Question: Use the information below to construct the Dec. 31, 2014 Balance Sheet and deferred tax and valuation equity worksheets. Note: Not all items will be

|

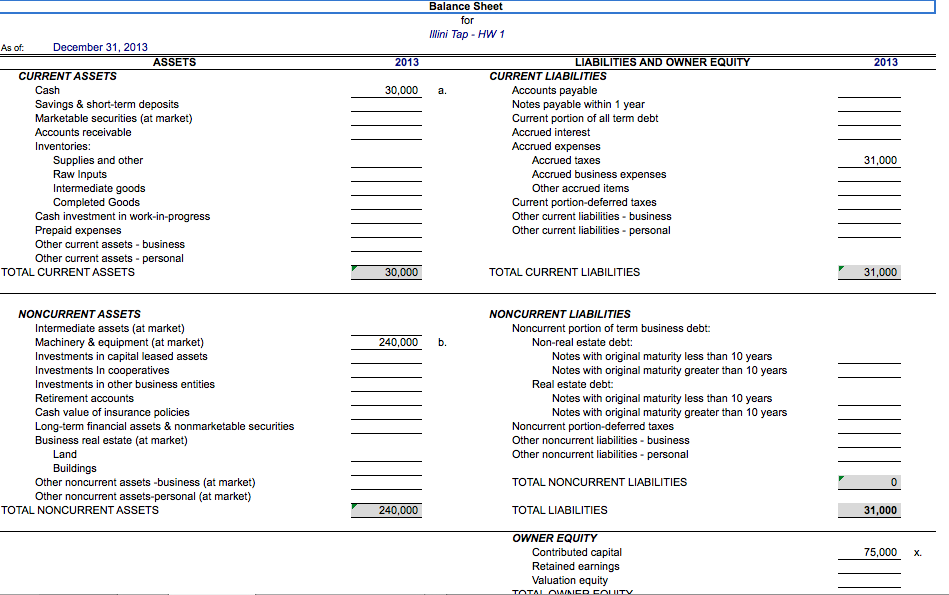

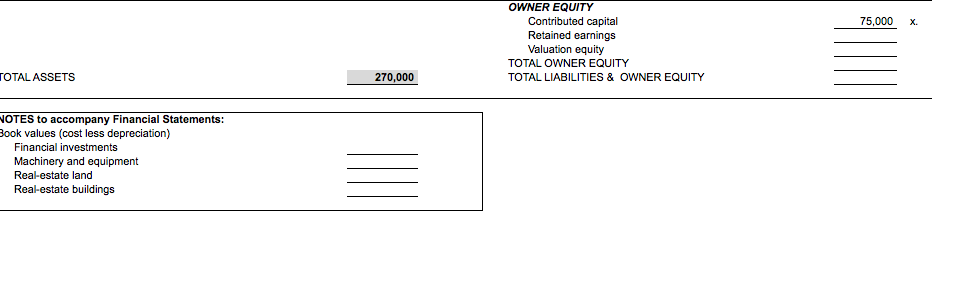

| Use the information below to construct the Dec. 31, 2014 Balance Sheet and deferred tax and valuation equity worksheets. Note: Not all items will be used | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| (all balances are as of 12/31/14, unless otherwise stated) |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Assignment: |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1. | Develop a completed balance sheet, and completed statement of deferred taxes (including the Valuation Equity report). Reference line items above on the B/S, DT, and VE reports using the item letters (a few examples are completed for you). (80 points) |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Ive included a blank template in the Homework 1 folder along with the assignment. Note that some calculations/subtotals are already built in to the template (these cells are shaded in gray), but you should double-check each of them to ensure their accuracy. |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2. | Briefly explain why deferred taxes are included on the B/S. (10 points) |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3. | Briefly explain/define Valuation Equity and its potential sources. (10 points) |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 4. | Extra Credit: For each unused line item above, provide a brief description of why it was NOT used on the 12/31/13 Balance Statement (0.5 points each) |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Balance Sheet for lini Tap - HW 1 As ofDecember 31, 2013 ASSETS 2013 LIABILITIES AND OWNER EQUITY 2013 CURRENT ASSETS CURRENT LIABILITIES Cash Savings & short-term deposits Marketable securities (at market) 30,000 a. Accounts payable Notes payable within 1 year Current portion of all term debt Accrued interest Accrued expenses 31,000 Supplies and other Raw Inputs Intermediate goods Completed Goods Accrued taxes Accrued business expenses Other accrued items Current portion-deferred taxes Other current liabilities business Other current liabilities personal Cash investment in work-in-progress Prepaid expenses Other current assets business Other current assets - personal TOTAL CURRENT ASSETS 30,000 TOTAL CURRENT LIABILITIES 31,000 NONCURRENT ASSETS NONCURRENT LIABILITIES Intermediate assets (at market) Machinery & equipment (at market) Investments in capital leased assets Investments In cooperatives Investments in other business entities Noncurrent portion of term business debt: 240,000 b Non-real estate debt Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Real estate debt Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Cash value of insurance policies Long-term financial assets & nonmarketable securities Business real estate (at market) Noncurrent portion-deferred taxes Other noncurrent liabilities business Other noncurrent liabilities - personal Land Buildings Other noncurrent assets -business (at market) Other noncurrent assets-personal (at market) TOTAL NONCURRENT LIABILITIES TOTAL LIABILITIES OWNER EQUITY TOTAL NONCURRENT ASSETS 240,000 31,000 Contributed capital Retained earnings Valuation equity 75,000 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts