Question: Use the information below for questions (9) to (15) Scroll to the right to visualire all the text if necessary You have been hired as

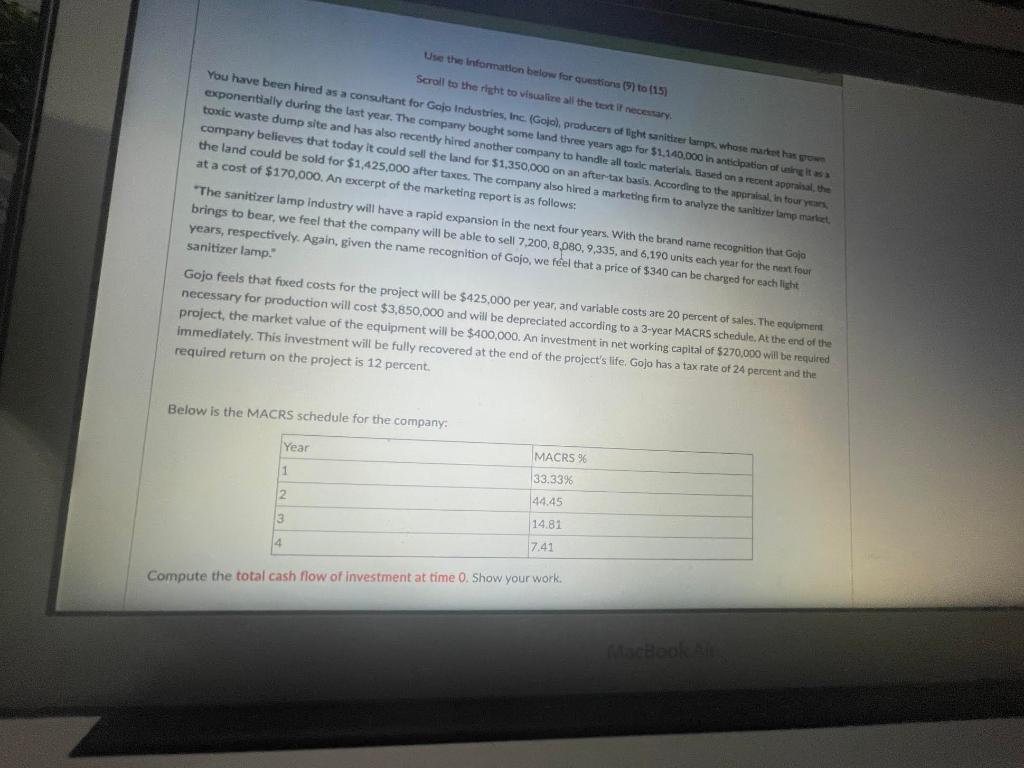

Use the information below for questions (9) to (15) Scroll to the right to visualire all the text if necessary You have been hired as a consultant for Gojo Industries, Inc. (Golo), producers of light sanitizer tarps, whose market has you exponentially during the last year. The company bought some land three years ago for $1.140.000 in anticipation of using its toxic waste dump site and has also recently hired another company to handle all toxic materials. Based on a recent appraisal, the company believes that today it could sell the land for $1,350,000 on an after tax basis. According to the appraisal in four years the land could be sold for $1,425,000 after taxes. The company also hired a marketing firm to analyze the santier tamp market at a cost of $170,000. An excerpt of the marketing report is as follows: "The sanitizer lamp industry will have a rapid expansion in the next four years. With the brand name recognition that Gojo brings to bear, we feel that the company will be able to sell 7,200, 8.080,9,335 and 6,190 units each year for the next four years, respectively. Again, given the name recognition of Gojo, we feel that a price of $340 can be charged for each light sanitizer lamp Gojo feels that fixed costs for the project will be $425,000 per year, and variable costs are 20 percent of sales. The equipment necessary for production will cost $3,850,000 and will be depreciated according to a 3-year MACRS schedule. At the end of the project, the market value of the equipment will be $400,000. An investment in net working capital of $270,000 will be required immediately. This investment will be fully recovered at the end of the project's life. Gojo has a tax rate of 24 percent and the required return on the project is 12 percent. Below is the MACRS schedule for the company: Year MACRS % 1 2 33.33% 44.45 14.81 7.41 3 4 Compute the total cash flow of investment at time 0. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts