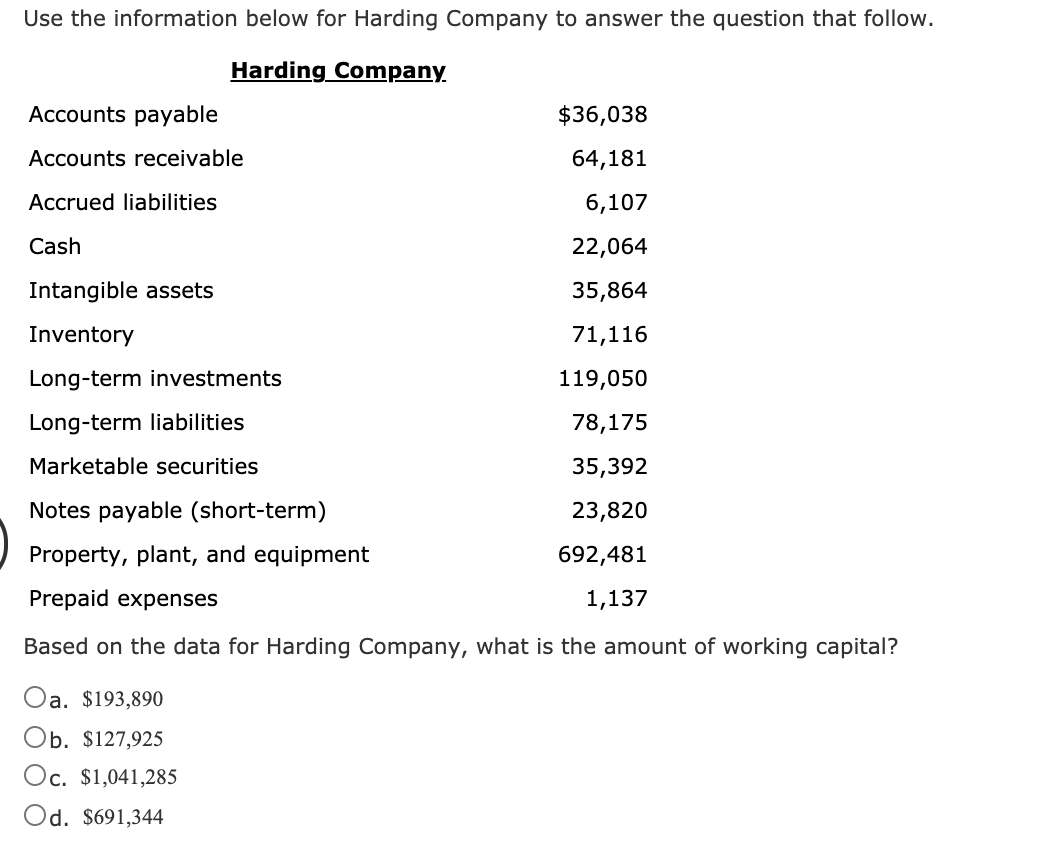

Question: & Use the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $36,038 Accounts receivable 64,181 Accrued liabilities 6,107

&

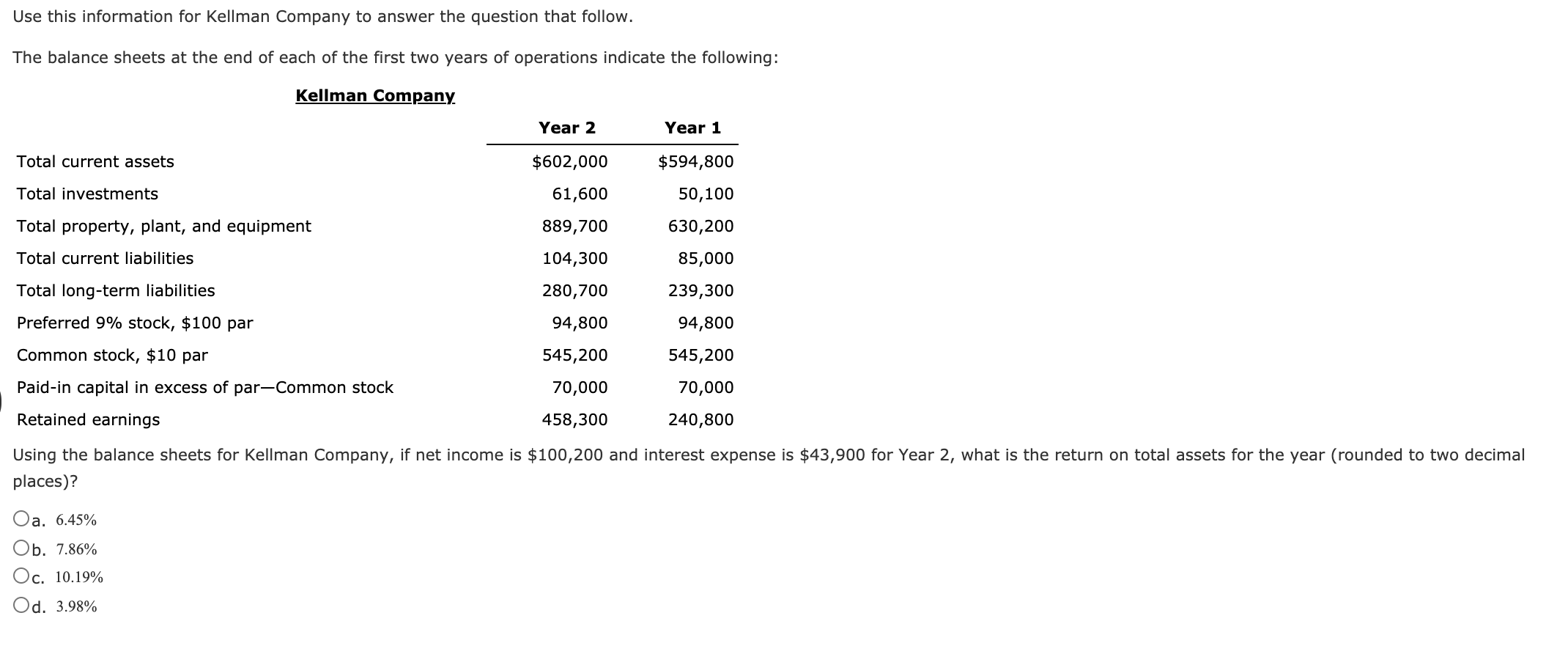

Use the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $36,038 Accounts receivable 64,181 Accrued liabilities 6,107 Cash 22,064 35,864 Intangible assets Inventory 71,116 Long-term investments 119,050 Long-term liabilities 78,175 Marketable securities 35,392 23,820 Notes payable (short-term) Property, plant, and equipment 692,481 Prepaid expenses 1,137 Based on the data for Harding Company, what is the amount of working capital? Oa. $193,890 Ob. $127,925 Oc. $1,041,285 Od. $691,344 Use this information for Kellman Company to answer the question that follow. The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 2 Year 1 Total current assets $602,000 $594,800 Total investments 61,600 889,700 Total property, plant, and equipment 50,100 630,200 85,000 Total current liabilities 104,300 Total long-term liabilities 280,700 239,300 Preferred 9% stock, $100 par 94,800 94,800 Common stock, $10 par 545,200 545,200 Paid-in capital in excess of par-Common stock 70,000 70,000 Retained earnings 458,300 240,800 Using the balance sheets for Kellman Company, if net income is $100,200 and interest expense is $43,900 for Year 2, what is the return on total assets for the year (rounded to two decimal places)? Oa. 6.45% Ob. 7.86% Oc. 10.19% Od. 3.98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts