Question: Use the information given below for answering the following. Consider two bonds: a 5-year coupon bond with face value $3000, and a consol bond. Each

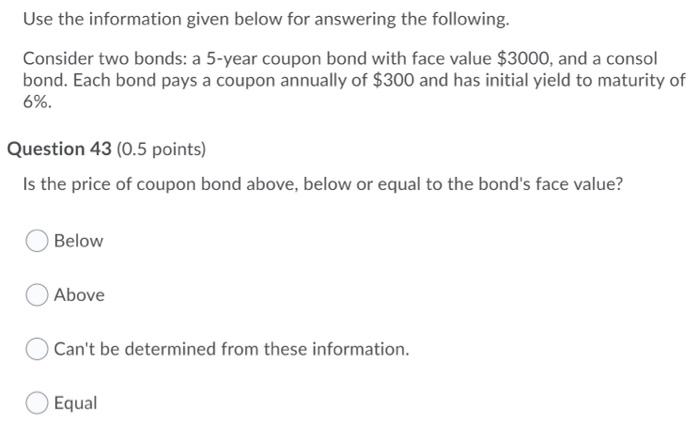

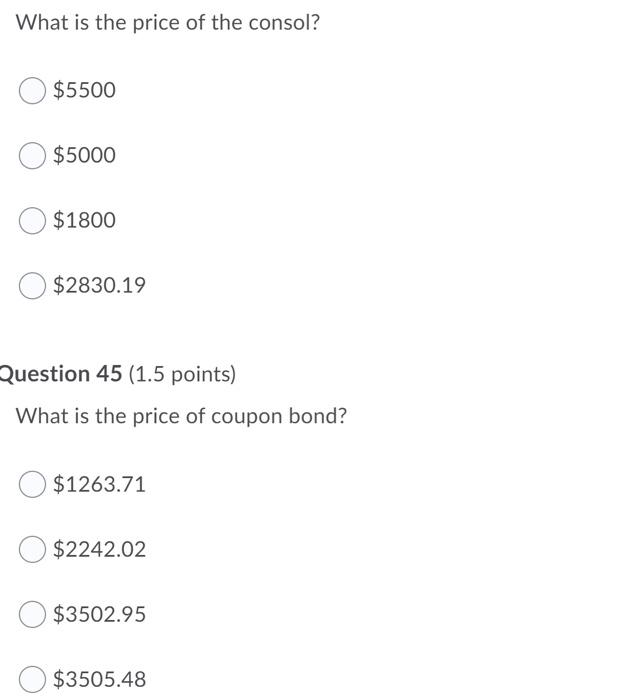

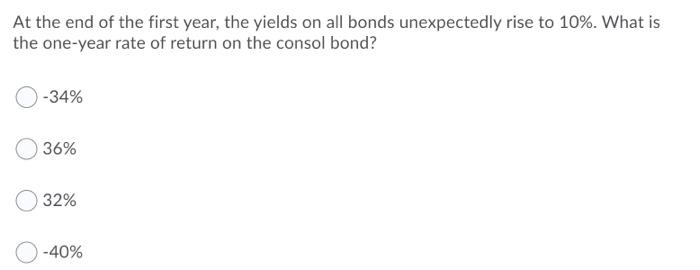

Use the information given below for answering the following. Consider two bonds: a 5-year coupon bond with face value $3000, and a consol bond. Each bond pays a coupon annually of $300 and has initial yield to maturity of 6%. Question 43 (0.5 points) Is the price of coupon bond above, below or equal to the bond's face value? Below Above Can't be determined from these information. Equal What is the price of the consol? $5500 $5000 $1800 $2830.19 Question 45 (1.5 points) What is the price of coupon bond? $1263.71 $2242.02 $3502.95 $3505.48 At the end of the first year, the yields on all bonds unexpectedly rise to 10%. What is the one-year rate of return on the consol bond? -34% 36% 32% -40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts