Question: Use the information below to answer the two questions that follow. A company prepares its master budget for the year 2021 on a monthly basis.

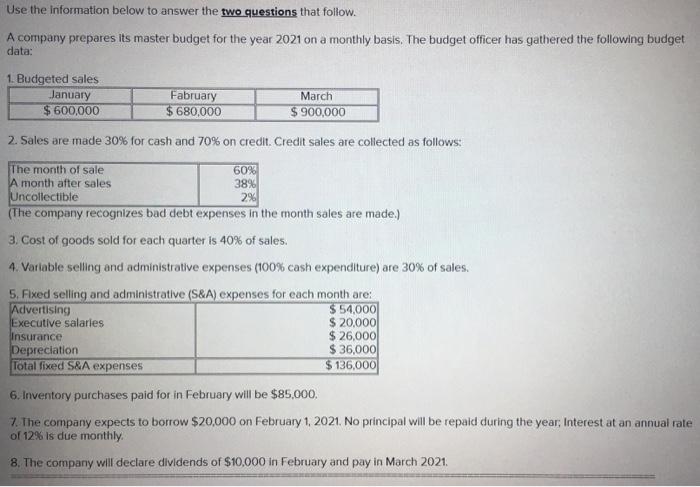

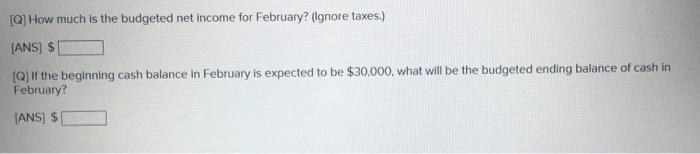

Use the information below to answer the two questions that follow. A company prepares its master budget for the year 2021 on a monthly basis. The budget officer has gathered the following budget data: 1. Budgeted sales January $ 600,000 Fabruary $ 680,000 March $900,000 2. Sales are made 30% for cash and 70% on credit. Credit sales are collected as follows: The month of sale 60% A month after sales 38% Uncollectible 2% (The company recognizes bad debt expenses in the month sales are made.) 3. Cost of goods sold for each quarter is 40% of sales. 4. Variable selling and administrative expenses (100% cash expenditure) are 30% of sales. 5. Fixed selling and administrative (S&A) expenses for each month are: Advertising $ 54,000 Executive salaries $ 20,000 Insurance $ 26,000 Depreciation $ 35,000 Total fixed S&A expenses $ 136,000 6. Inventory purchases paid for in February will be $85,000. 7. The company expects to borrow $20,000 on February 1, 2021. No principal will be repaid during the year, Interest at an annual rate of 12% is due monthly 8. The company will declare dividends of $10,000 in February and pay in March 2021. [Q] How much is the budgeted net income for February? (Ignore taxes.) (ANS) $ [Q] if the beginning cash balance in February is expected to be $30.000, what will be the budgeted ending balance of cash in February? (ANS) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts