Question: Use the information provided in QUESTION 4 to answer the following questions. 5.1 Calculate the following ratios for 2021 only. Express the answers to

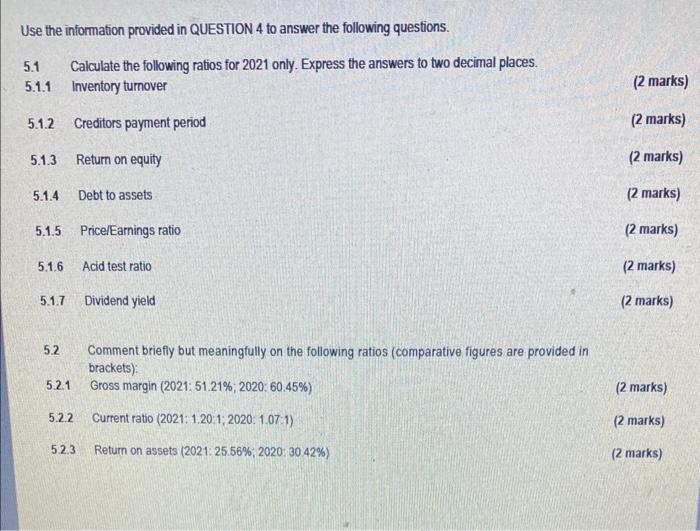

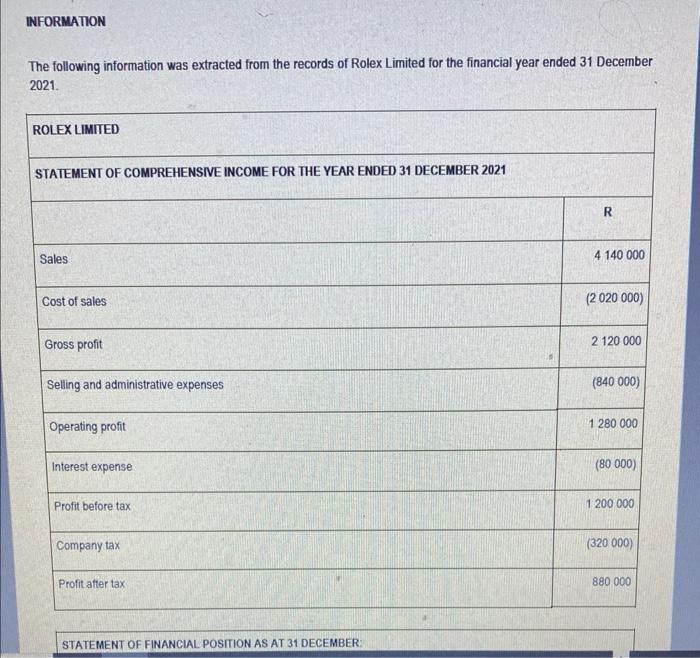

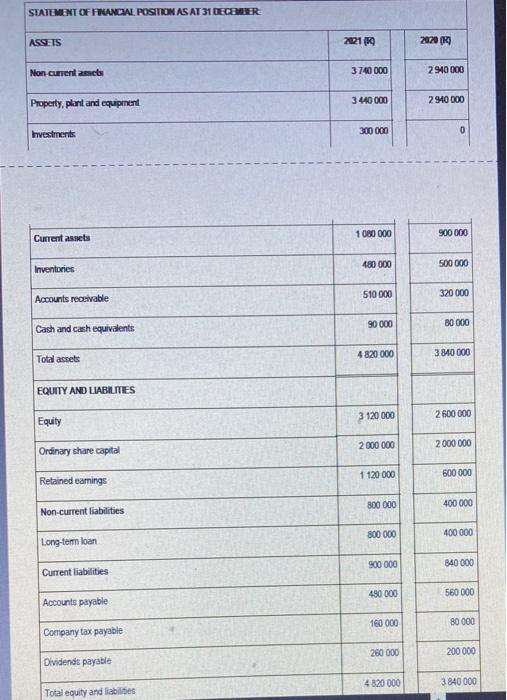

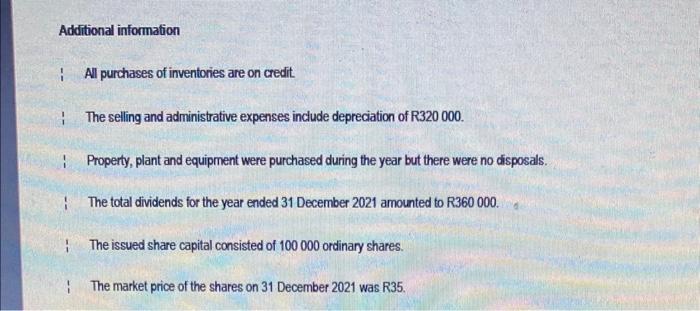

Use the information provided in QUESTION 4 to answer the following questions. 5.1 Calculate the following ratios for 2021 only. Express the answers to two decimal places. 5.1.1 Inventory turnover 5.1.2 Creditors payment period Return on equity 5.1.3 5.1.4 5.1.5 Price/Earnings ratio 5.1.6 Acid test ratio 5.1.7 5.2 5.2.1 Debt to assets 5.2.2 5.2.3 Dividend yield Comment briefly but meaningfully on the following ratios (comparative figures are provided in brackets): Gross margin (2021: 51.21%, 2020: 60.45%) Current ratio (2021: 1.20:1; 2020: 1.07:1) Return on assets (2021: 25.56%, 2020: 30.42%) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) INFORMATION The following information was extracted from the records of Rolex Limited for the financial year ended 31 December 2021. ROLEX LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 Sales Cost of sales Gross profit Selling and administrative expenses Operating profit Interest expense Profit before tax Company tax Profit after taxi STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER: R 4 140 000 (2 020 000) 2 120 000 (840 000) 1 280 000 (80 000) 1 200 000 (320 000) 880 000 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER ASSETS Non-current ameb Property, plant and equipment Investments Current assets Inventories Accounts receivable Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary share capital Retained earnings Non-current liabilities Long-term loan Current liabilities Accounts payable Company tax payable Dividends payable Total equity and liabilities 2021 (0) 3740 000 3440 000 300 000 1 080 000 480 000 510 000 90 000 4 820 000 3 120 000 2 000 000 1120 000 800 000 800 000 900 000 480 000 160 000 260 000 4 820 000 2020 (1) 2940 000 2940 000 0 900 000 500 000 320 000 80 000 3840 000 2 600 000 2 000 000 600 000 400 000 400 000 840 000 560 000 80 000 200 000 3.840 000 Additional information All purchases of inventories are on credit. 1 The selling and administrative expenses include depreciation of R320 000. Property, plant and equipment were purchased during the year but there were no disposals. The total dividends for the year ended 31 December 2021 amounted to R360 000. 1 The issued share capital consisted of 100 000 ordinary shares. The market price of the shares on 31 December 2021 was R35.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts