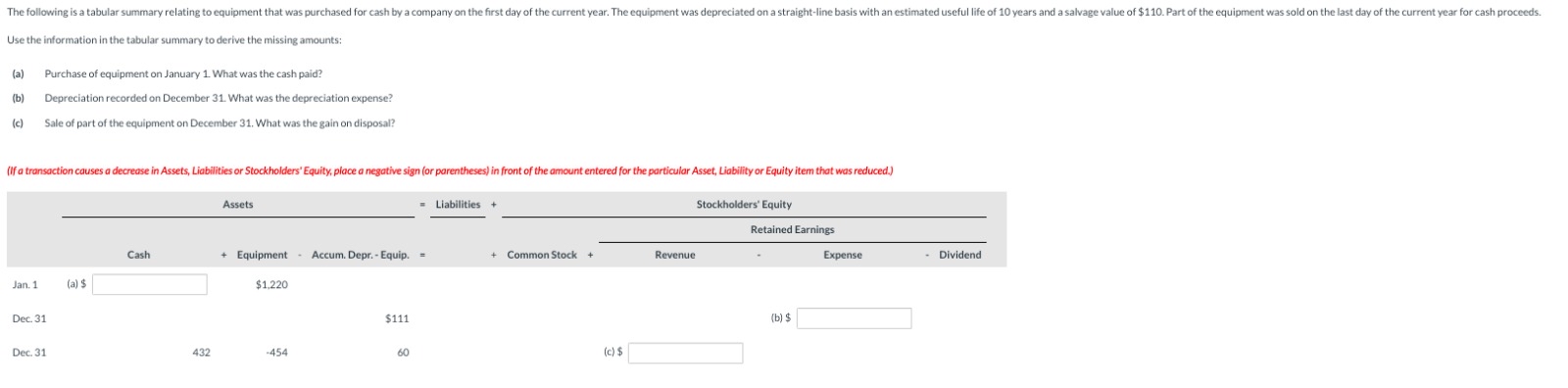

Question: Use the information in the tabular summary to derive the missing amounts: ( a ) Purchase of equipment on January 1 . What was the

Use the information in the tabular summary to derive the missing amounts:

a Purchase of equipment on January What was the cash paid?

b Depreciation recorded on December What was the depreciation expense?

c Sale of part of the equipment on December What was the gain on disposal?

If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign or parentheses in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.

tableAssetsLiabilities,Stockholders' EquityCashEquipment,Accum. Depr. Equip.,,Common Stock,Revenue,Retained EarningsExpense,,Dividend

Jan.

a $

$

Dec.

$

b $

Dec.

c $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock