Question: Use the information below to prepare an income statement using both variable and absorption costing methods. You will need to complete Absoprtion Costing Unit

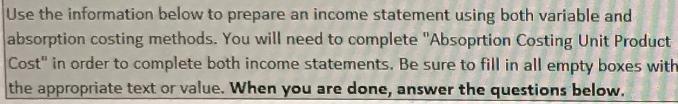

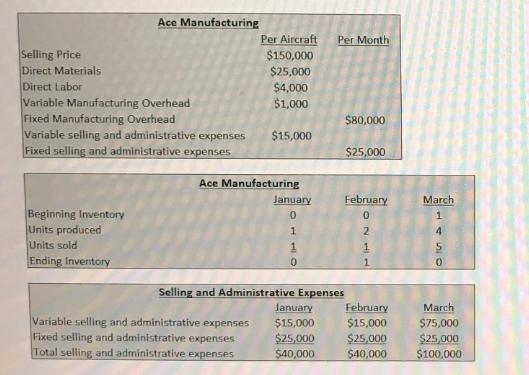

Use the information below to prepare an income statement using both variable and absorption costing methods. You will need to complete "Absoprtion Costing Unit Product Cost" in order to complete both income statements. Be sure to fill in all empty boxes with the appropriate text or value. When you are done, answer the questions below. Selling Price Direct Materials Direct Labor Ace Manufacturing Beginning Inventory Units produced Units sold Ending Inventory Variable Manufacturing Overhead Fixed Manufacturing Overhead Variable selling and administrative expenses $15,000 Fixed selling and administrative expenses Ace Manufacturing Per Aircraft $150,000 $25,000 $4,000 $1,000 Variable selling and administrative expenses Fixed selling and administrative expenses Total selling and administrative expenses January 0 1 0 Per Month January $15,000 $25,000 $40,000 $80,000 $25,000 Selling and Administrative Expenses February 0 2 February $15,000 $25,000 $40,000 March 1 450 March $75,000 $25,000 $100,000 Variable expenses: Total variable expenses Contribution margin Fixed expenses: Total fixed expenses Net operating income (loss) Direct materials Direct labor Variable Costing Contribution Form Income Statement January February Gross Margin Variable manufacturing overhead Fixed manufacturing overhead Absorption Costing Unit Product Cost Net operating income Absorption Costing Unit Product Cost January Absorption Costing Income Statement January February February March March March In the space below, briefly explain the difference between the outcomes of using variable and absorption costing. Why is there a difference? When should you use each method?

Step by Step Solution

There are 3 Steps involved in it

Ace Manufacturing Variable Costing Contribution Form Income Statement January Sales 1 unit 150000 150000 Variable Expenses Direct Materials 1 unit 25000 25000 Direct Labor 1 unit 4000 4000 Variable Mf... View full answer

Get step-by-step solutions from verified subject matter experts