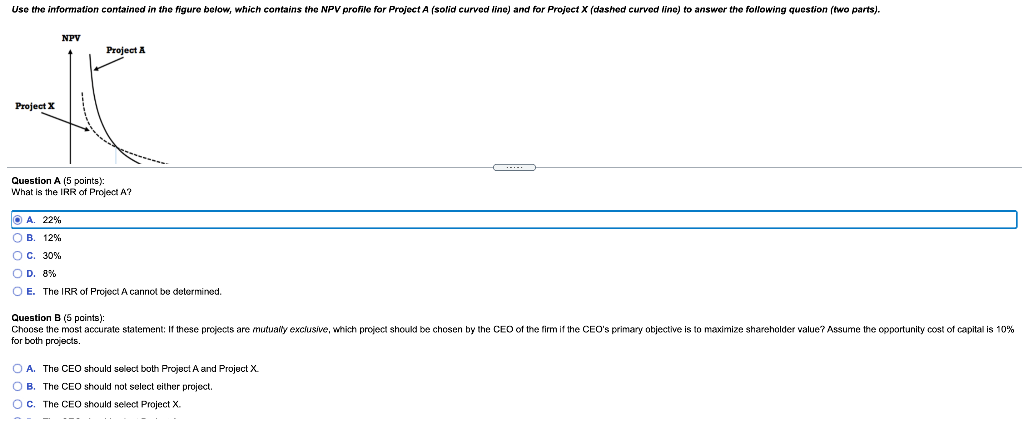

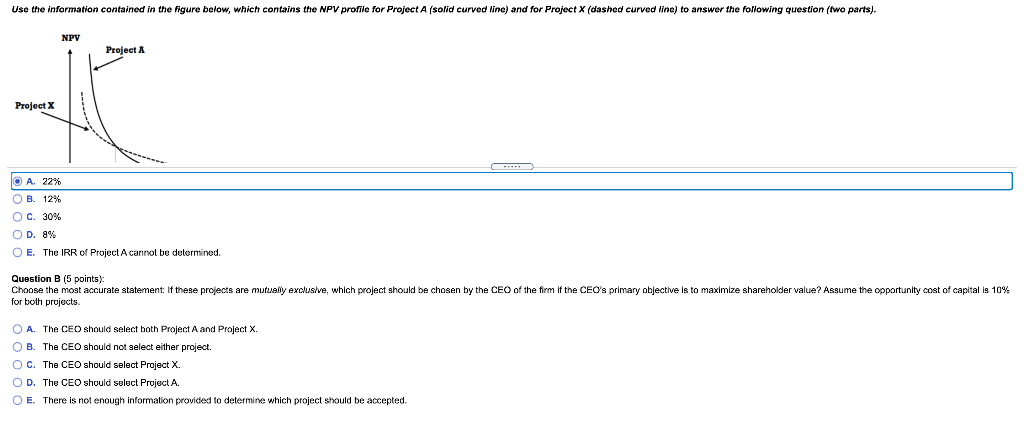

Question: Use the information contained in the figure below, which contains the NPV profile for Project A (solid curved line) and for Project X (dashed curved

Use the information contained in the figure below, which contains the NPV profile for Project A (solid curved line) and for Project X (dashed curved line) to answer the following question (two parts). NPV Project A Project X CIS Question A (5 points): What is the IRR of Project A? O A. 22% OB. 12% O c. 30% OD 8% O E. The IRR of Project A cannot be determined. Question B (5 points): Choose the most accurate statement: If these projects are mutually exclusive, which project should be chosen by the CEO of the firm if the CEO's primary objective is to maximize shareholder value? Assume the opportunity cost of capital is 10% for both projects. O A. The CEO should select both Project A and Project X OB. The CEO should not select either project. O c. The CEO should select Project X Use the information contained in the figure below, which contains the NPV profile for Project A (solid curved line) and for Project X (dashed curved line) to answer the following question (two parts). NPV Project A Project X O A. 22% OB. 12% OC. 30% OD. 8% O E. The IRR of Project A cannot be determined. Question B (5 points) Choose the most accurate statement: If these projects are mutually exclusive, which project should be chosen by the CEO of the firm If the CEO's primary objective is to maximize shareholder value? Assume the opportunity cost of capital for both projects. 10% O A. The CEO should select both Project A and Project X OB. The CEO should not select either project. O C. The CEO should select Project X. OD. Thu CEO should select Project A. O E. There is not enough information provided to determine which project should be accepted. Use the information contained in the figure below, which contains the NPV profile for Project A (solid curved line) and for Project X (dashed curved line) to answer the following question (two parts). NPV Project A Project X CIS Question A (5 points): What is the IRR of Project A? O A. 22% OB. 12% O c. 30% OD 8% O E. The IRR of Project A cannot be determined. Question B (5 points): Choose the most accurate statement: If these projects are mutually exclusive, which project should be chosen by the CEO of the firm if the CEO's primary objective is to maximize shareholder value? Assume the opportunity cost of capital is 10% for both projects. O A. The CEO should select both Project A and Project X OB. The CEO should not select either project. O c. The CEO should select Project X Use the information contained in the figure below, which contains the NPV profile for Project A (solid curved line) and for Project X (dashed curved line) to answer the following question (two parts). NPV Project A Project X O A. 22% OB. 12% OC. 30% OD. 8% O E. The IRR of Project A cannot be determined. Question B (5 points) Choose the most accurate statement: If these projects are mutually exclusive, which project should be chosen by the CEO of the firm If the CEO's primary objective is to maximize shareholder value? Assume the opportunity cost of capital for both projects. 10% O A. The CEO should select both Project A and Project X OB. The CEO should not select either project. O C. The CEO should select Project X. OD. Thu CEO should select Project A. O E. There is not enough information provided to determine which project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts