Question: use the information given( and additional information) to fill in the yellow boxes. Below is the Company's Balance Sheet October 31: Sales are budgeted at

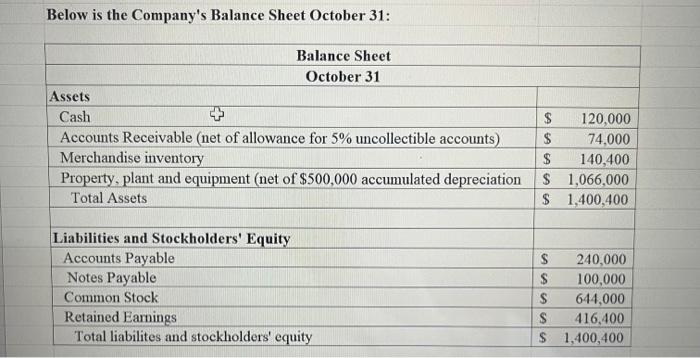

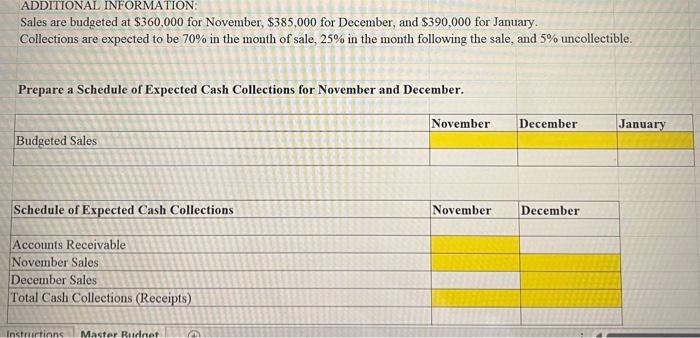

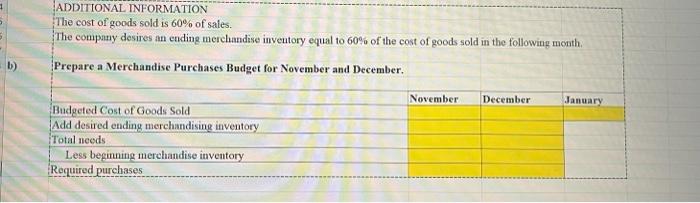

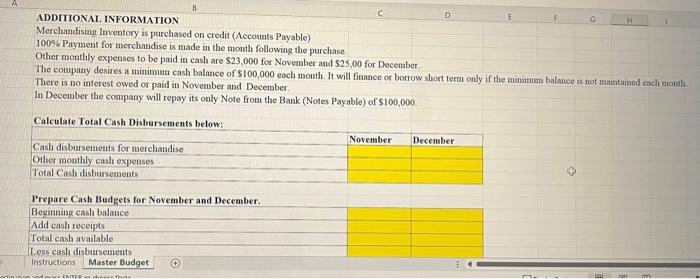

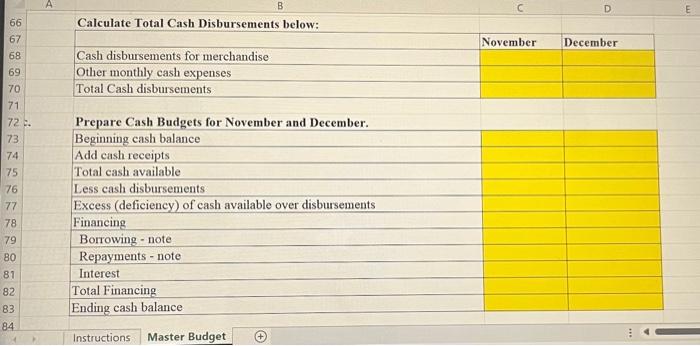

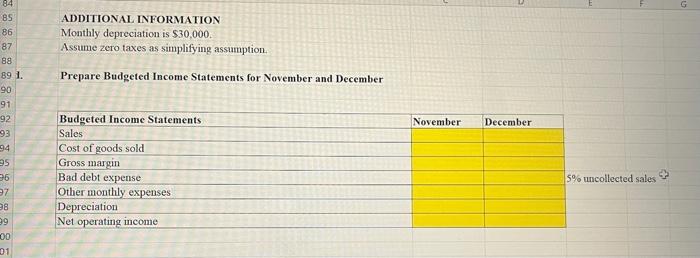

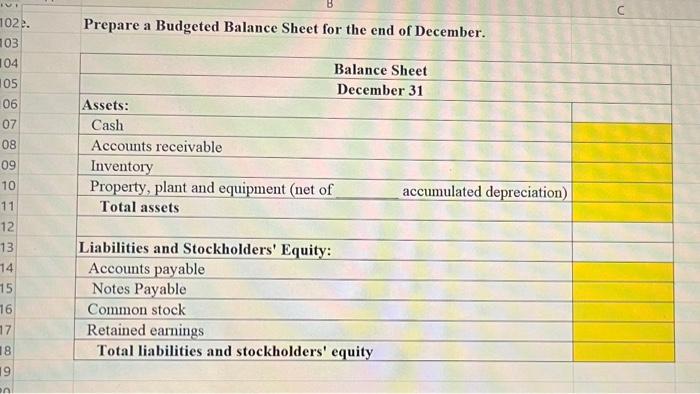

Below is the Company's Balance Sheet October 31: Sales are budgeted at $360,000 for November, $385,000 for December, and $390,000 for January. Collections are expected to be 70% in the month of sale, 25% in the month following the sale, and 5% uncollectible. Prepare a Schedule of Expected Cash Collections for November and December. ADDITIONAL INFORMATION The cost of goods sold is 60% of sales. The company desires an ending merchandise inveutory equal to 60% of the cost of goods sold in the following month. Prepare a Merchandise Purchases Budget for November and December. ADDITIONAL INFORMATION Merchandising Inventory is purchased on credit (Aecounts Payable) 100% Payment for merchandise is made in the month following the purchase Other monthly expenses to be paid in cash are $23,000 for Noveaber and $25,00 for December The company desires a minimun cash balance of $100,000 each month. It will finance or borrow short termi only if the minnimum balance is not maintained each month There is no interest owed or paid in November and December. In December the company will repay its only Note from the Bank (Notes Payable) of $100,000. Calculate Total Cash Disbursements below: Prepare Cash Budgets for November and December. Beginning cash balance Add cash receipts Total cash available Less cash disbursements Excess (deficiency) of cash available over disbursements Financing Borrowing - note Repayments - note Interest Total Financing Ending cash balance ADDITIONAL INFORMATION Monthly depreciation is $30,000. Assume zero taxes as simplifying assumption. Prepare Budgeted Income Statements for November and December Prepare a Budgeted Balance Sheet for the end of December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts