Question: use the information given about the angle theta, sin theta = square root 13/4 eBook Calculator Print Item Problem 7-3 (Algorithmic) Accounting Methods (LO 7.2)

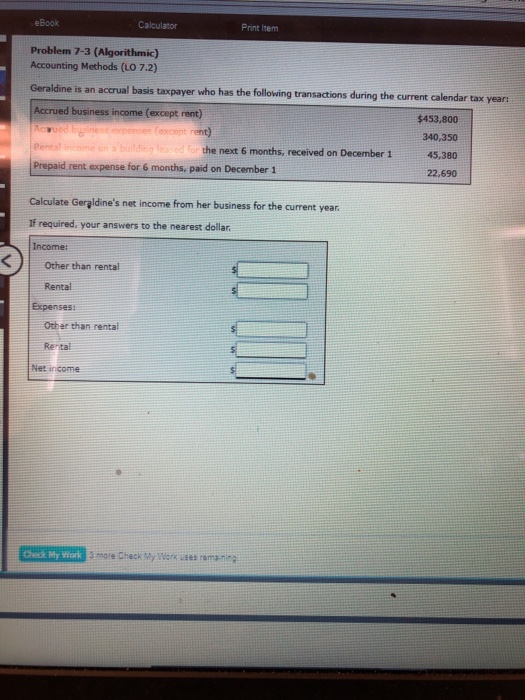

eBook Calculator Print Item Problem 7-3 (Algorithmic) Accounting Methods (LO 7.2) Geraldine is an accrual basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) $453,800 340,350 45,380 22,690 the next 6 months, received on December1 Prepaid rent expense for 6 months, paid on December 1 Calculate Geraldine's net income from her business for the current year. If required, your answers to the nearest dollar. Income: Other than rental Rental Expenses: Other than rental Rental Net income Check My Work eBook Calculator Print Item Problem 7-3 (Algorithmic) Accounting Methods (LO 7.2) Geraldine is an accrual basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) $453,800 340,350 45,380 22,690 the next 6 months, received on December1 Prepaid rent expense for 6 months, paid on December 1 Calculate Geraldine's net income from her business for the current year. If required, your answers to the nearest dollar. Income: Other than rental Rental Expenses: Other than rental Rental Net income Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts