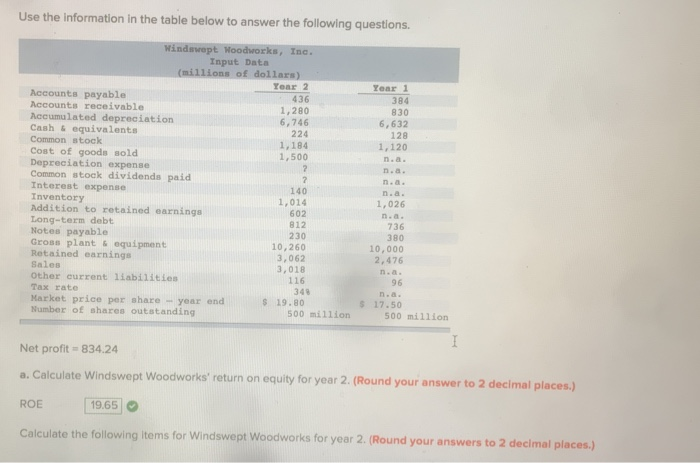

Question: Use the information in the table below to answer the following questions. Windswept Woodworks, Inc. Input Data (millions of dollars) Year 2 Year 1 Accounts

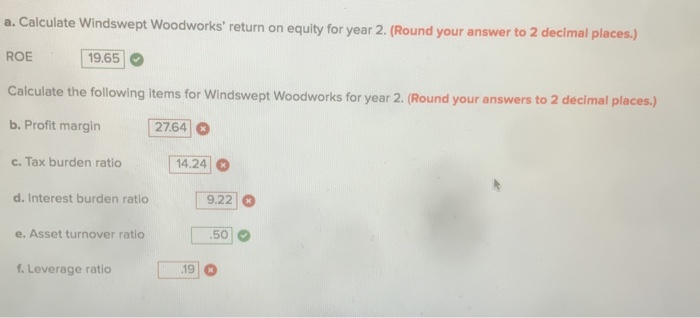

Use the information in the table below to answer the following questions. Windswept Woodworks, Inc. Input Data (millions of dollars) Year 2 Year 1 Accounts payable 436 384 Accounts receivable 1,280 830 Accumulated depreciation 6,746 Cash & equivalents 6,632 224 128 Common stock 1,184 1,120 Cost of goods sold 1,500 Depreciation expense 2 n.a. Common stock dividends paid 2 Interest expense 140 Inventory 1,014 1,026 Addition to retained earnings 602 Long-term debt 812 736 Notes payable 230 380 Gross plant & equipment 10,260 10,000 Retained earnings 3,062 2.476 Sales 3,018 n.a. Other current liabilities 116 96 Tax rate 348 Market price per share - year and $ 19.80 $17.50 Number of shares outstanding 500 million 500 million I Net profit - 834.24 a. Calculate Windswept Woodworks' return on equity for year 2. (Round your answer to 2 decimal places.) ROE 19.65 Calculate the following items for Windswept Woodworks for year 2. (Round your answers to 2 decimal places.) a. Calculate Windswept Woodworks' return on equity for year 2. (Round your answer to 2 decimal places.) ROE 19.65 Calculate the following items for Windswept Woodworks for year 2. (Round your answers to 2 decimal places.) b. Profit margin 27.64 c. Tax burden ratio 14.24 d. Interest burden ratio 9.22 e. Asset turnover ratio .50 f. Leverage ratio .19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts