Question: Use the information provided below to (a) complete the table, (b) calculate the 3 employer's payroll taxes, and (c) record the payroll taxes in the

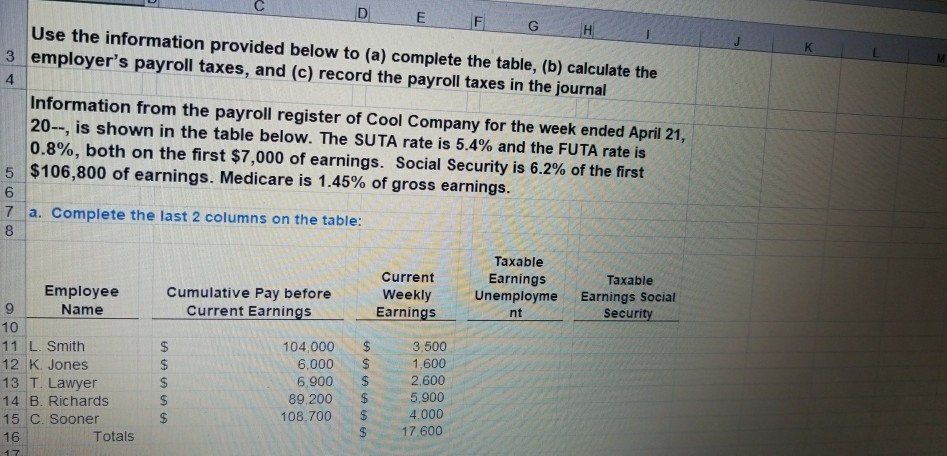

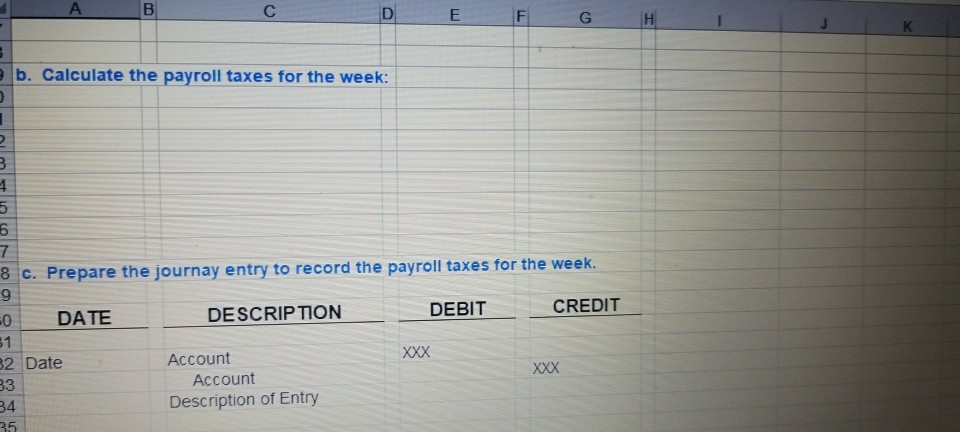

Use the information provided below to (a) complete the table, (b) calculate the 3 employer's payroll taxes, and (c) record the payroll taxes in the journal 4 Information from the payroll register of Cool Company for the week ended April 21, 20-, is shown in the table below. The SUTA rate is 5.4% and the FUTA rate is 0.8%, both on the first $7,000 of earnings. Social Security is 6.2% of the first 5 $106,800 of earnings. Medicare is 1.45% of gross earnings 6 7 a. Complete the last 2 columns on the table: 8 Taxable Earnings Current Taxable Employee Cumulative Pay before Weekly Unemployme Earnings Social Earnings nt Security 9 Name 10 11 L. Smith 12 K. Jones 13 T. Lawyer 14 B. Richards 15 C. Sooner 16 Current Earnings 3,500 1,600 2,600 5,900 108,7004,000 17.600 104,000 6,000 6,900 $ 89.200 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts