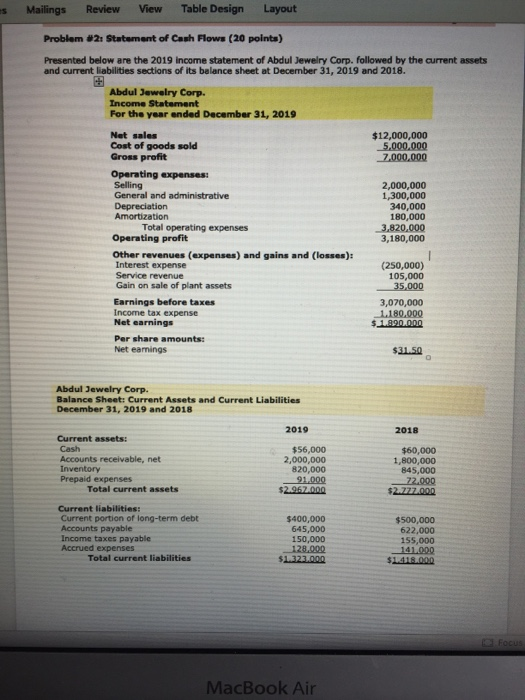

Question: Use the indirect method to compute and present the net cash flows from operating activities of the statement of cash flows for abdul jewlery corp.

S Mailings Review View Table Design Layout Problem #2: Statement of Cash Flows (20 points) Presented below are the 2019 income statement of Abdul Jewelry Corp. followed by the current assets and current liabilities sections of its balance sheet at December 31, 2019 and 2018. Abdul Jewelry Corp. Income Statement For the year ended December 31, 2019 $12,000,000 5.000.000 7,000,000 Net sales Cost of goods sold Gross profit Operating expenses: Selling General and administrative Depreciation Amortization Total operating expenses Operating profit Other revenues (expenses) and gains and losses): Interest expense Service revenue Gain on sale of plant assets Earnings before taxes Income tax expense Net earnings 2,000,000 1,300,000 340,000 180.000 3,820,000 3,180,000 (250,000) 105,000 35,000 3,070,000 1.180.000 $ 1.890.000 Per share amounts: Net earnings $31.50 Abdul Jewelry Corp. Balance Sheet: Current Assets and Current Liabilities December 31, 2019 and 2018 2019 2018 Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets $56,000 2,000,000 820,000 91.000 $2.967.000 $60,000 1,800,000 845,000 72.000 $27.000 Current liabilities: Current portion of long-term debt Accounts payable Income taxes payable Accrued expenses Total current liabilities $400,000 645.000 150,000 120.000 $1.3221.000 $500,000 622,000 155,000 101.000 0 .00 $ 1 MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts