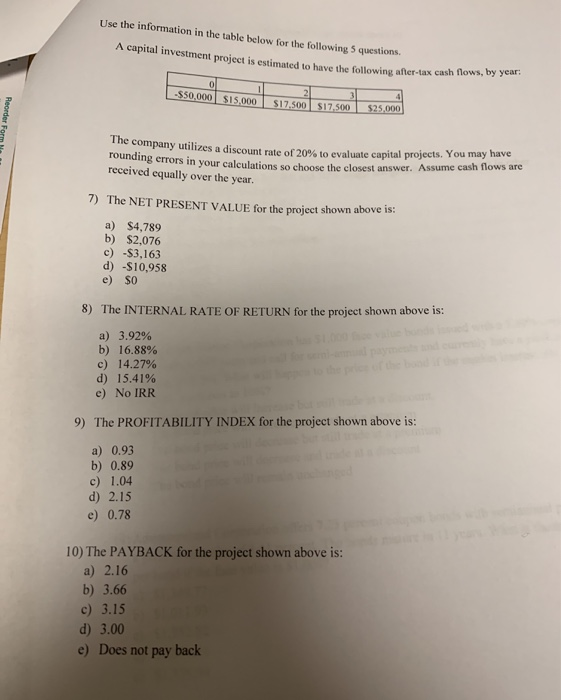

Question: Use the information in the table below for the following 5 questions. A capital investment project is estimated to have the following after-tax cash the

Use the information in the table below for the following 5 questions. A capital investment project is estimated to have the following after-tax cash the following after-tax cash flows, by year 0 -S50,000 $15.000 $17.500 517.500 som $25,000 Reorder Form The company utilizes a discount rate of 20 Pany utilizes a discount rate of 20% to evaluate capital projects. You may have rounding errors in your calculations so choose the closest Sin your calculations so choose the closest answer. Assume cash flows are received equally over the year. 7) The NET PRESENT VALUE for the project shown above is: a) $4.789 b) $2,076 c) -$3,163 d) -$10.958 e) $0 8) The INTERNAL RATE OF RETURN for the project shown above is: a) 3.92% b) 16.88% c) 14.27% d) 15.41% e) No IRR 9) The PROFITABILITY INDEX for the project shown above is: a) 0.93 b) 0.89 c) 1.04 d) 2.15 e) 0.78 10) The PAYBACK for the project shown above is: a) 2.16 b) 3.66 c) 3.15 d) 3.00 e) Does not pay back 11) The DISCOUNTED PAYBACK for the project shown above is: a) 2.27 b) 4.86 c) 3.66 d) 3.85 e) Does not pay back

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts