Question: Use the information in Question 3 to answer this question. What is the M^(2) measure of ATR Fund? A) Cannot be computed with the Information

Use the information in Question 3 to answer this question. What is the

M^(2)measure of ATR Fund?\ A) Cannot be computed with the Information provided\ B)

70bps\ C)

78bps\ D)

112bps\ E)

120bps\ 2\ Use the information in Question 3 to answer this question. If you could invest in the S&P500 through the SPY ETF but knew that your combined tracking error and fees would amount to a constant 50 basis points (bps) per year, what would be the annualized average NET RETUAN of the SPY and ATR?\ A) Cannot be computed with the information provided\ B)

6%and

4.89%\ C)

5.5%and

4.89%\ D)

6%and

5.2%\ E)

5.5%and

5.2%

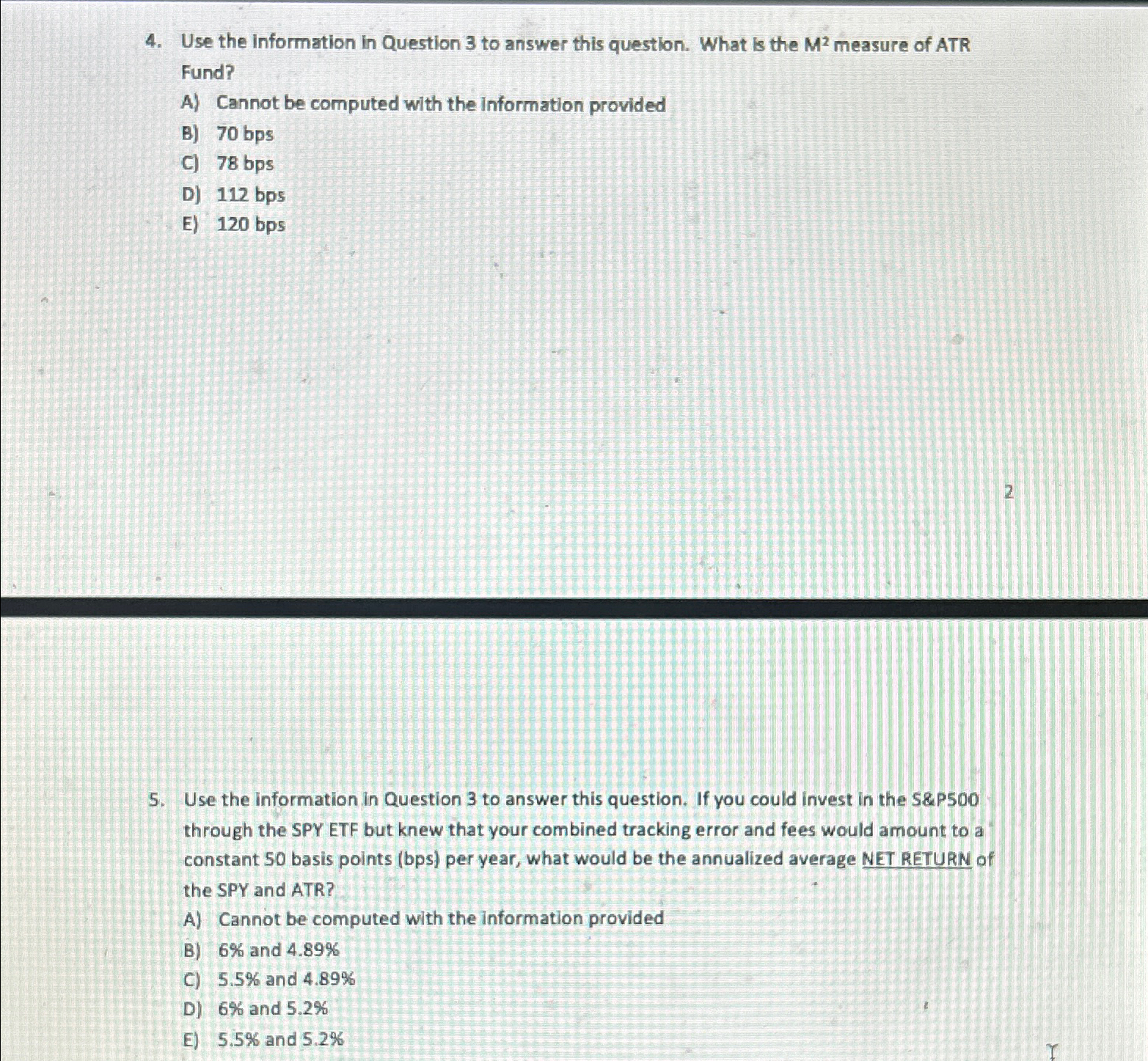

4. Use the information in Question 3 to answer this question. What is the M2 measure of ATR Fund? A) Cannot be computed with the Information provided B) 70bps C) 78 bps D) 112bps E) 120bps 2 5. Use the information in Question 3 to answer this question. If you could invest in the S\&PSO0 through the SPY ETF but knew that your combined tracking error and fees would amount to a constant 50 basis points (bps) per year, what would be the annualized average NET RETURN of the SPY and ATR? A) Cannot be computed with the information provided B) 6% and 4.89% C) 5.5% and 4.89% D) 6% and 5.2% E) 5.5% and 5.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts