Question: USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) EXHIBIT : An analyst is considering investing in funds A, B, C, and D. The market portfolio

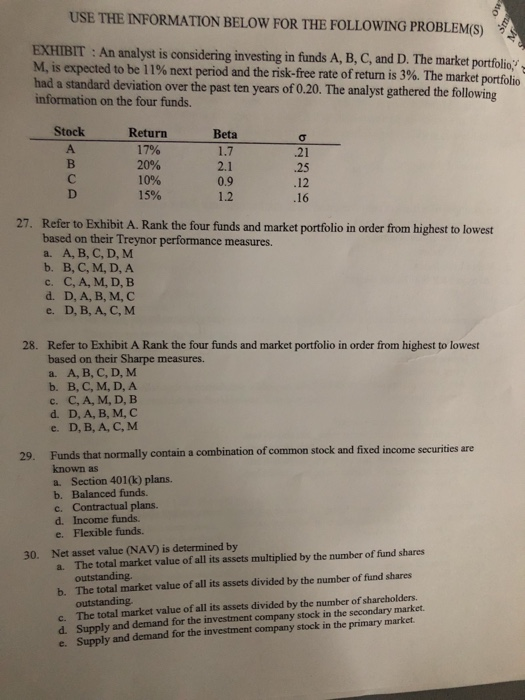

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) EXHIBIT : An analyst is considering investing in funds A, B, C, and D. The market portfolio M, is expected to be 11% next period and the risk-free rate of return is 3%. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds. Stock Beta 1.7 Return 17% 20% 10% 15% 2.1 0.9 .16 27. Refer to Exhibit A. Rank the four funds and market portfolio in order from highest to lowest based on their Treynor performance measures. a. A, B, C, D,M b. B, C, M, D, A c. C, A, M, D,B d. D, A, B,MC e. D, B, A, C,M 28. Refer to Exhibit A Rank the four funds and market portfolio in order from highest to lowest based on their Sharpe measures. a. A, B, C, D,M b. B, C, M, D, A c. C, A, M, D, B d. D, A, B, M, C e. D, B, A, C,M 29. Funds that normally contain a combination of common stock and fixed income securities are known as a Section 401(k) plans. b. Balanced funds. c. Contractual plans. d. Income funds. e. Flexible funds. 30. Net asset value (NAV) is determined by a. The total market value of all its assets multiplied by the number of fund shares outstanding. b. The total market value of all its assets divided by the number of fund shares outstanding c. The total market value of all its assets divided by the number of shareholders. d Supply and demand for the investment company stock in the secondary market. e Supply and demand for the investment company stock in the primary market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts