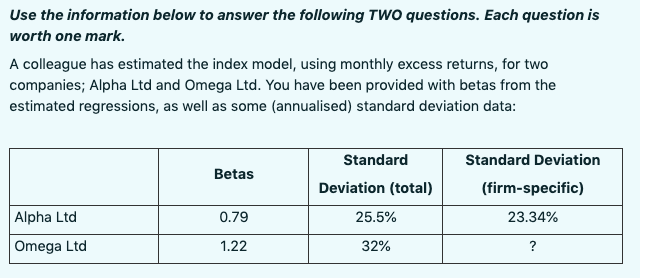

Question: Use the information below to answer the following TWO questions. Each question is worth one mark. A colleague has estimated the index model, using monthly

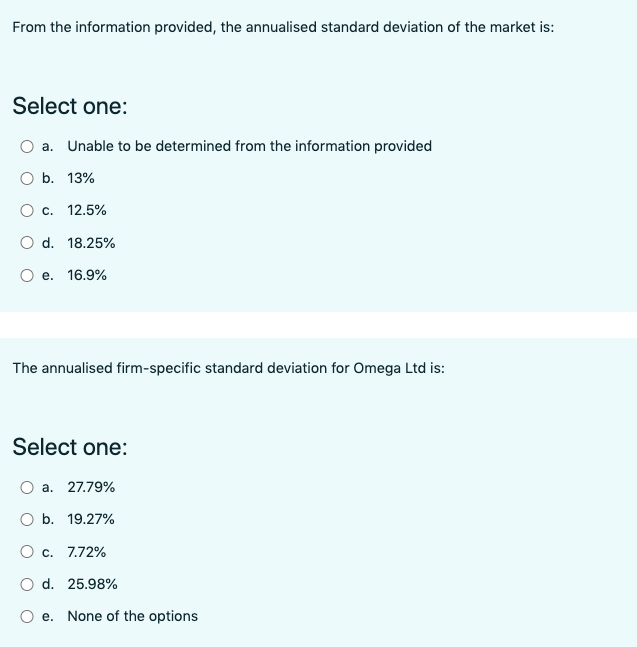

Use the information below to answer the following TWO questions. Each question is worth one mark. A colleague has estimated the index model, using monthly excess returns, for two companies; Alpha Ltd and Omega Ltd. You have been provided with betas from the estimated regressions, as well as some (annualised) standard deviation data: Betas Standard Deviation (total) Standard Deviation (firm-specific) 23.34% Alpha Ltd 0.79 25.5% Omega Ltd 1.22 32% ? From the information provided, the annualised standard deviation of the market is: Select one: a. Unable to be determined from the information provided O b. 13% O c. 12.5% d. 18.25% e. 16.9% The annualised firm-specific standard deviation for Omega Ltd is: Select one: O a. 27.79% O b. 19.27% O c. 7.72% O d. 25.98% e. None of the options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts