Question: USE THE INFORMATION BELOW TO ANSWER QUESTIONS 10 through 16 On January 1, 2015, Abridge Inc. purchased a fleet of tractors for $22,500,000. When the

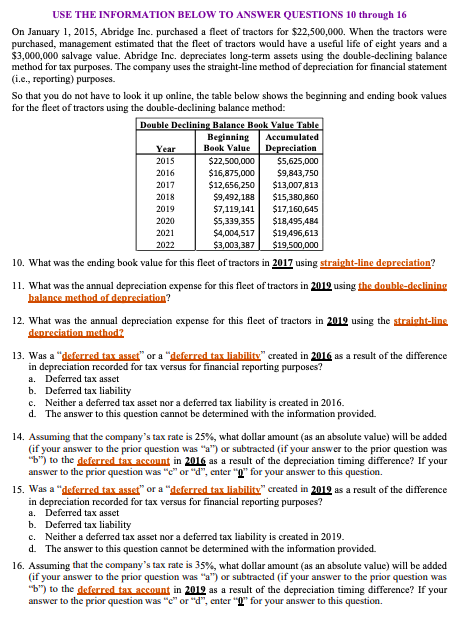

USE THE INFORMATION BELOW TO ANSWER QUESTIONS 10 through 16 On January 1, 2015, Abridge Inc. purchased a fleet of tractors for $22,500,000. When the tractors were purchased, management estimated that the fleet of tractors would have a useful life of eight years and a $3,000,000 salvage value. Abridge Inc. depreciates long-term assets using the double-declining balance method for tax purposes. The company uses the straight-line method of depreciation for financial statement (i.e., reporting) purposes. So that you do not have to look it up online, the table below shows the beginning and ending book values for the fleet of tractors using the double-declining balance method: 10. What was the ending book value for this fleet of tractors in 2017 using straight-line depreciation? 11. What was the annual depreciation expense for this fleet of tractors in 2019 using the donble-declining balance method of denreciation? 12. What was the annual depreciation expense for this fleet of tractors in 2019 using the straight-line denreciation method? 13. Was a "deferred tax asset" or a "deferred tax liability" created in 2016 as a result of the difference in depreciation recorded for tax versus for financial reporting purposes? a. Deferred tax asset b. Deferred tax liability c. Neither a deferred tax asset nor a deferred tax liability is created in 2016. d. The answer to this question cannot be determined with the information provided. 14. Assuming that the company's tax rate is 25%, what dollar amount (as an absolute value) will be added (if your answer to the prior question was "a") or subtracted (if your answer to the prior question was "b") to the deferred tax account in 2016 as a result of the depreciation timing difference? If your answer to the prior question was " c " or " d ", enter " 0 " for your answer to this question. 15. Was a "deferred tax asset." or a "deferred tax liability" created in 2019 as a result of the difference in depreciation recorded for tax versus for financial reporting purposes? a. Deferred tax asset b. Deferred tax liability c. Neither a deferred tax asset nor a deferred tax liability is created in 2019. d. The answer to this question cannot be determined with the information provided. 16. Assuming that the company's tax rate is 35%, what dollar amount (as an absolute value) will be added (if your answer to the prior question was "a") or subtracted (if your answer to the prior question was "b") to the deferred tax acceunt in 2019 as a result of the depreciation timing difference? If your answer to the prior question was "c" or " d ", enter "0" for your answer to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts