Question: Use the information provided in QUESTION 4 to answer the following questions: 5.1 Calculate the following ratios (expressed to two decimal places) for 2022 only.

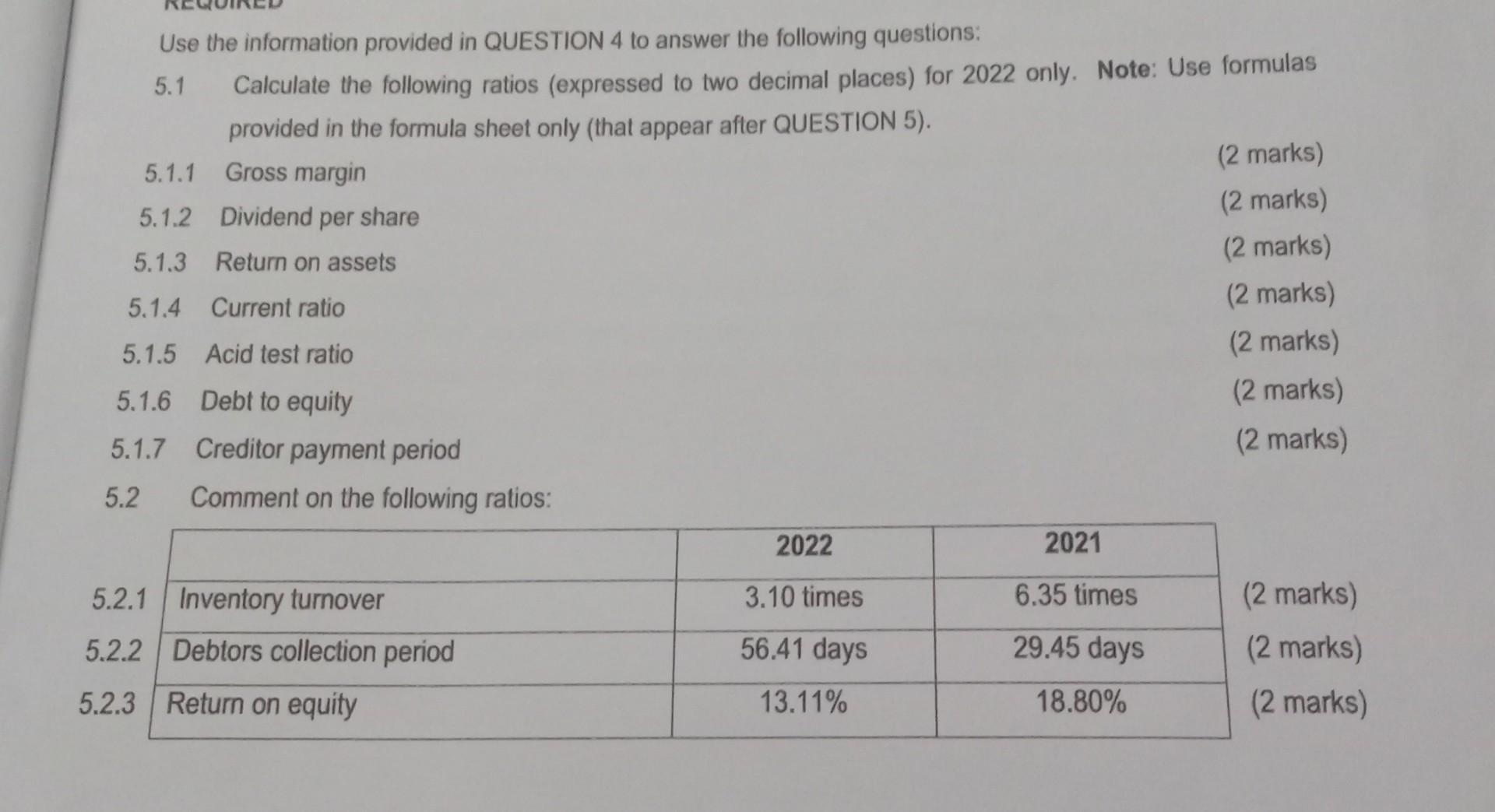

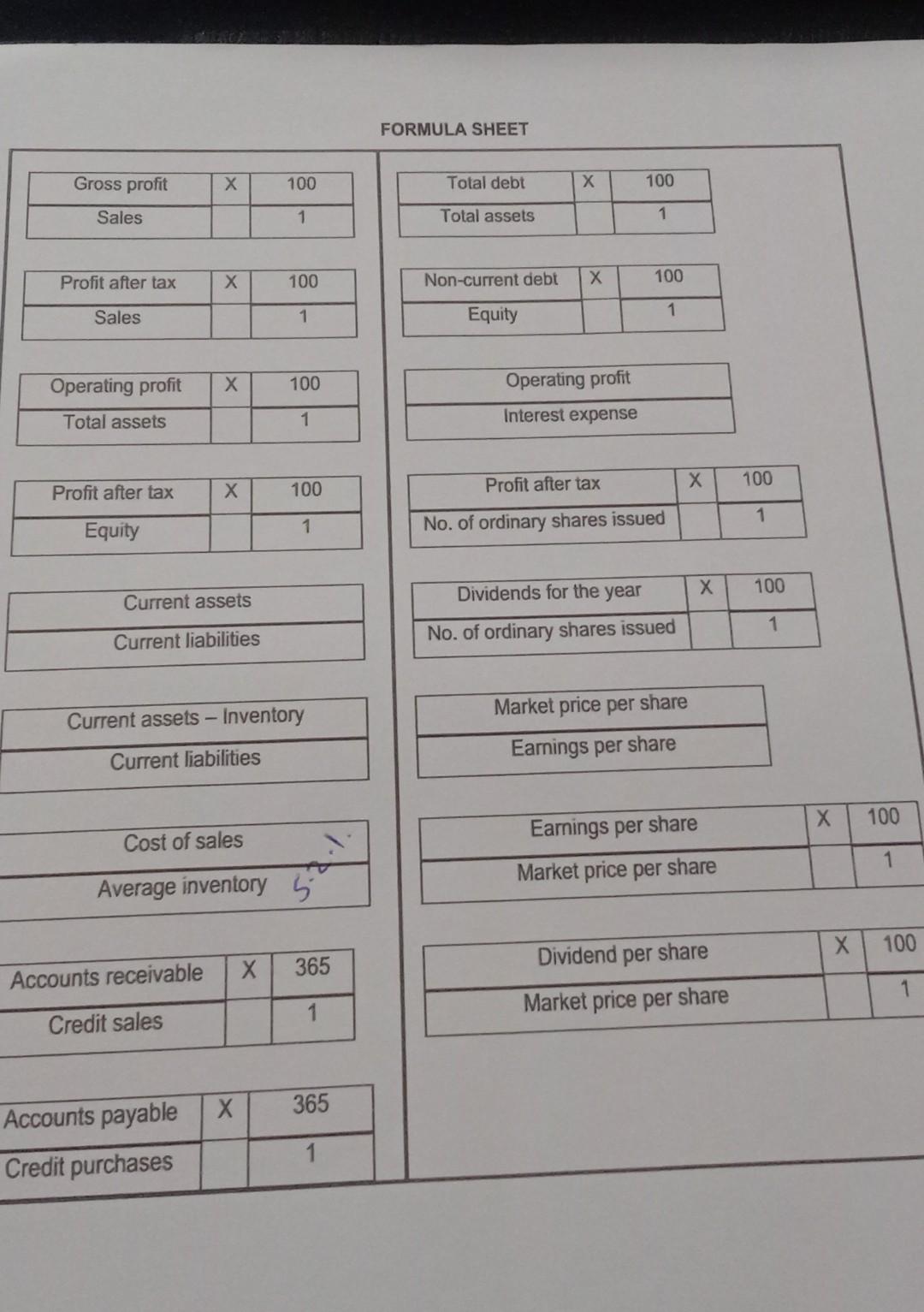

Use the information provided in QUESTION 4 to answer the following questions: 5.1 Calculate the following ratios (expressed to two decimal places) for 2022 only. Note: Use formulas provided in the formula sheet only (that appear after QUESTION 5). 5.1.1 Gross margin (2 marks) 5.1.2 Dividend per share (2 marks) 5.1.3 Return on assets (2 marks) 5.1.4 Current ratio (2 marks) 5.1.5 Acid test ratio (2 marks) 5.1.6 Debt to equity (2 marks) 5.1.7 Creditor payment period (2 marks) 5.2 Comment on the following ratios: FORMULA SHEET \begin{tabular}{|c|c|c|} \hline Gross profit & X & 100 \\ \hline Sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Total debt & X & 100 \\ \hline Total assets & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline Sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Non-current debt & X & 100 \\ \hline Equity & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Operating profit & X & 100 \\ \hline Total assets & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Operating profit \\ \hline Interest expense \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline Equity & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline No. of ordinary shares issued & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Current assets \\ \hline Current liabilities \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Dividends for the year & X & 100 \\ \hline No. of ordinary shares issued & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Current assets - Inventory \\ \hline Current liabilities \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Market price per share \\ \hline Earnings per share \\ \hline \end{tabular} Cost of sales \begin{tabular}{|c|c|c|} \hline Earnings per share & X & 100 \\ \hline Market price per share & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Accounts receivable & X & 365 \\ \hline Credit sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Dividend per share & X & 100 \\ \hline Market price per share & & 1 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline Accounts payable & X & 365 \\ \hline Credit purchases & & 1 \\ \hline \end{tabular} Use the information provided in QUESTION 4 to answer the following questions: 5.1 Calculate the following ratios (expressed to two decimal places) for 2022 only. Note: Use formulas provided in the formula sheet only (that appear after QUESTION 5). 5.1.1 Gross margin (2 marks) 5.1.2 Dividend per share (2 marks) 5.1.3 Return on assets (2 marks) 5.1.4 Current ratio (2 marks) 5.1.5 Acid test ratio (2 marks) 5.1.6 Debt to equity (2 marks) 5.1.7 Creditor payment period (2 marks) 5.2 Comment on the following ratios: FORMULA SHEET \begin{tabular}{|c|c|c|} \hline Gross profit & X & 100 \\ \hline Sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Total debt & X & 100 \\ \hline Total assets & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline Sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Non-current debt & X & 100 \\ \hline Equity & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Operating profit & X & 100 \\ \hline Total assets & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Operating profit \\ \hline Interest expense \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline Equity & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Profit after tax & X & 100 \\ \hline No. of ordinary shares issued & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Current assets \\ \hline Current liabilities \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Dividends for the year & X & 100 \\ \hline No. of ordinary shares issued & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Current assets - Inventory \\ \hline Current liabilities \\ \hline \end{tabular} \begin{tabular}{|c|} \hline Market price per share \\ \hline Earnings per share \\ \hline \end{tabular} Cost of sales \begin{tabular}{|c|c|c|} \hline Earnings per share & X & 100 \\ \hline Market price per share & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Accounts receivable & X & 365 \\ \hline Credit sales & & 1 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Dividend per share & X & 100 \\ \hline Market price per share & & 1 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|} \hline Accounts payable & X & 365 \\ \hline Credit purchases & & 1 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts