Question: Use the information given below to answer Questions 3 6 - 3 8 . Mickey Mouse Industries, Inc., [ MMI ] manufactures and sells electronic

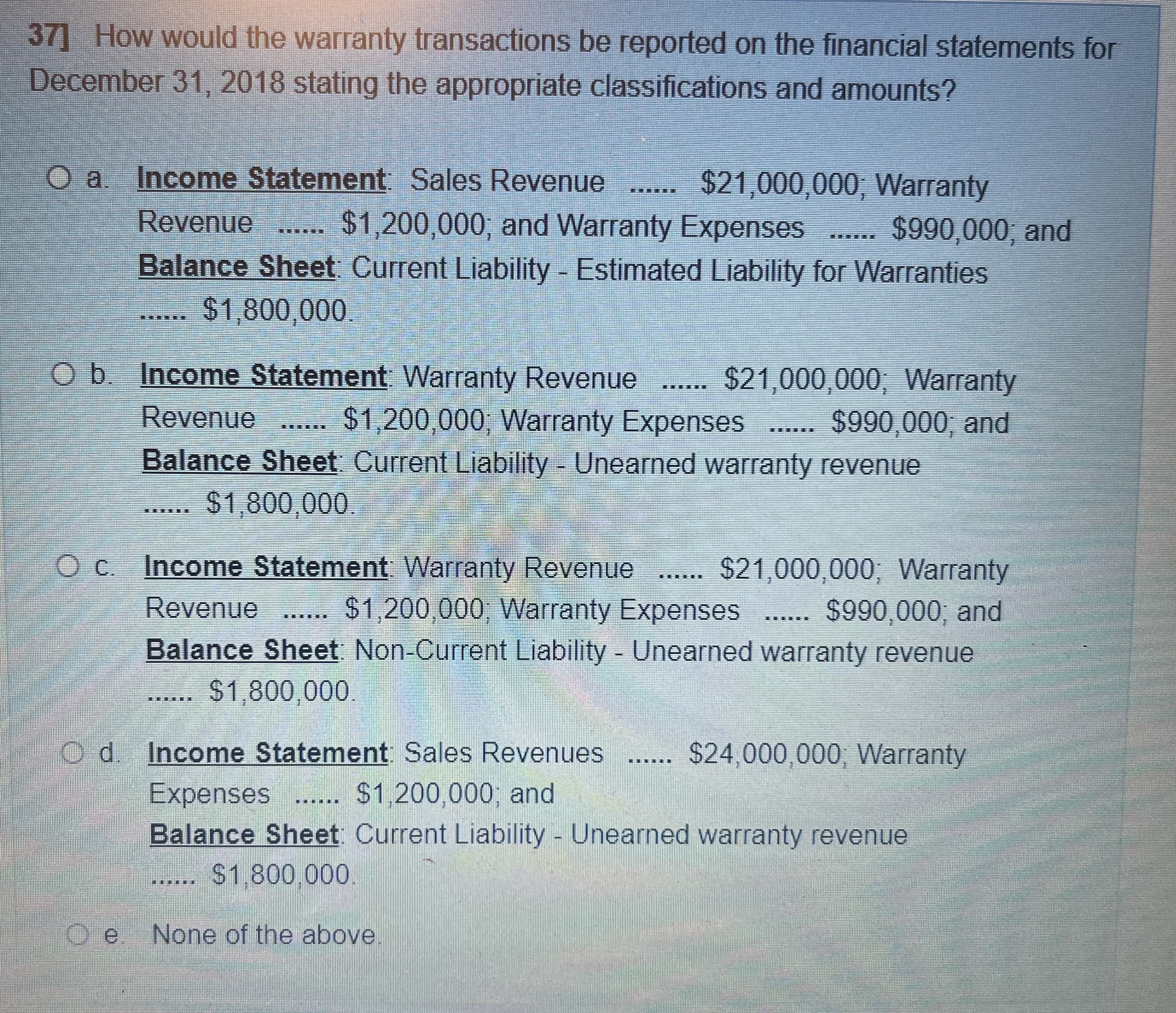

Use the information given below to answer Questions Mickey Mouse Industries, Inc., MMI manufactures and sells electronic solid fuel powered vehicles popularly known as RatKars RK The company offers a comprehensive twoyear warranty contract with a commitment to replace all defective parts and provide the necessary labor services. During the corporation sold RK for cash at a unit price of $ Based on past experience, the twoyear warranty contracts are estimated to cost the company $ per unit which included $ per unit on parts and the balance for labor. These are recorded at the time when the sales are recorded. During MMI incurred actual costs of $which consisted of $ for parts and the rest for labor on repair work called for by customers on the sold units NEXT You are then further informed that MMI estimates $ per unit of the product revenues from the above mentioned sales would would be considered as warranty revenues. of these warranty revenues relate to year and the balance to year Now apply the revenuebased servicetype approach for answering Questions

The journal entry to record the actual warranty costs incurred in would be

a Warranty Expense DR $

Cash CR $; Parts Inventory CR $

b Warranty Expense DR $; Warranty Payable CR $

c Warranty Expense DR $; Estimated Liability for Warranties CR $

d Warranty Revenues DR $; Cash CR $; Parts Inventory CR $

e Warranty Expense DR $

Direct Labor CR $; Parts Inventory CR $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock