Question: Use the information below to answer the question that follow. Sandra and Kelsey are forming a partnership. Sandra wil Invest a plece of equipment with

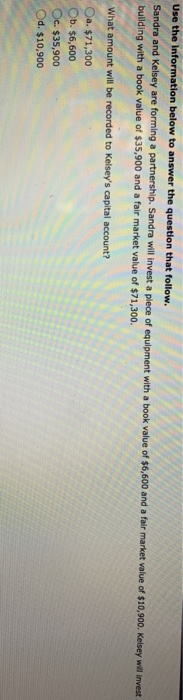

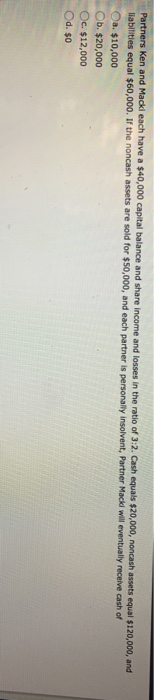

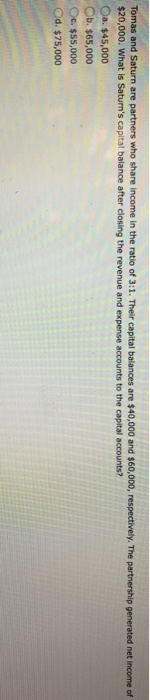

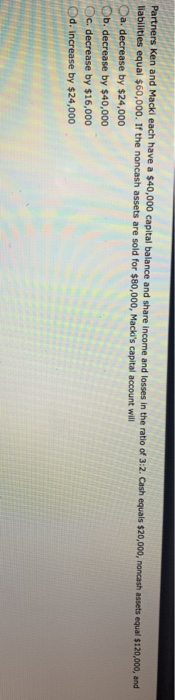

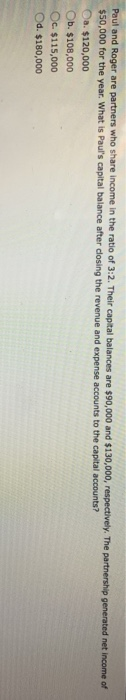

Use the information below to answer the question that follow. Sandra and Kelsey are forming a partnership. Sandra wil Invest a plece of equipment with a book value of $6.600 and a fair market value of $10,00 Kelsey wilIivet building with a book value of $35,900 and a fair market value of $71,300. What amount will be recorded to Kelsey's capital account? Oa. $71,300 Ob. $6,600 Oc, $35,900 Od. $10,900 Partners Ken and Macki each have a $40,000 capital balance and share income and losses in the ratio of 3 liablities equal $60,000. If the noncash assets are sold for $50,000, and each partner is personalily insolvent, Partner M insolvent, Partner Macki will eventually receive cash of Oa. $10,000 Ob. $20,000 Oc. $12,000 Od. so Tomas and Saturn are $20,000. What is Saturn's capital balance after closing the revenue and expense accounts to the capital accounts? -$45,000 Ob. $65,000 who share income in the ratio of 3:1. Their capital balances are $40,000 and $60,000, respectively. The partnership generated net income of . $55,000 Od. $75,00o Partners Ken and Macki each have a $40,000 capital balance and share income and losses in the ratio of 3:2 liabilities equal $60,000. If the nancash assets are sold for $80,000, Macki's capital account will Oa. decrease by $24,000 Ob. decrease by $40,000 Dc. decrease by $16,000 Od. increase by $24,000 . Cash equals $20,000, noncash assets equal $1.20,000, and ratio of 3:2. Their capital balances are $90,000 and $130,000, respectively. The partnership generated net income of Paul and Roger are partners who share income in the 50,000 for the year. What is Paul's capital balance after closing the revenue and expense accounts to the capital accounts? Ca, $120,000 Ob. $108,000 Oc. $115,000 Od. $180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts