Question: Use the information from Income Statement, Statement Owners Equity, and Cash Flow Statment to answer questions. Income Statement Statement of Owners Equity End of Period

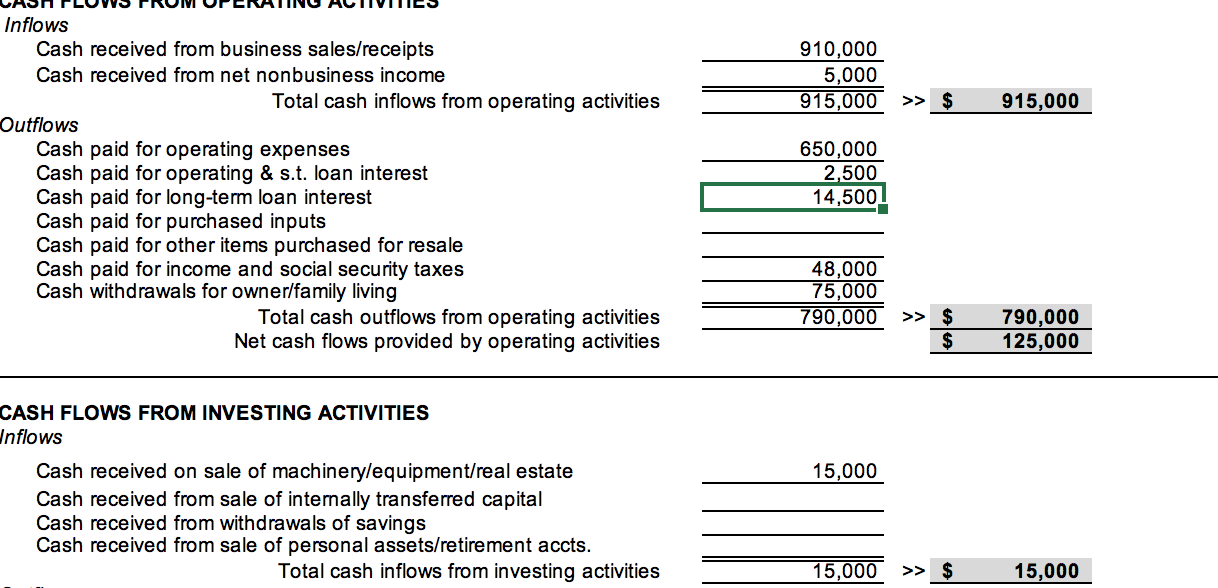

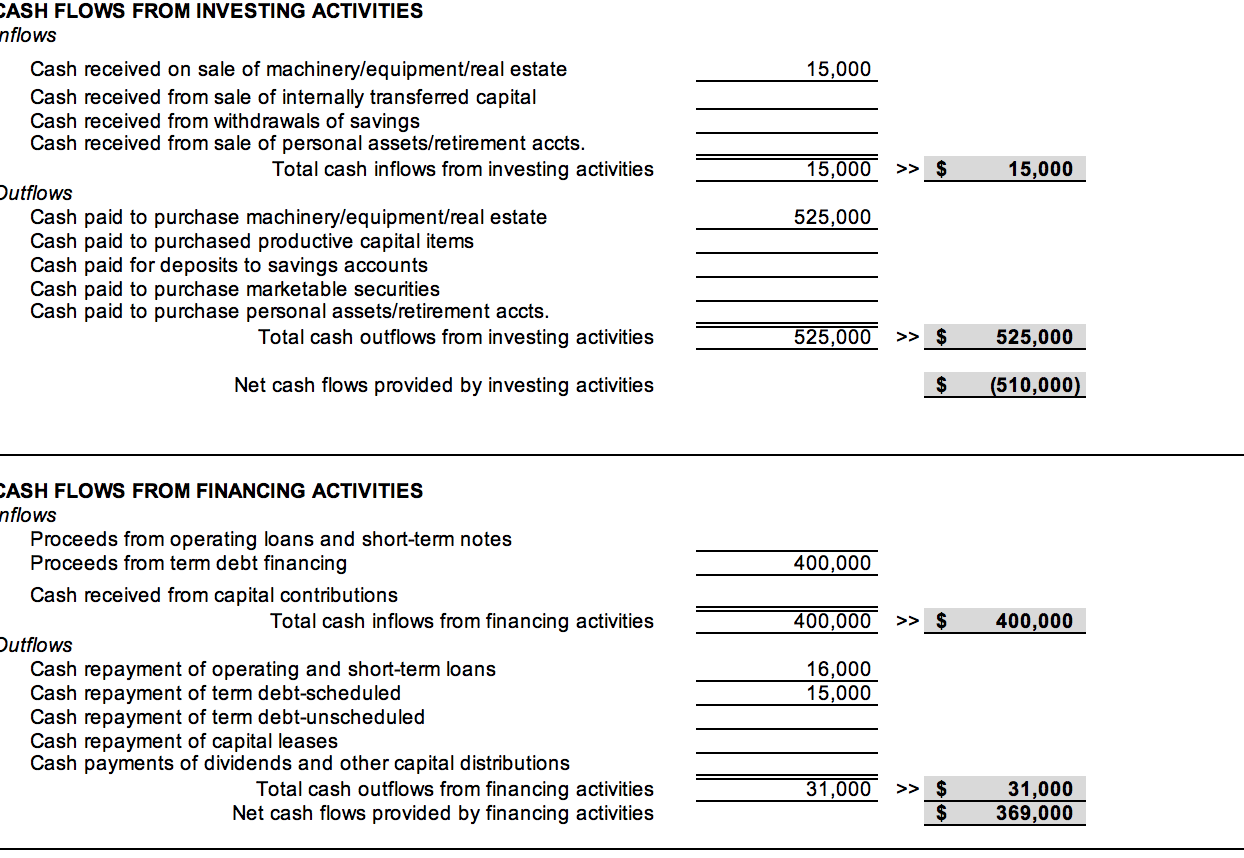

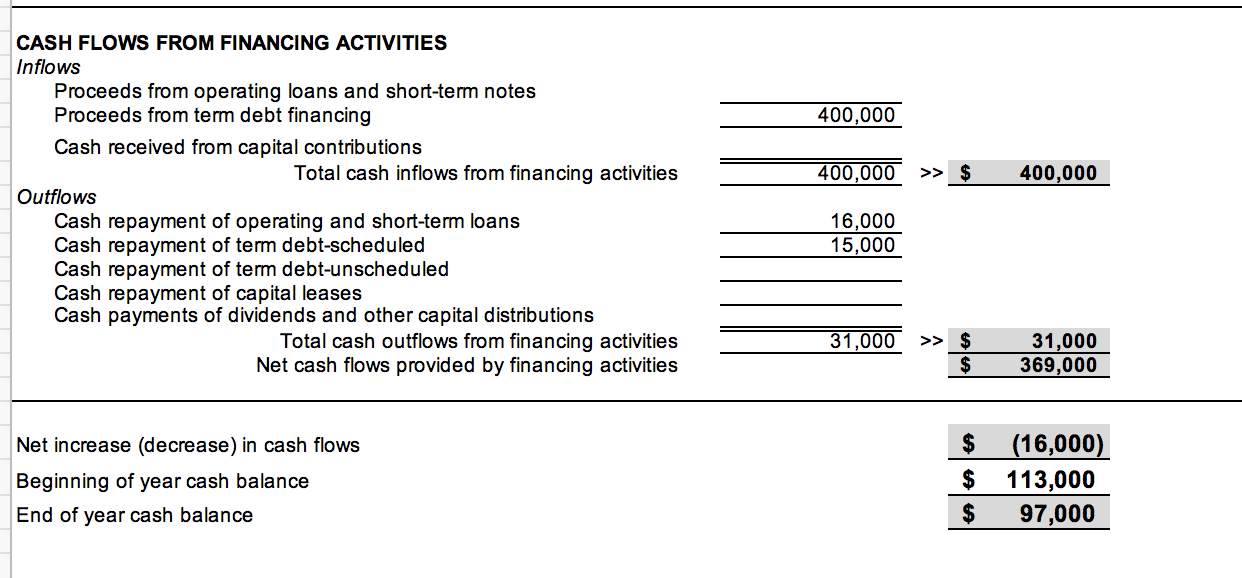

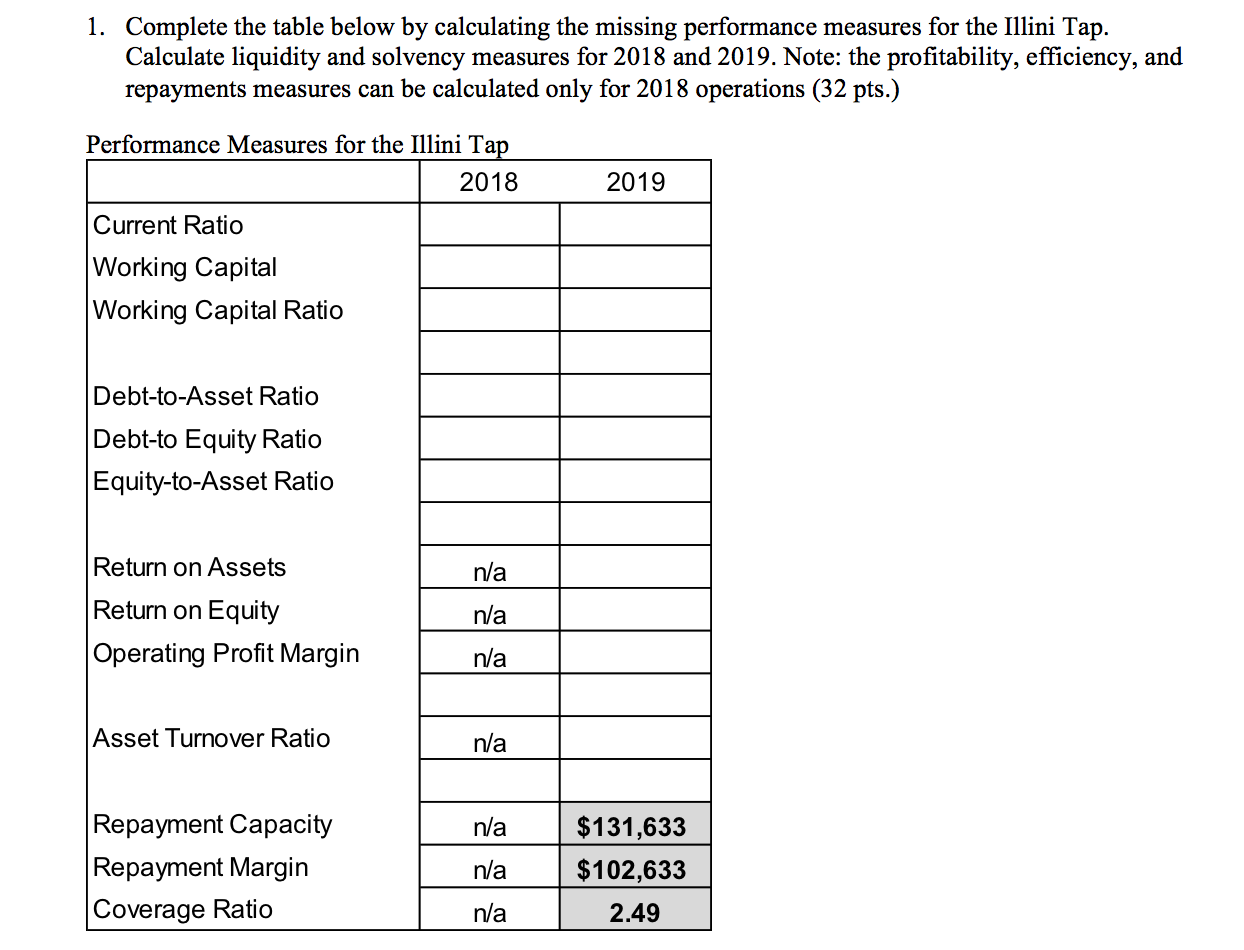

Use the information from Income Statement, Statement Owners Equity, and Cash Flow Statment to answer questions.

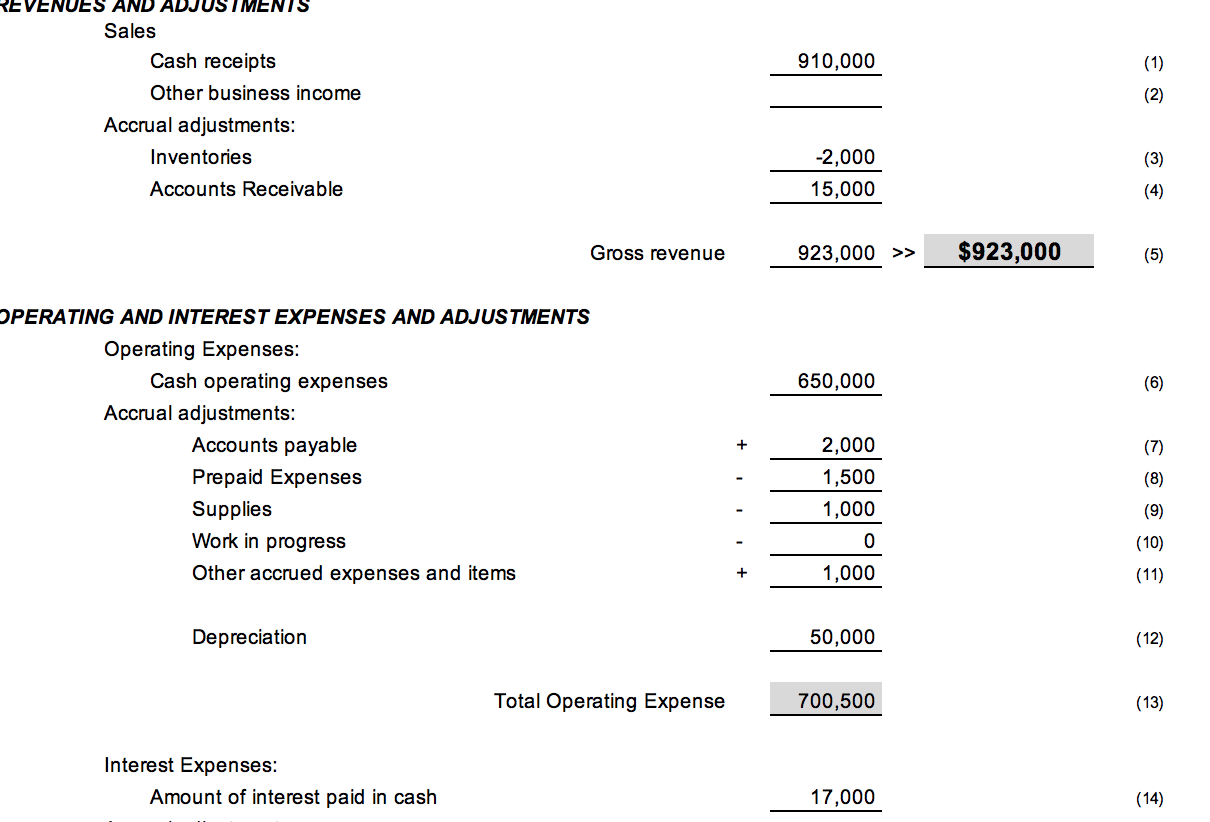

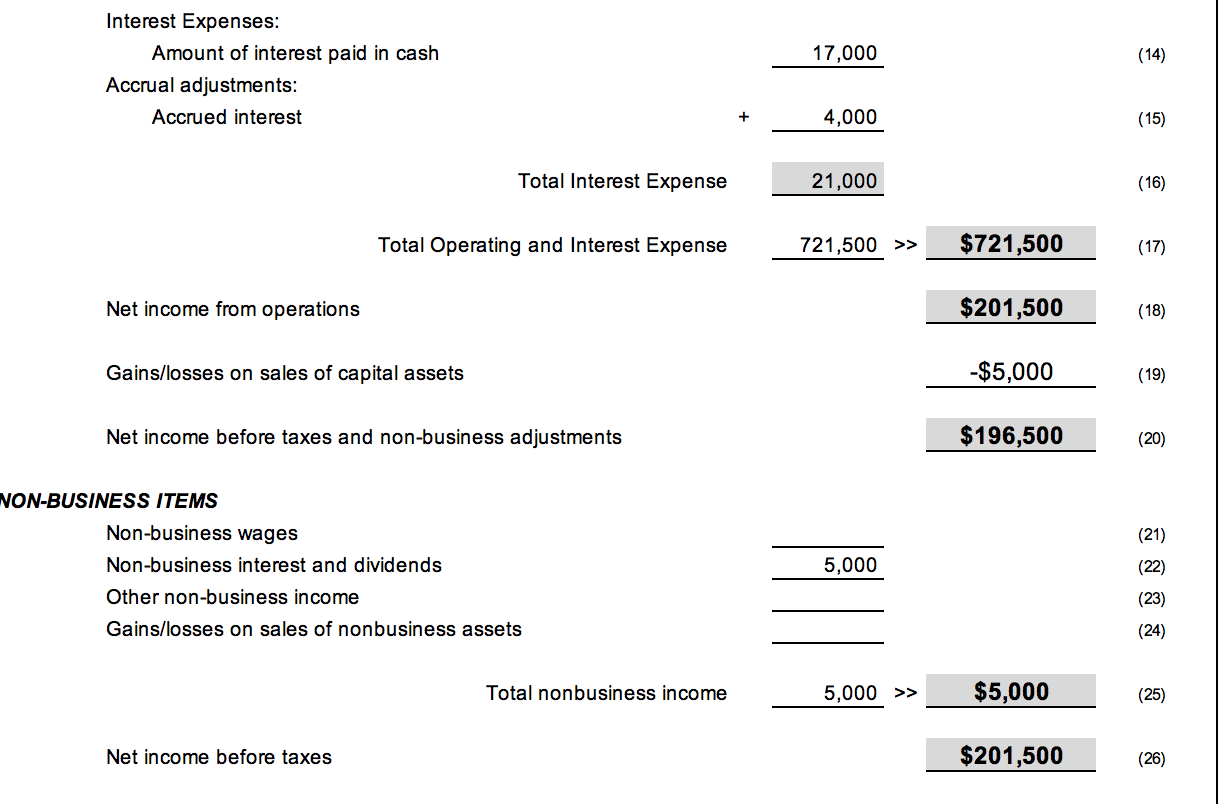

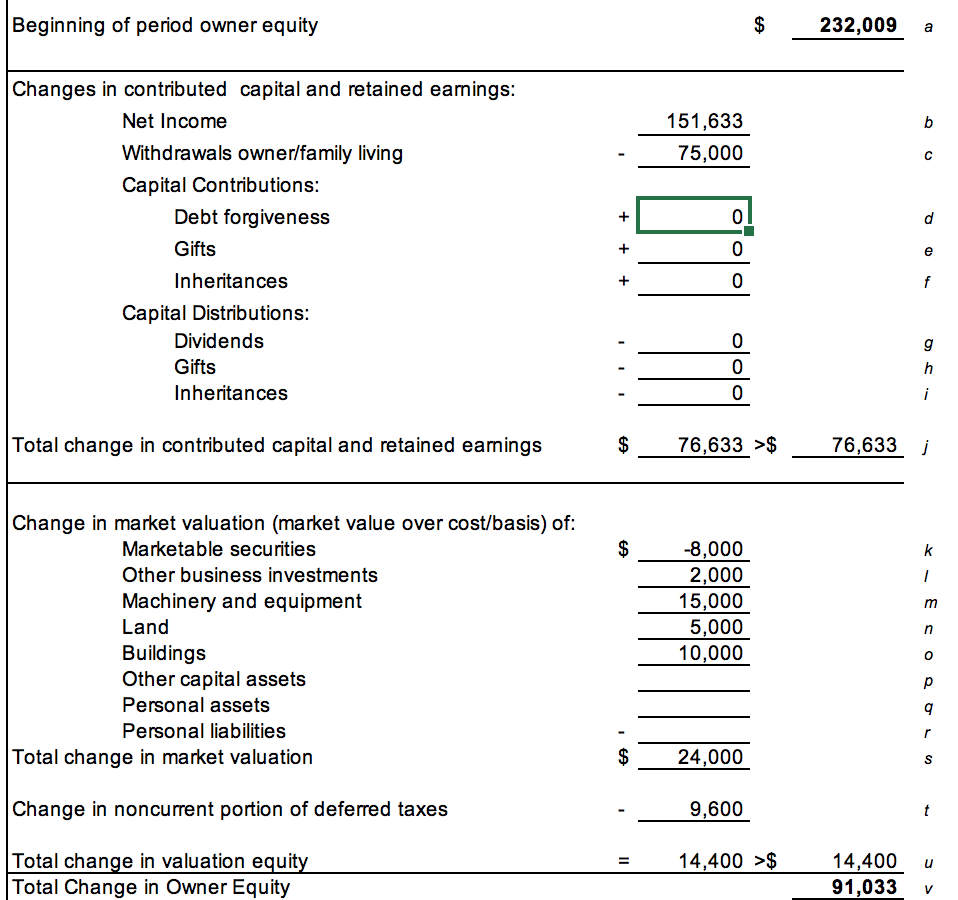

Income Statement

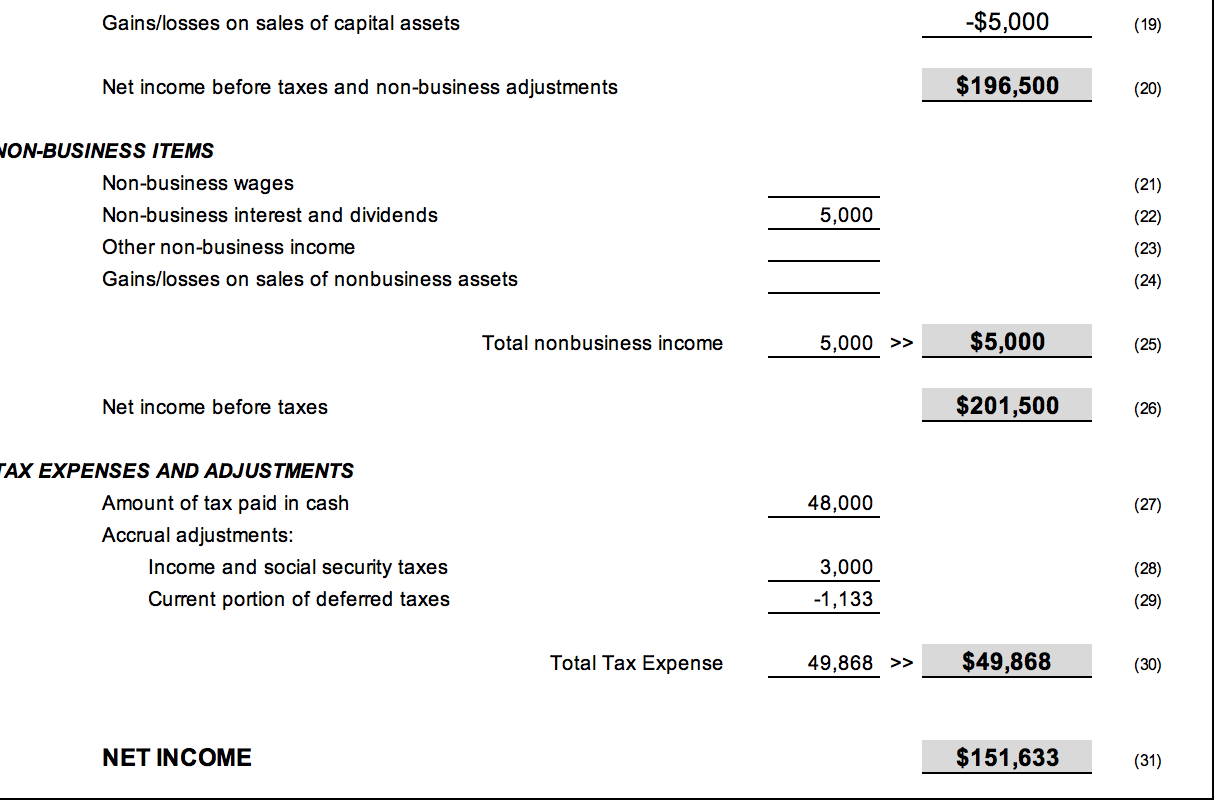

Statement of Owners Equity

Statement of Owners Equity

End of Period Owners Equity $323,041

End of Period Owners Equity $323,041

Cash Flow Statement

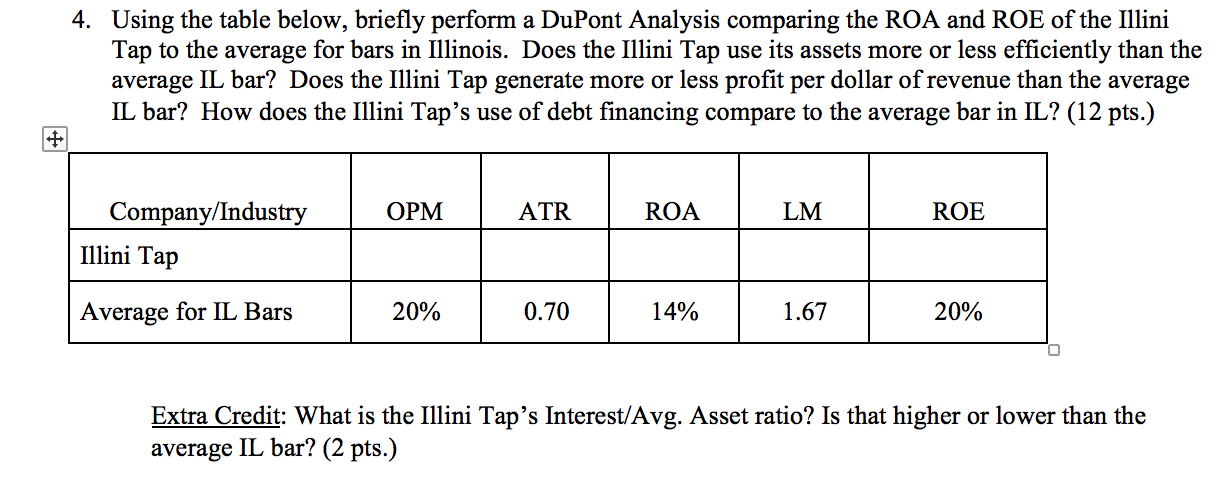

910,000 REVENUES AND ADJUSTMENTS Sales Cash receipts Other business income Accrual adjustments: Inventories (1) (2) -2,000 15,000 (3) (4) Accounts Receivable Gross revenue 923,000 >> $923,000 (5) 650,000 (6) OPERATING AND INTEREST EXPENSES AND ADJUSTMENTS Operating Expenses: Cash operating expenses Accrual adjustments: Accounts payable Prepaid Expenses Supplies Work in progress Other accrued expenses and items + 2,000 1,500 1,000 0 1,000 (7) (8) (9) (10) (11) Depreciation 50,000 (12) Total Operating Expense 700,500 (13) Interest Expenses: Amount of interest paid in cash 17,000 (14) 17,000 Interest Expenses: Amount of interest paid in cash Accrual adjustments: Accrued interest (14) 4,000 (15) Total Interest Expense 21,000 (16) Total Operating and Interest Expense 721,500 >> $721,500 (17) Net income from operations $201,500 (18) Gains/losses on sales of capital assets -$5,000 (19) Net income before taxes and non-business adjustments $196,500 (20) (21) NON-BUSINESS ITEMS Non-business wages Non-business interest and dividends Other non-business income Gains/losses on sales of nonbusiness assets 5,000 (22) (23) (24) Total nonbusiness income 5,000 >> $5,000 (25) Net income before taxes $201,500 (26) Gains/losses on sales of capital assets -$5,000 (19) Net income before taxes and non-business adjustments $196,500 (20) (21) NON-BUSINESS ITEMS Non-business wages Non-business interest and dividends Other non-business income Gains/losses on sales of nonbusiness assets 5,000 (22) (23) (24) Total nonbusiness income 5,000 >> $5,000 (25) Net income before taxes $201,500 (26) 48,000 (27) TAX EXPENSES AND ADJUSTMENTS Amount of tax paid in cash Accrual adjustments: Income and social security taxes Current portion of deferred taxes (28) 3,000 -1,133 (29) Total Tax Expense 49,868 >> $49,868 (30) NET INCOME $ 151,633 (31) Beginning of period owner equity $ 232,009 a b 151,633 75,000 C d Changes in contributed capital and retained earings: Net Income Withdrawals owner/family living Capital Contributions: Debt forgiveness Gifts Inheritances Capital Distributions: Dividends Gifts Inheritances 11 e f 0 0 0 g h i Total change in contributed capital and retained earnings $ 76,633 >$ 76,633 ] $ k 1 Change in market valuation (market value over cost/basis) of: Marketable securities Other business investments Machinery and equipment Land Buildings Other capital assets Personal assets Personal liabilities Total change in market valuation -8,000 2,000 15,000 5,000 10,000 Oooo33 $ 24,000 Change in noncurrent portion of deferred taxes 9,600 1 t = 14,400 >$ U Total change in valuation equity Total Change in Owner Equity 14,400 91,033 V 910,000 5,000 915,000 >> $ 915,000 Inflows Cash received from business sales/receipts Cash received from net nonbusiness income Total cash inflows from operating activities Outflows Cash paid for operating expenses Cash paid for operating & s.t. loan interest Cash paid for long-term loan interest Cash paid for purchased inputs Cash paid for other items purchased for resale Cash paid for income and social security taxes Cash withdrawals for owner/family living Total cash outflows from operating activities Net cash flows provided by operating activities 650,000 2,500 14,500 48,000 75,000 790,000 >> $ $ 790,000 125,000 CASH FLOWS FROM INVESTING ACTIVITIES Inflows 15,000 Cash received on sale of machinery/equipment/real estate Cash received from sale of internally transferred capital Cash received from withdrawals of savings Cash received from sale of personal assets/retirement accts. Total cash inflows from investing activities 15,000 >> $ 15,000 15,000 CASH FLOWS FROM INVESTING ACTIVITIES nflows Cash received on sale of machinery/equipment/real estate Cash received from sale of internally transferred capital Cash received from withdrawals of savings Cash received from sale of personal assets/retirement accts. Total cash inflows from investing activities Dutflows Cash paid to purchase machinery/equipment/real estate Cash paid to purchased productive capital items Cash paid for deposits to savings accounts Cash paid to purchase marketable securities Cash paid to purchase personal assets/retirement accts. Total cash outflows from investing activities 15,000 >> $ 15,000 525,000 525,000 >> $ 525,000 Net cash flows provided by investing activities $ (510,000) 400,000 400,000 >> $ 400,000 CASH FLOWS FROM FINANCING ACTIVITIES nflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Dutflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities 16,000 15,000 31,000 >> $ $ 31,000 369,000 400,000 400,000 $ 400,000 CASH FLOWS FROM FINANCING ACTIVITIES Inflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Outflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities 16,000 15,000 31,000 >> $ $ 31,000 369,000 $ Net increase (decrease) in cash flows Beginning of year cash balance End of year cash balance $ $ (16,000) 113,000 97,000 1. Complete the table below by calculating the missing performance measures for the Illini Tap. Calculate liquidity and solvency measures for 2018 and 2019. Note: the profitability, efficiency, and repayments measures can be calculated only for 2018 operations (32 pts.) Performance Measures for the Illini Tap 2018 2019 Current Ratio Working Capital Working Capital Ratio Debt-to-Asset Ratio Debt-to Equity Ratio Equity-to-Asset Ratio n/a Return on Assets Return on Equity Operating Profit Margin n/a n/a Asset Turnover Ratio n/a n/a Repayment Capacity Repayment Margin Coverage Ratio n/a $131,633 $102,633 2.49 n/a 4. Using the table below, briefly perform a DuPont Analysis comparing the ROA and ROE of the Illini Tap to the average for bars in Illinois. Does the Illini Tap use its assets more or less efficiently than the average IL bar? Does the Illini Tap generate more or less profit per dollar of revenue than the average IL bar? How does the Illini Tap's use of debt financing compare to the average bar in IL? (12 pts.) OPM ATR ROA LM ROE Company/Industry Illini Tap Average for IL Bars 20% 0.70 14% 1.67 20% Extra Credit: What is the Illini Tap's Interest/Avg. Asset ratio? Is that higher or lower than the average IL bar? (2 pts.) 910,000 REVENUES AND ADJUSTMENTS Sales Cash receipts Other business income Accrual adjustments: Inventories (1) (2) -2,000 15,000 (3) (4) Accounts Receivable Gross revenue 923,000 >> $923,000 (5) 650,000 (6) OPERATING AND INTEREST EXPENSES AND ADJUSTMENTS Operating Expenses: Cash operating expenses Accrual adjustments: Accounts payable Prepaid Expenses Supplies Work in progress Other accrued expenses and items + 2,000 1,500 1,000 0 1,000 (7) (8) (9) (10) (11) Depreciation 50,000 (12) Total Operating Expense 700,500 (13) Interest Expenses: Amount of interest paid in cash 17,000 (14) 17,000 Interest Expenses: Amount of interest paid in cash Accrual adjustments: Accrued interest (14) 4,000 (15) Total Interest Expense 21,000 (16) Total Operating and Interest Expense 721,500 >> $721,500 (17) Net income from operations $201,500 (18) Gains/losses on sales of capital assets -$5,000 (19) Net income before taxes and non-business adjustments $196,500 (20) (21) NON-BUSINESS ITEMS Non-business wages Non-business interest and dividends Other non-business income Gains/losses on sales of nonbusiness assets 5,000 (22) (23) (24) Total nonbusiness income 5,000 >> $5,000 (25) Net income before taxes $201,500 (26) Gains/losses on sales of capital assets -$5,000 (19) Net income before taxes and non-business adjustments $196,500 (20) (21) NON-BUSINESS ITEMS Non-business wages Non-business interest and dividends Other non-business income Gains/losses on sales of nonbusiness assets 5,000 (22) (23) (24) Total nonbusiness income 5,000 >> $5,000 (25) Net income before taxes $201,500 (26) 48,000 (27) TAX EXPENSES AND ADJUSTMENTS Amount of tax paid in cash Accrual adjustments: Income and social security taxes Current portion of deferred taxes (28) 3,000 -1,133 (29) Total Tax Expense 49,868 >> $49,868 (30) NET INCOME $ 151,633 (31) Beginning of period owner equity $ 232,009 a b 151,633 75,000 C d Changes in contributed capital and retained earings: Net Income Withdrawals owner/family living Capital Contributions: Debt forgiveness Gifts Inheritances Capital Distributions: Dividends Gifts Inheritances 11 e f 0 0 0 g h i Total change in contributed capital and retained earnings $ 76,633 >$ 76,633 ] $ k 1 Change in market valuation (market value over cost/basis) of: Marketable securities Other business investments Machinery and equipment Land Buildings Other capital assets Personal assets Personal liabilities Total change in market valuation -8,000 2,000 15,000 5,000 10,000 Oooo33 $ 24,000 Change in noncurrent portion of deferred taxes 9,600 1 t = 14,400 >$ U Total change in valuation equity Total Change in Owner Equity 14,400 91,033 V 910,000 5,000 915,000 >> $ 915,000 Inflows Cash received from business sales/receipts Cash received from net nonbusiness income Total cash inflows from operating activities Outflows Cash paid for operating expenses Cash paid for operating & s.t. loan interest Cash paid for long-term loan interest Cash paid for purchased inputs Cash paid for other items purchased for resale Cash paid for income and social security taxes Cash withdrawals for owner/family living Total cash outflows from operating activities Net cash flows provided by operating activities 650,000 2,500 14,500 48,000 75,000 790,000 >> $ $ 790,000 125,000 CASH FLOWS FROM INVESTING ACTIVITIES Inflows 15,000 Cash received on sale of machinery/equipment/real estate Cash received from sale of internally transferred capital Cash received from withdrawals of savings Cash received from sale of personal assets/retirement accts. Total cash inflows from investing activities 15,000 >> $ 15,000 15,000 CASH FLOWS FROM INVESTING ACTIVITIES nflows Cash received on sale of machinery/equipment/real estate Cash received from sale of internally transferred capital Cash received from withdrawals of savings Cash received from sale of personal assets/retirement accts. Total cash inflows from investing activities Dutflows Cash paid to purchase machinery/equipment/real estate Cash paid to purchased productive capital items Cash paid for deposits to savings accounts Cash paid to purchase marketable securities Cash paid to purchase personal assets/retirement accts. Total cash outflows from investing activities 15,000 >> $ 15,000 525,000 525,000 >> $ 525,000 Net cash flows provided by investing activities $ (510,000) 400,000 400,000 >> $ 400,000 CASH FLOWS FROM FINANCING ACTIVITIES nflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Dutflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities 16,000 15,000 31,000 >> $ $ 31,000 369,000 400,000 400,000 $ 400,000 CASH FLOWS FROM FINANCING ACTIVITIES Inflows Proceeds from operating loans and short-term notes Proceeds from term debt financing Cash received from capital contributions Total cash inflows from financing activities Outflows Cash repayment of operating and short-term loans Cash repayment of term debt-scheduled Cash repayment of term debt-unscheduled Cash repayment of capital leases Cash payments of dividends and other capital distributions Total cash outflows from financing activities Net cash flows provided by financing activities 16,000 15,000 31,000 >> $ $ 31,000 369,000 $ Net increase (decrease) in cash flows Beginning of year cash balance End of year cash balance $ $ (16,000) 113,000 97,000 1. Complete the table below by calculating the missing performance measures for the Illini Tap. Calculate liquidity and solvency measures for 2018 and 2019. Note: the profitability, efficiency, and repayments measures can be calculated only for 2018 operations (32 pts.) Performance Measures for the Illini Tap 2018 2019 Current Ratio Working Capital Working Capital Ratio Debt-to-Asset Ratio Debt-to Equity Ratio Equity-to-Asset Ratio n/a Return on Assets Return on Equity Operating Profit Margin n/a n/a Asset Turnover Ratio n/a n/a Repayment Capacity Repayment Margin Coverage Ratio n/a $131,633 $102,633 2.49 n/a 4. Using the table below, briefly perform a DuPont Analysis comparing the ROA and ROE of the Illini Tap to the average for bars in Illinois. Does the Illini Tap use its assets more or less efficiently than the average IL bar? Does the Illini Tap generate more or less profit per dollar of revenue than the average IL bar? How does the Illini Tap's use of debt financing compare to the average bar in IL? (12 pts.) OPM ATR ROA LM ROE Company/Industry Illini Tap Average for IL Bars 20% 0.70 14% 1.67 20% Extra Credit: What is the Illini Tap's Interest/Avg. Asset ratio? Is that higher or lower than the average IL bar? (2 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts