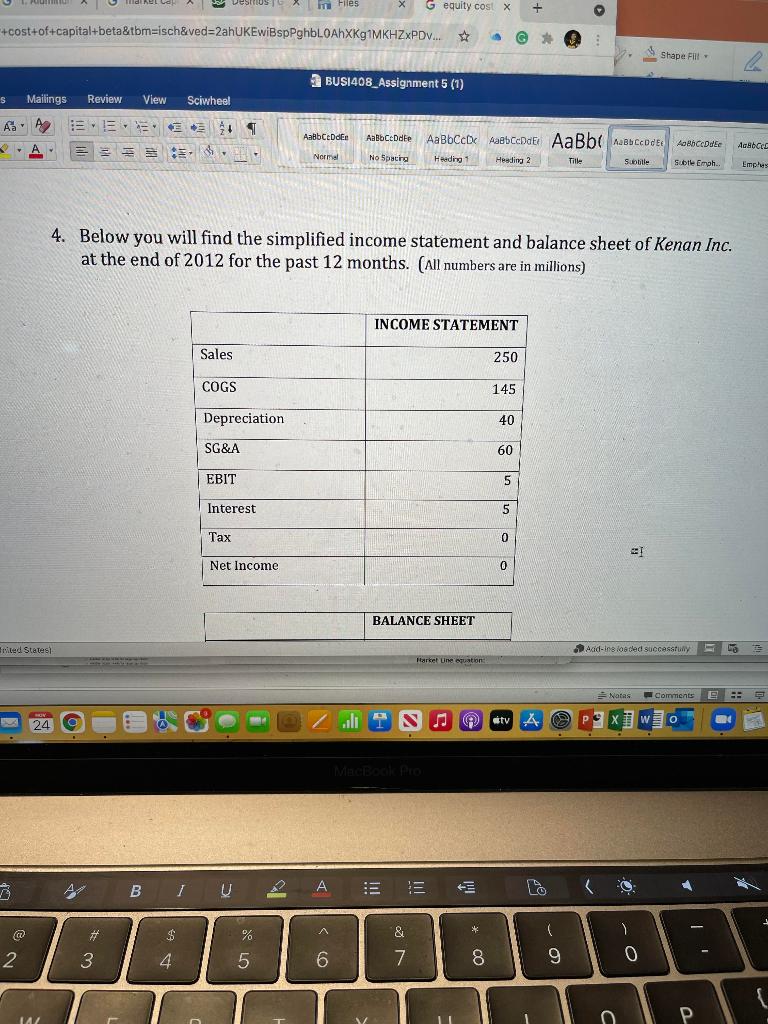

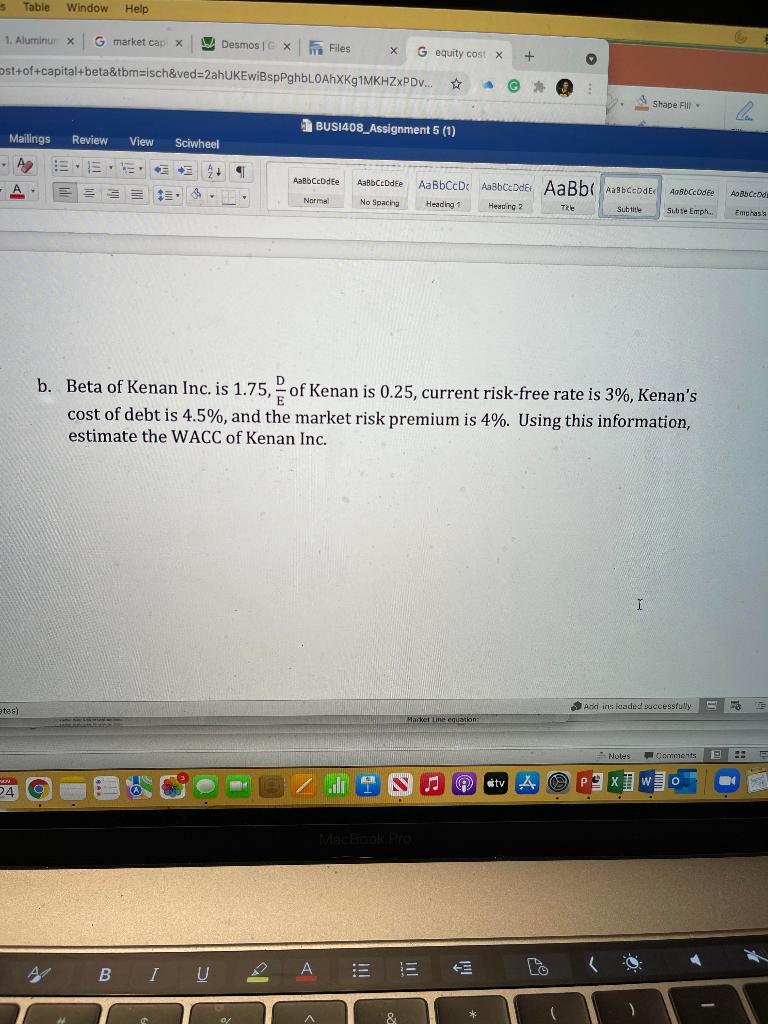

der m Files G equity cost X +cost+of+capital+beta&tbm=isch&ved=2ahUKEwiBspPghbloAhXKg1MKHZXPDV... @ Shapa Fill Fm - BUSI408_Assignment 5 (1) S Mailings Review View Sciwheel AS A AabbCeDdE AaBb Cede AaBbCcDc AaabCende AaBb Bbcode: ASHCeDdEE AsatCE 3 Normal No Spacing Feeding 1 Heading 2 Title Subtle Sole Emph. Emples 4. Below you will find the simplified income statement and balance sheet of Kenan Inc. at the end of 2012 for the past 12 months. (All numbers are in millions) INCOME STATEMENT Sales 250 COGS 145 Depreciation 40 SG&A 60 EBIT 5 Interest 5 Tax 0 Net Income 0 BALANCE SHEET nited States) Add-ins loaded successfully Harket Une tuation = Notas Comments E -- ili T S v A O P 24 w X o MacBook Pro BU A E E 3 @ A # ) $ & C % 5 * 00 2 3 4 6 7 8 9 0 P 147 E - c Table Window Help 1. Aluminux G market cap A Desmos CX Files X Gequity cost X + st+of+capital+beta&tbm=isch&ved=2ahUKEwiBspPghbloAhXKg1MKHZxPDv.. $ Shape Fill BUSI408_Assignment 5 (1) Mailings Review View Sciwheel E. AaBbCcDdEe AaCeDdee AaBbcDc ABCDde AaBb Aasbcode TE AasbCcode Abcd Normal No Spacing Heading? Heading 2 Tale Subtitle Subte Emph. Emchas's b. Beta of Kenan Inc. is 1.75, of Kenan is 0.25, current risk-free rate is 3%, Kenan's - - cost of debt is 4.5%, and the market risk premium is 4%. Using this information, estimate the WACC of Kenan Inc. I I atas) Add-ins loaded successfully Marker Line equation Notes Comments : 74 stv A pex w 24 Me Pro BI U AS E *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts