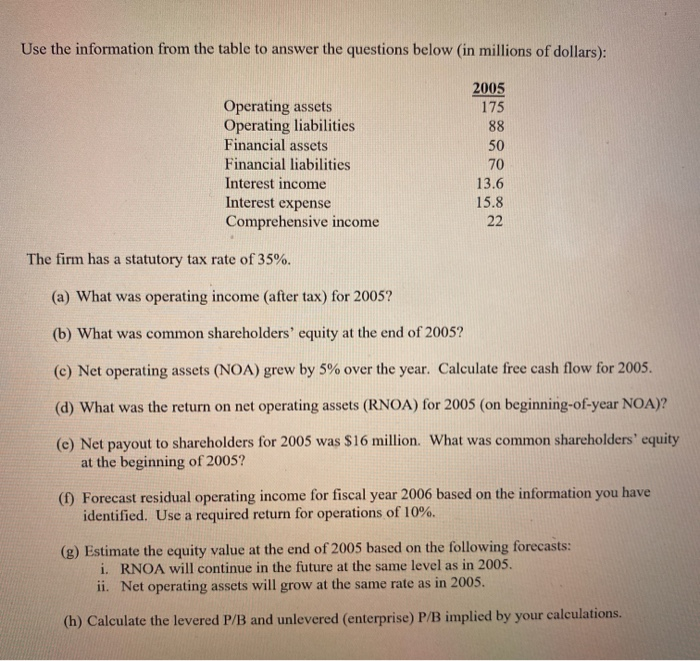

Question: Use the information from the table to answer the questions below (in millions of dollars): 2005 175 88 Operating assets Operating liabilities Financial assets Financial

Use the information from the table to answer the questions below (in millions of dollars): 2005 175 88 Operating assets Operating liabilities Financial assets Financial liabilities Interest income Interest expense Comprehensive income 70 13.6 15.8 The firm has a statutory tax rate of 35%. (a) What was operating income (after tax) for 2005? (b) What was common shareholders' equity at the end of 2005? (c) Net operating assets (NOA) grew by 5% over the year. Calculate free cash flow for 2005. (d) What was the return on net operating assets (RNOA) for 2005 (on beginning-of-year NOA)?! (c) Net payout to shareholders for 2005 was $16 million. What was common shareholders' equity at the beginning of 2005? (f) Forecast residual operating income for fiscal year 2006 based on the information you have identified. Use a required return for operations of 10%. (g) Estimate the equity value at the end of 2005 based on the following forecasts: i. RNOA will continue in the future at the same level as in 2005. ii. Net operating assets will grow at the same rate as in 2005. (h) Calculate the levered P/B and unlevered (enterprise) P/B implied by your calculations. Use the information from the table to answer the questions below (in millions of dollars): 2005 175 88 Operating assets Operating liabilities Financial assets Financial liabilities Interest income Interest expense Comprehensive income 70 13.6 15.8 The firm has a statutory tax rate of 35%. (a) What was operating income (after tax) for 2005? (b) What was common shareholders' equity at the end of 2005? (c) Net operating assets (NOA) grew by 5% over the year. Calculate free cash flow for 2005. (d) What was the return on net operating assets (RNOA) for 2005 (on beginning-of-year NOA)?! (c) Net payout to shareholders for 2005 was $16 million. What was common shareholders' equity at the beginning of 2005? (f) Forecast residual operating income for fiscal year 2006 based on the information you have identified. Use a required return for operations of 10%. (g) Estimate the equity value at the end of 2005 based on the following forecasts: i. RNOA will continue in the future at the same level as in 2005. ii. Net operating assets will grow at the same rate as in 2005. (h) Calculate the levered P/B and unlevered (enterprise) P/B implied by your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts